Innovation and Demand Instigating ESG Step-change

Giving final clients the means to manage and assess the level of Environmental, Social Responsibility and Governance of their investments

By Michel Camilleri

Transforming the vision of asset ownership

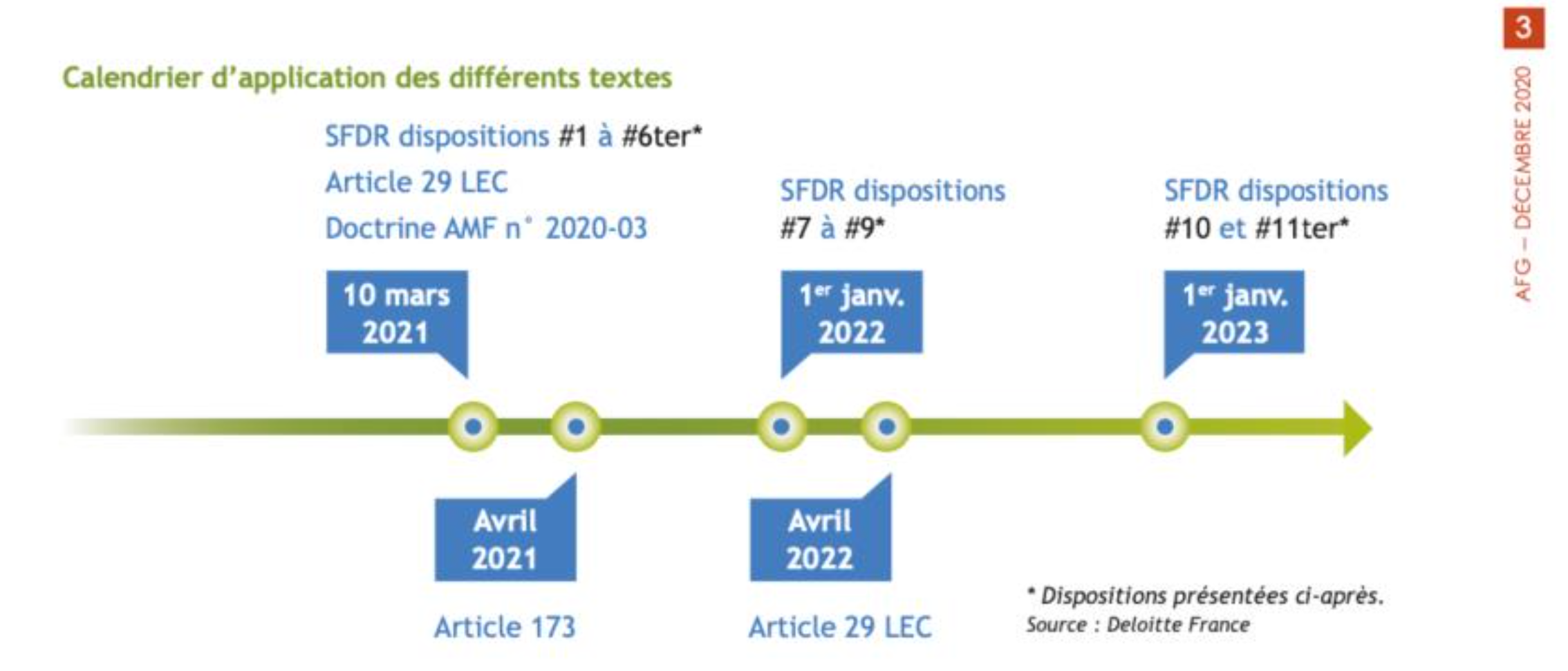

The “Year 2020 Ahead” outlook published at this time last year, listed expected changes in CSR financial regulation as well as the timetable for other future reforms.

All financial players will increasingly need to become more transparent, or will otherwise risk of being side-lined in the evolving asset management sector. Asset managers are accountable to publish periodic reporting to customers and regulatory authorities.

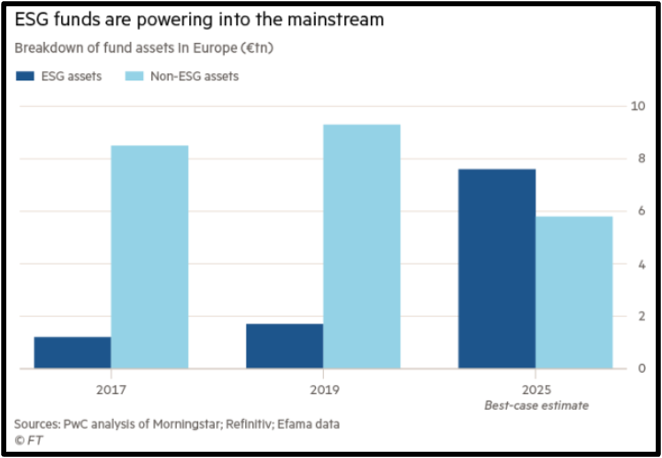

Client demand for transparency in financial management and social responsibility has become significant and will most likely persist. It is therefore essential to offer end customers (asset owners) a CSR roadmap for their investments, as well as provide them the means to monitor the evolution of ESG criteria over time.

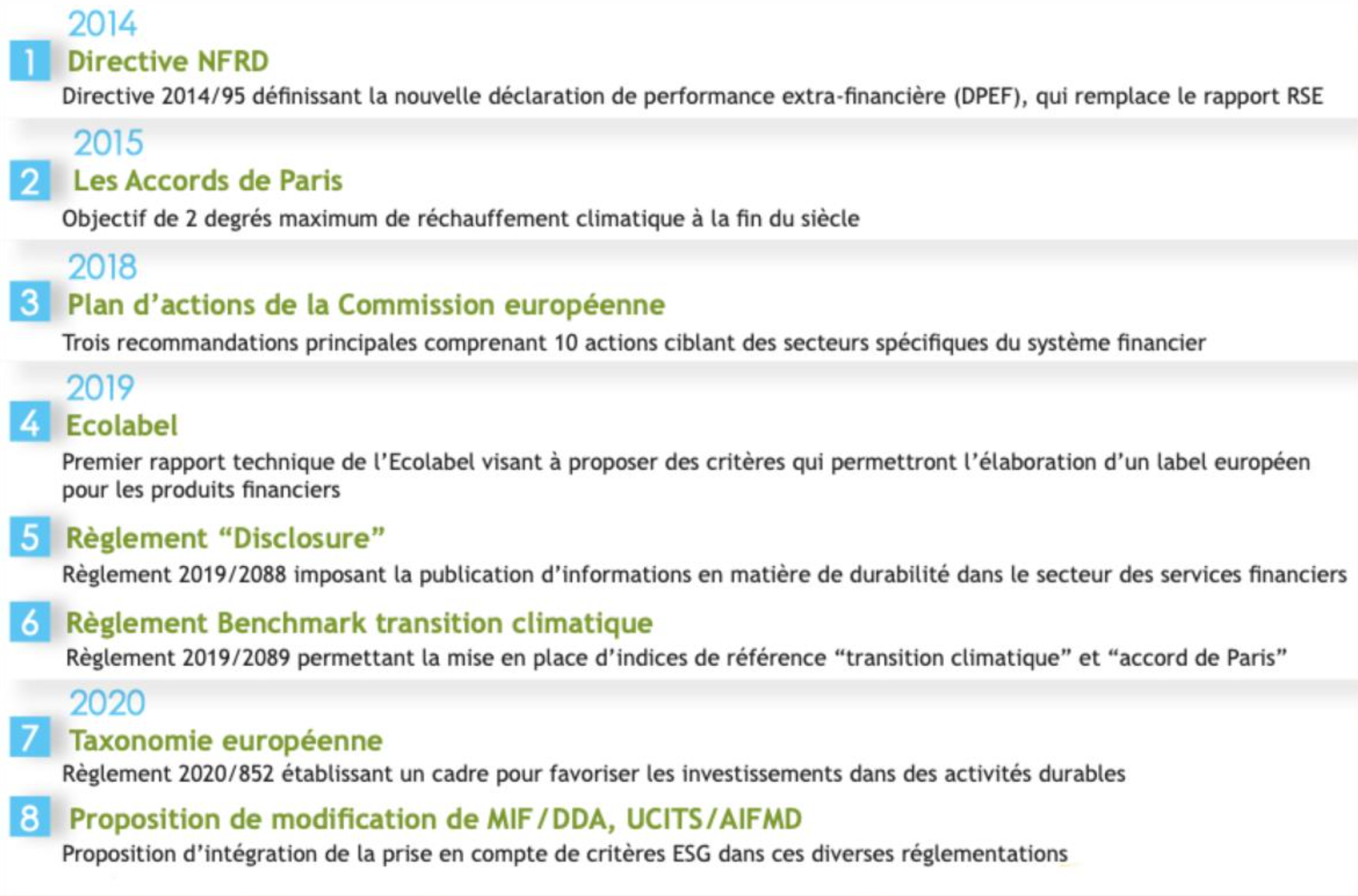

History of the work of the European Commission

Source : Deloitte France

Regulation is making great strides : year 2020 saw the publication of Regulation 2020/852, which established the framework for promoting investments in sustainability activities. It also proposed modifications to MIF / DDA, UCITS / AIFMD by integrating ESG criteria and the new AMF 2020-03 doctrine to ensure clarity in the interpretation of “ESG Washing”.

In 2021 EU Regulation No. 2019/2088 (known as the SFDR/Disclosure) will be implemented, which is the law on energy transition for “green” growth; Article 173 will be amended by the Energy Climate law – Article 29.

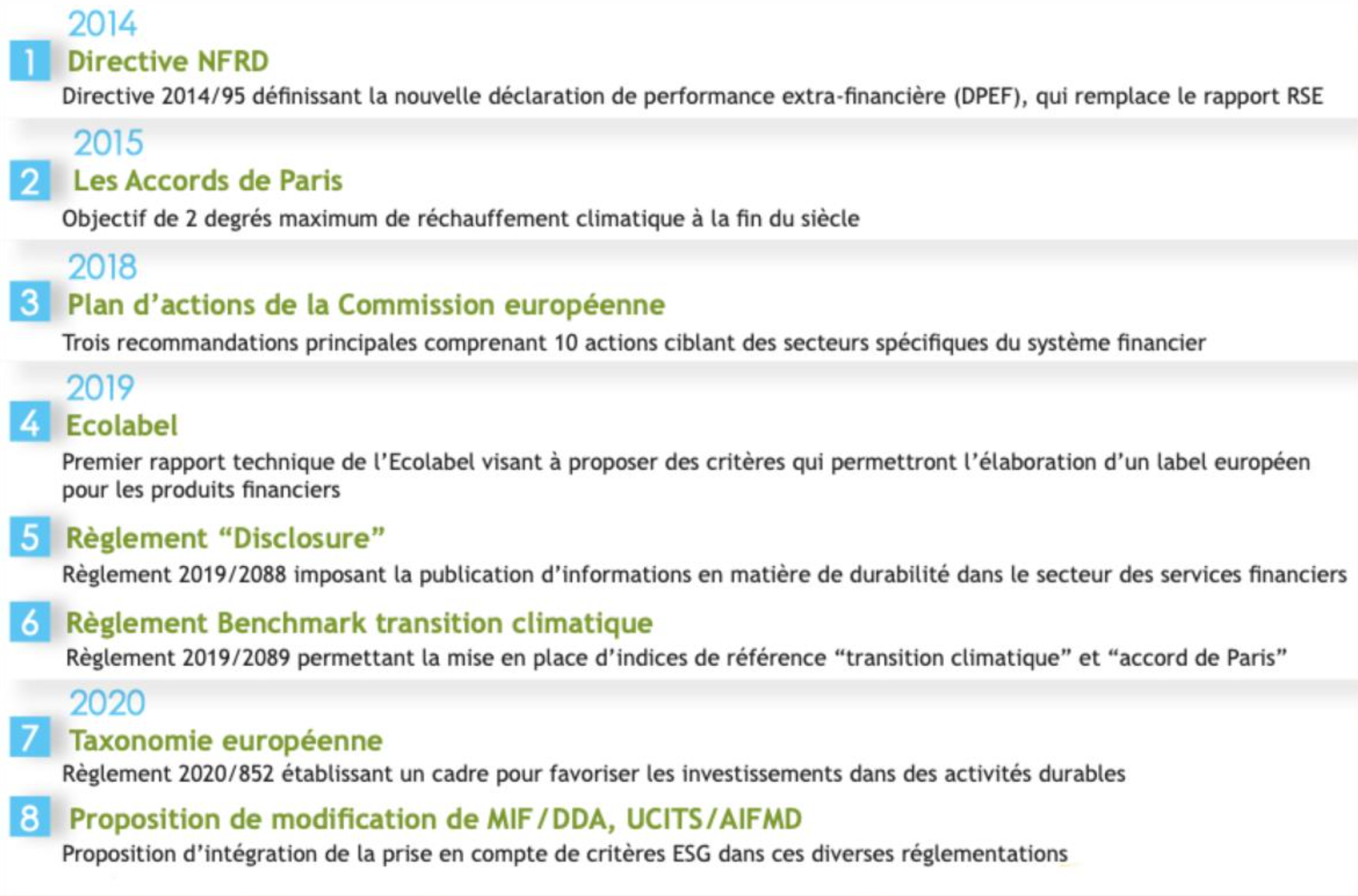

History of the work of the European Commission

Source : Deloitte France

From year 2022 onwards :

- \MiFID delegated acts: integration of final client sustainability preferences into the framework of product governance and the management of conflicts of interest

- \ESMA consultation for the integration of risks and sustainability factors into UCITS and AIFM guidelines

These developments will permit end-clients to obtain a clearer reading of the social and environmental impacts of their investments, as well as monitor the evolutions over time.

Text application calendar

State of the art to-date

Final client (asset owner) financial reporting is currently not as detailed and comprehensive as required by regulators for asset manager reporting.

Client reporting merely communicates static, accounting updates with segmentations by asset class, geographic exposure, acquisition cost price and separate risk levels of assets held in portfolio.

Risk (volatility) is at best defined by time frozen calculation methodologies, similar to the “Time Weighted” or “Dietz” methods with no disclosure on the calculation interval.

Client reporting today therefore rarely benefits from precise information regarding the overall level of financial risk of the portfolio’s consolidated investments. Disclosure of units per risk are only given at the asset class level.

The same degree of simplistic reporting also exists with CSR/ESG criteria: little information is shared with the final client, apart from the underlying assets on a unitary basis. The non-existence of a unified “sustainability” rating system additionally impedes the clear reading of standard mutual funds or basic life insurance contracts.

Coming innovation

Moving the focus onto the final client

Temporal readings and consolidated overviews of client assets held in portfolio are valuable, needed information to exhibit ESG data in a meaningful way.

Both financial market regulatory authorities and asset-owner final-clients seek a viewing of the evolution of investments within a financial risk framework as well as continuous metrics of the portfolio’s social and environmental responsibility.

Modify the current approach of monitoring “Client” portfolios

In a first step, those tools monitoring end-client portfolios will need to evolve towards the presentation of temporal changes in asset holdings and risk levels versus the current static views.

Running the analysis for a broad set of assets collectively, as one homogenous mutual fund, would subsequently further enhance the evaluation methodology of the final client. Current market solutions do not fulfil this demand and quick-fix proposals often attempt putting together a patchwork of traditional tools with Excel.

Audacity : let the clients define their own ESG ratings

Well established rating agencies have made great progress in developing ESG databases and research, with several offering their proprietary ratings.

The increased pace of multi-annual updates of E-S-G fields for financial securities has indeed enriched the analysis of sustainable corporate business models. Each of these ESG axes reference hundreds of fields over numerous fiscal years, enhancing the granularity of the collected data.

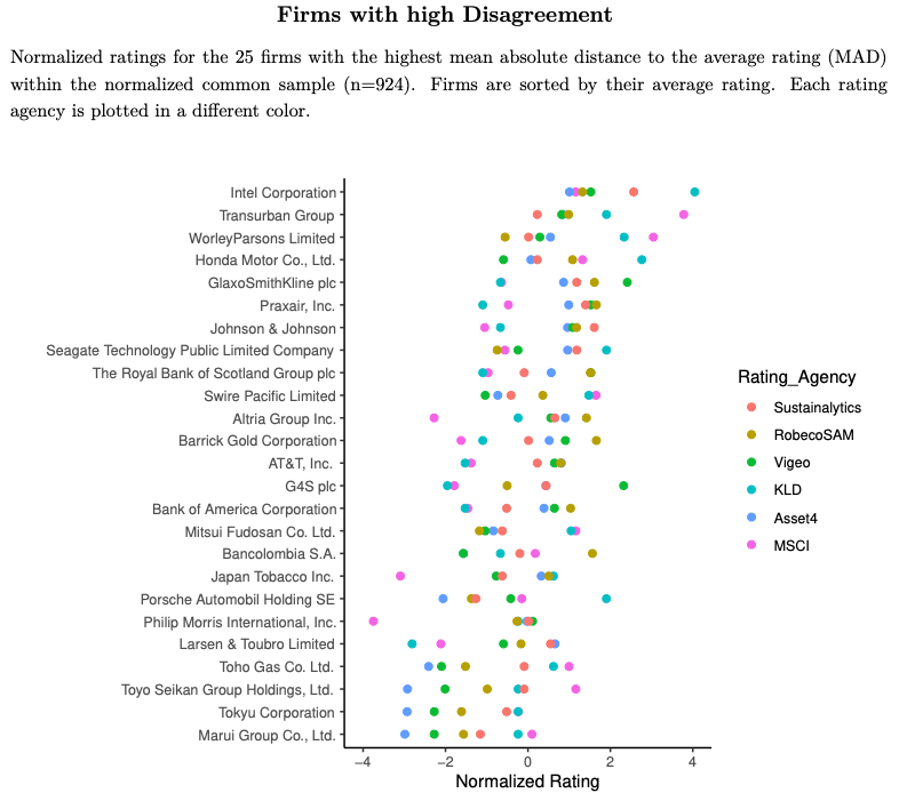

At a time of vast amounts of collated ESG information and regulation striving for more transparency along with the transition to a greener world, there is also interest amongst asset owners for common benchmarks, as stands the more established credit rating agency sector today. The current, fragmented ESG rating agency sector often assigns different ratings for the same companies (click here to see the graph) whereas Standard & Poors, Moody’s and Fitch arrive at more aligned stances.

Consolidation of the ESG rating agency sector will eventually bring together ESG ratings onto the same page, but only over the long term. Several professional unions (ie. AFG, UNPRI, FASB, etc.) have therefore endeavoured to define acceptable global frameworks.

Since the ESG rating agency space will likely remain fragmented over the medium term, final-client asset-owners will in the meantime increasingly value “à la carte” ESG investment proposals, best catered to their beliefs and preferences. Greater participation within the overall investment process of their own assets under management can be facilitated by offering end-customers the means to monitor the evolution of their portfolio ESG composition over time. Depending upon asset-owner convictions, emphasis for instance, could be placed more so on specific E,S, or G criteria.

By 10 March, 2021 asset manager’s widespread use of conventional Know-Your-Customer risk questionnaires will be obliged to add-in an ESG chapter, meeting the directives of Regulation 2019/2088 (known as Disclosure 4 or SFDR). The asset management industry’s awareness of this coming development dates back to 27 November, 2019, with an EU Official Journal publication on sustainability in the financial services sector.

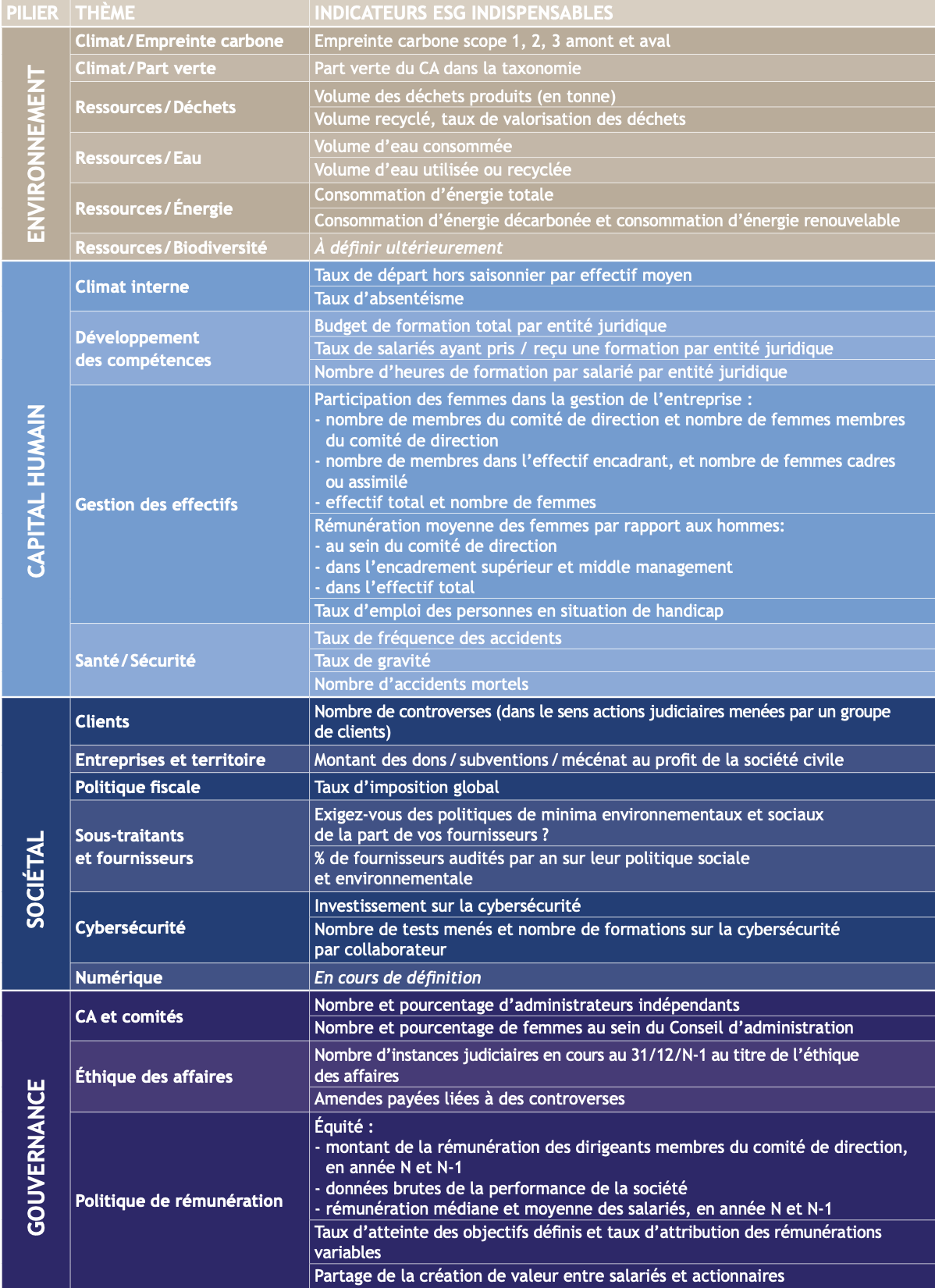

AFG’s proposal for the presentation of ESG axes

Source AFG

Source: Aggregate Confusion, The Divergence of ESG Ratings (Berg, Koelbel, Rigobon, MIT Sloan, University of Zurich) 28 September, 2020

Enrichment of financial securities databases

Progressive regulation and imminent ESG portfolio monitoring tools will call for considerable transformation of account holder databases (bankers and insurers): each financial security will need to be enriched with a series of multi-annual ESG intelligence to meet specific reporting needs of clients, who will seek personalised and detailed ratings.

A harmonised ESG rating

The ESG rating harmonisation end game will need to overcome one major obstacle: most players in the asset management sector define their own rating criteria for competitive product differentiation purposes. Little interest in common ground ESG evaluations will consequently act as a brake to achieve a universal ESG rating approach. Regulatory authorities have interestingly avoided significant intervention of ESG rating agencies, largely leaving market forces to determine the structure of the sector.

Access to mutual fund inventories and implementation of “see through” processes could, however, help accelerate the slow-moving consolidation of the ESG rating agency sector. The significance of needed change in banking and insurance information systems stands out well, while final client ESG requests will ultimately break the ice for change.

The ESG rating harmonisation end game will need to overcome one major obstacle: most players in the asset management sector define their own rating criteria for competitive product differentiation purposes. Little interest in common ground ESG evaluations will consequently act as a brake to achieve a universal ESG rating approach. Regulatory authorities have interestingly avoided significant intervention of ESG rating agencies, largely leaving market forces to determine the structure of the sector.

Access to mutual fund inventories and implementation of “see through” processes could, however, help accelerate the slow-moving consolidation of the ESG rating agency sector. The significance of needed change in banking and insurance information systems stands out well, while final client ESG requests will ultimately break the ice for change.

Conclusion

In short, asset owner reporting today often displays minimal portfolio inventory readings (at time “t”) with no information presenting the risk/return evolution in a dynamic manner. End customers meanwhile increasingly expect to partake more so in the investment process regarding ESG drivers (benchmarks).

Few available tools exist today to monitor, on a continuous basis, whether investments in portfolio “are pointed in the right CSR direction”. Tweaking legacy information systems to provide dynamic ESG portfolio readings would meanwhile end up costly because many asset owner databases have rarely stored granular historic data on a per security basis. New forms of analysis will need to be built from scratch.

Empowering end customers to define their own ESG rating measurements, in compliance with regulation, would open up an enlightened trend of much greater transparency on social and environmental responsibility. Abiding by regulatory authority laws may often be seen as a business constraint, but concerted efforts for all asset management players to share the same ESG vision will undoubtedly reap rewards in little time.

While reinforcement of CSR/ESG principles into investment strategies is expected to lead to more robust, transparent results, the complexity of the exercise should not be under estimated. A mediocre implementation of new processes could backfire and bring increased opaqueness plus weaker performances of investment strategies. Hence, the importance of well-designed investment monitoring solutions.