ESG rating

An update on European regulations and our ESG vision

An update on European regulations and our ESG vision

Overview on regulations

The European Commission is preparing a taxonomy to regulate and harmonise (non-financial reporting or sustainability reporting) financial activity in terms of responsible investments. It has already voted for the 2020/852 Disclosure* Regulation, which imposes environmental and financial transparency standards.

The European Commission is preparing a taxonomy to regulate and harmonise (non-financial reporting or sustainability reporting) financial activity in terms of responsible investments. It has already voted for the 2020/852 Disclosure* Regulation, which imposes environmental and financial transparency standards.

The European Union is continuing its momentum of imposing mandatory indicators* to assess a company’s ESG rating.

* RTS project (Regulatory Technical Standards)

The regulations will see considerable progress over the next few years.

Many indicators are already required in the ESG rating of companies.

Our ESG rating process under the spotlight

An environmentally friendly rating method

%

Environment

%

Social

%

Governance

Going beyond regulation

The progress in regulation is notable and necessary. At Colibri AM, we will strive beyond regulation regarding the implementation of socially responsible investment practices. Hence, our use of more than one hundred ESG criteria to establish ESG ratings for companies, allocations and investment funds.

Rating criteria for each sector of activity

We are aware all criteria cannot be imposed on all sectors.

It is for this reason we have customised the selection of ESG criteria for each industry.

Multiple and varied sources

We retrieve company and allocation ESG data from :

– Company annual reports

– Bloomberg

– Robecco

– Sustainalytics

Customised ESG questionnaires

Still today, numerous companies do not publish ESG data. We have therefore adressed customised questionnaires to those companies for the collection their ESG information on a regular basis.

Multiple and varied sources

We retrieve company and allocation ESG data from :

– Company annual reports

– Bloomberg

– Robecco

– Sustainalytics

Customised ESG questionnaires

Still today, numerous companies do not publish ESG data. We have therefore adressed customised questionnaires to those companies for the collection their ESG information on a regular basis.

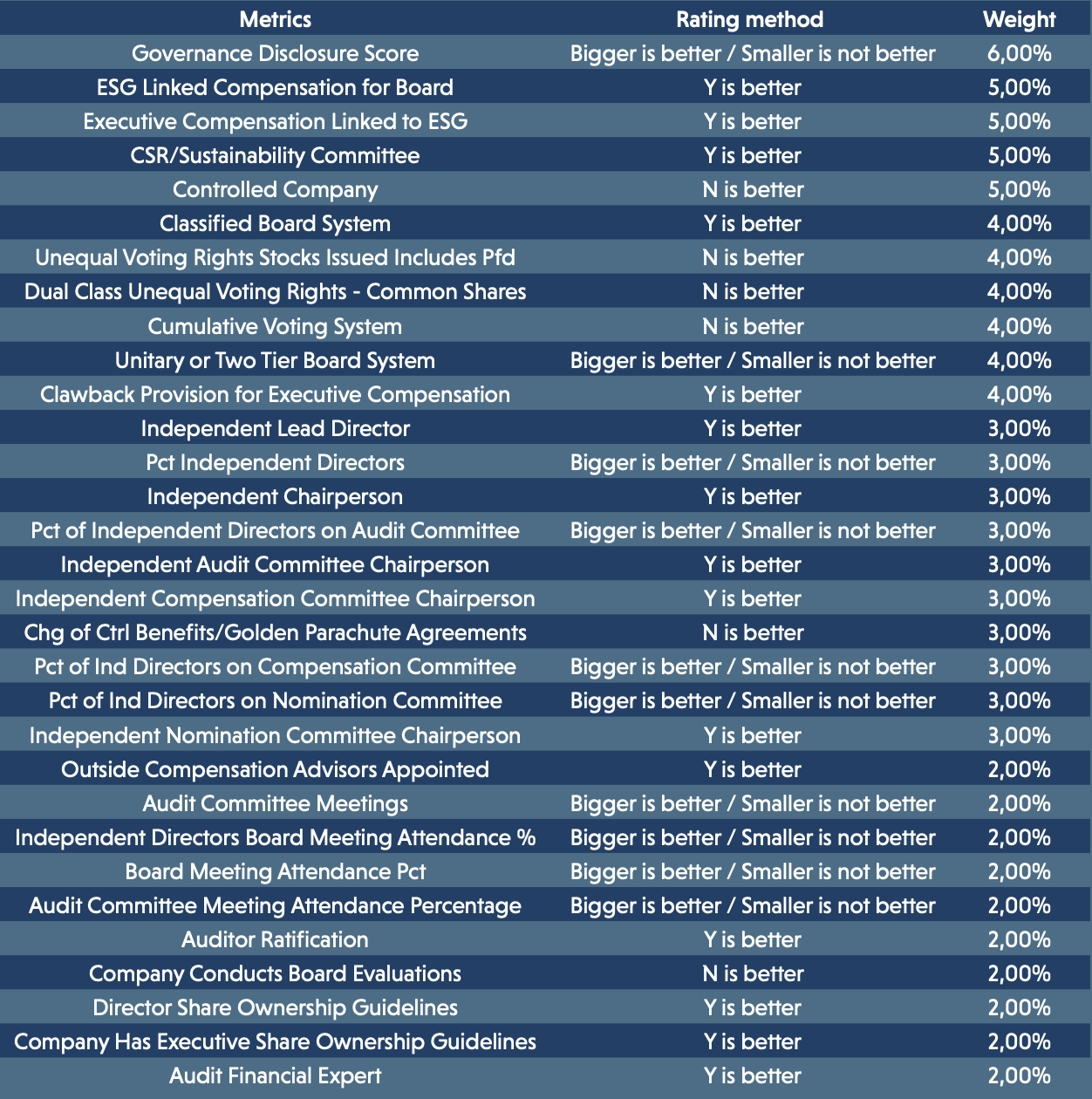

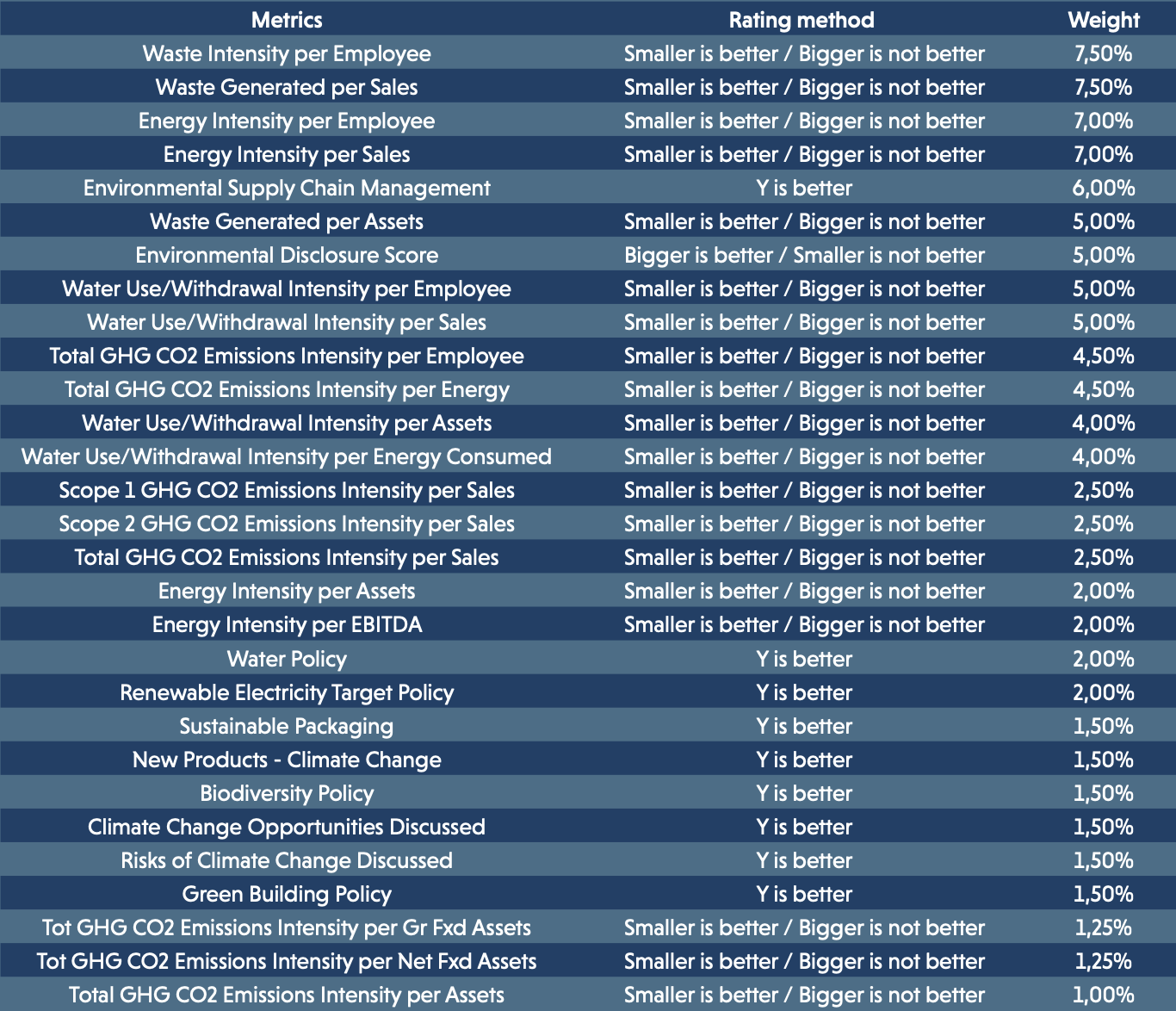

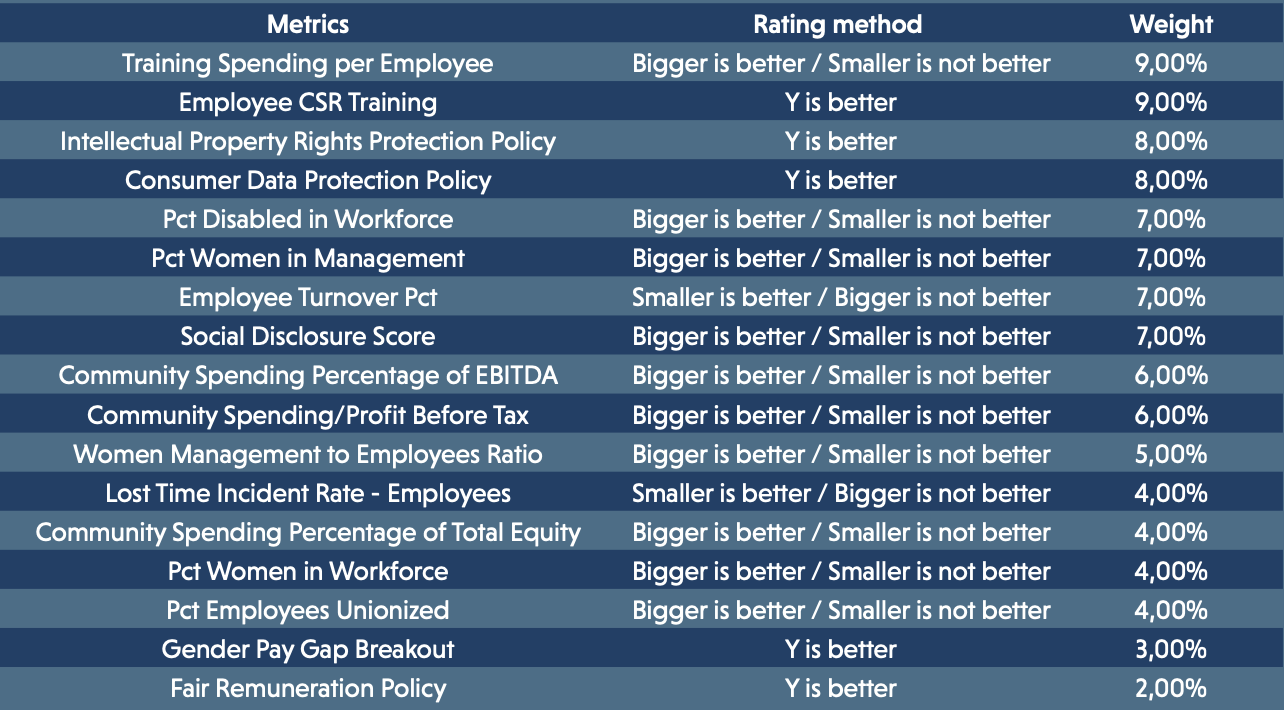

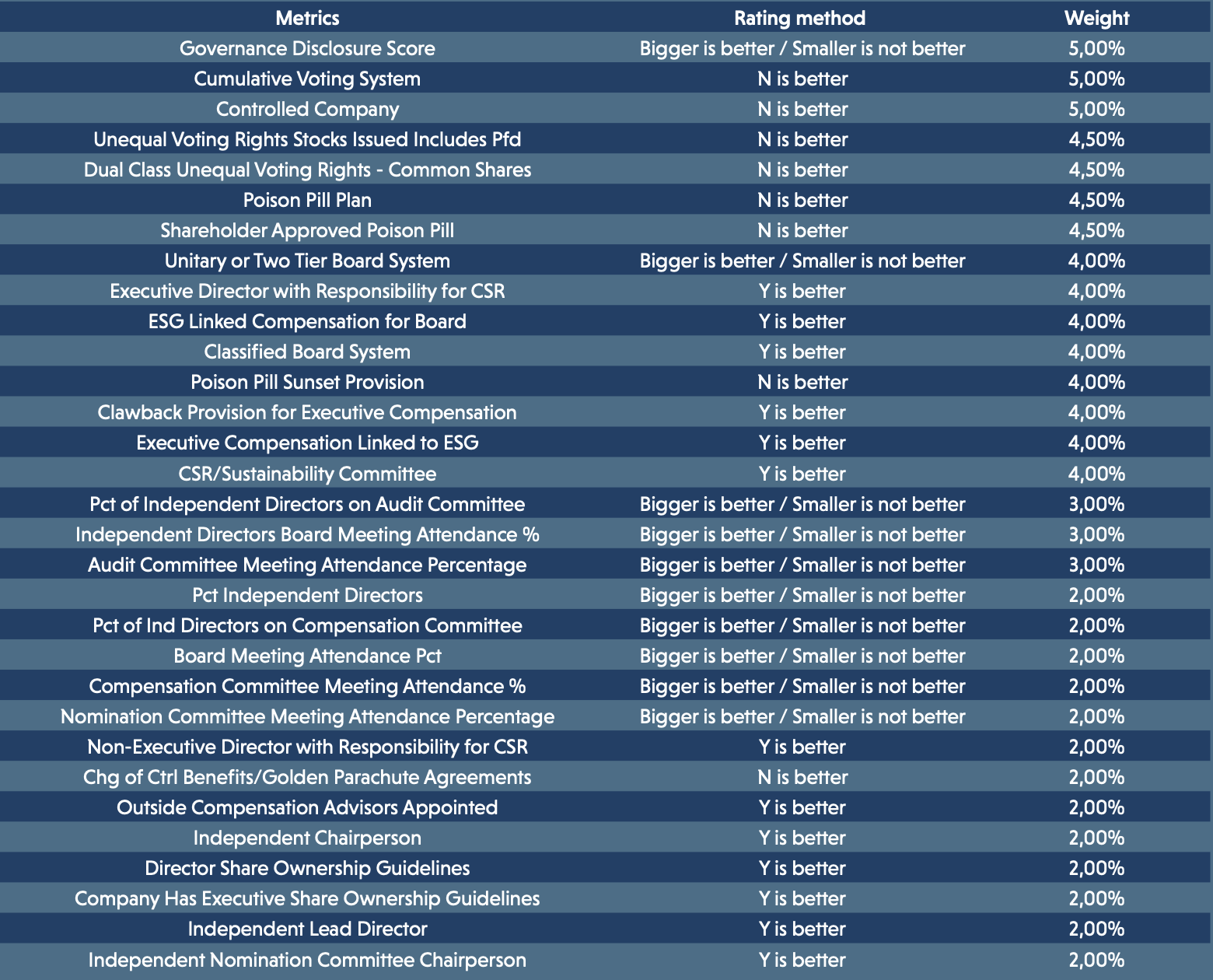

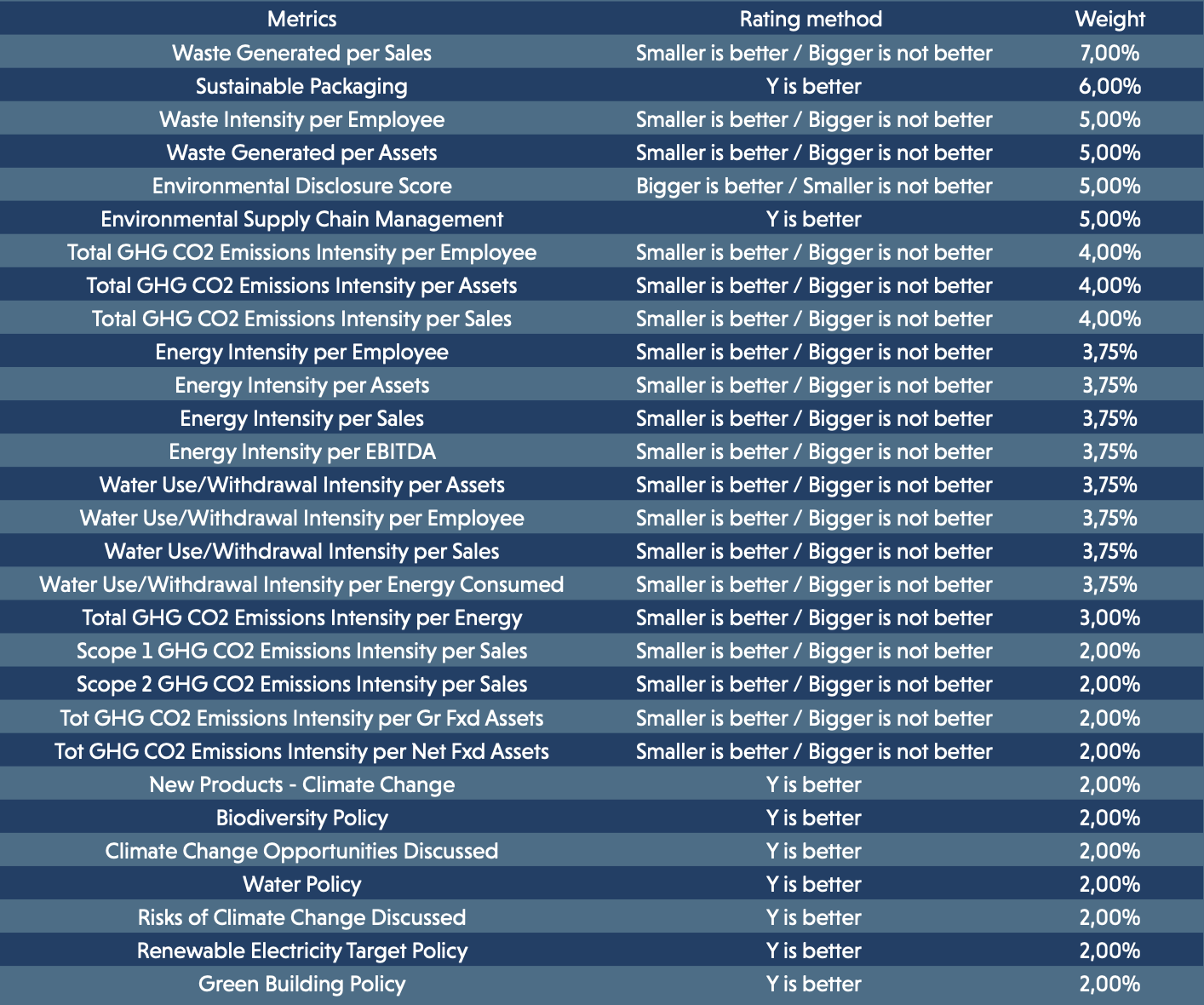

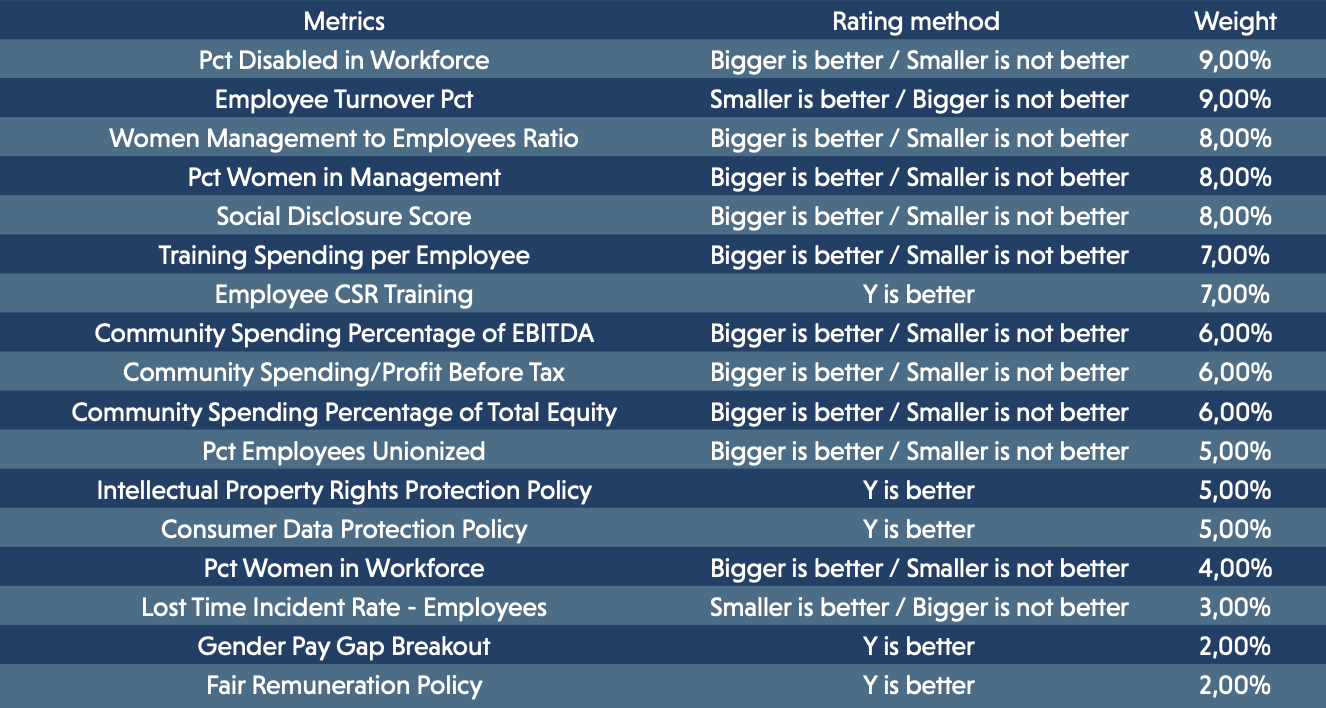

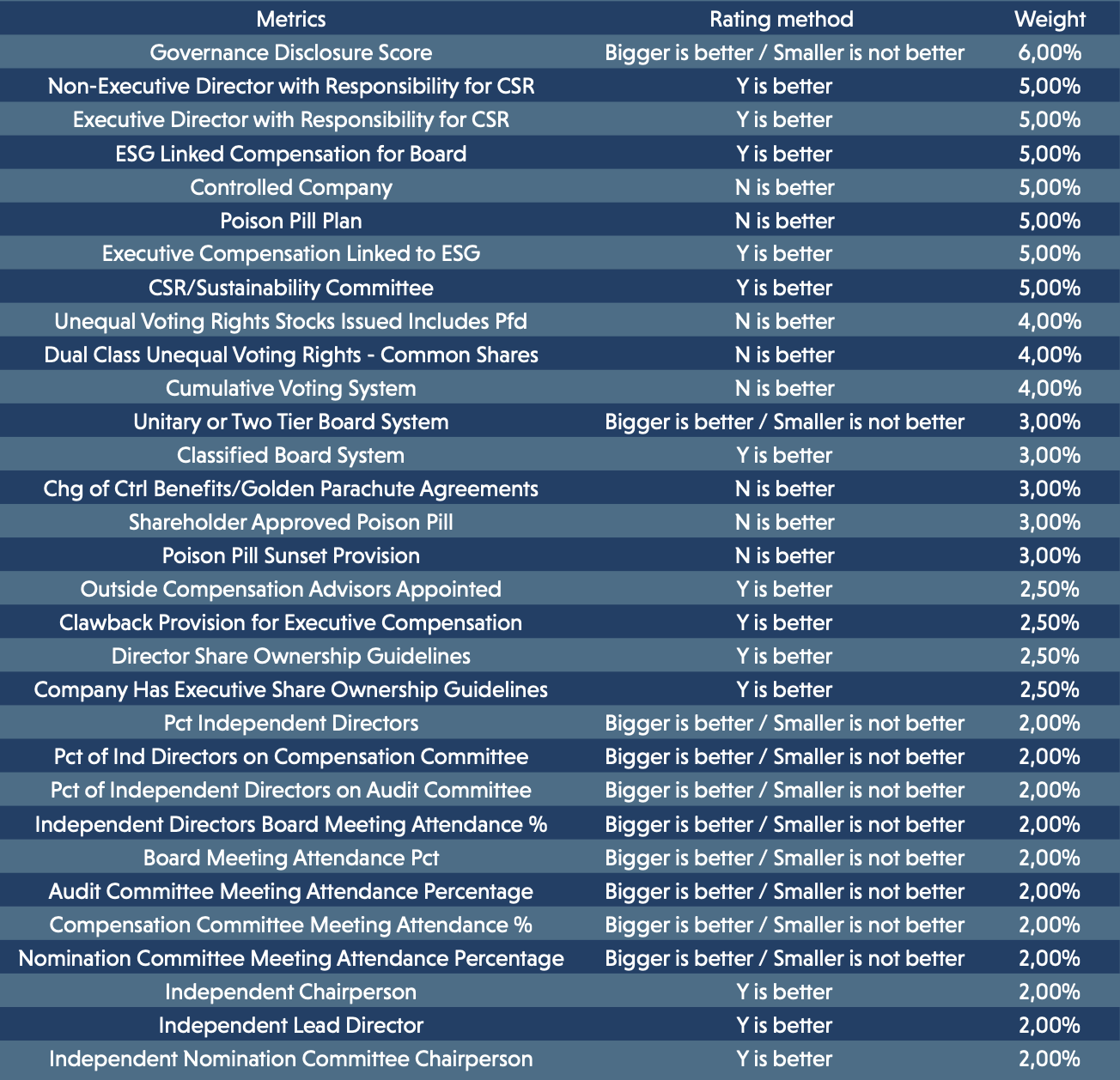

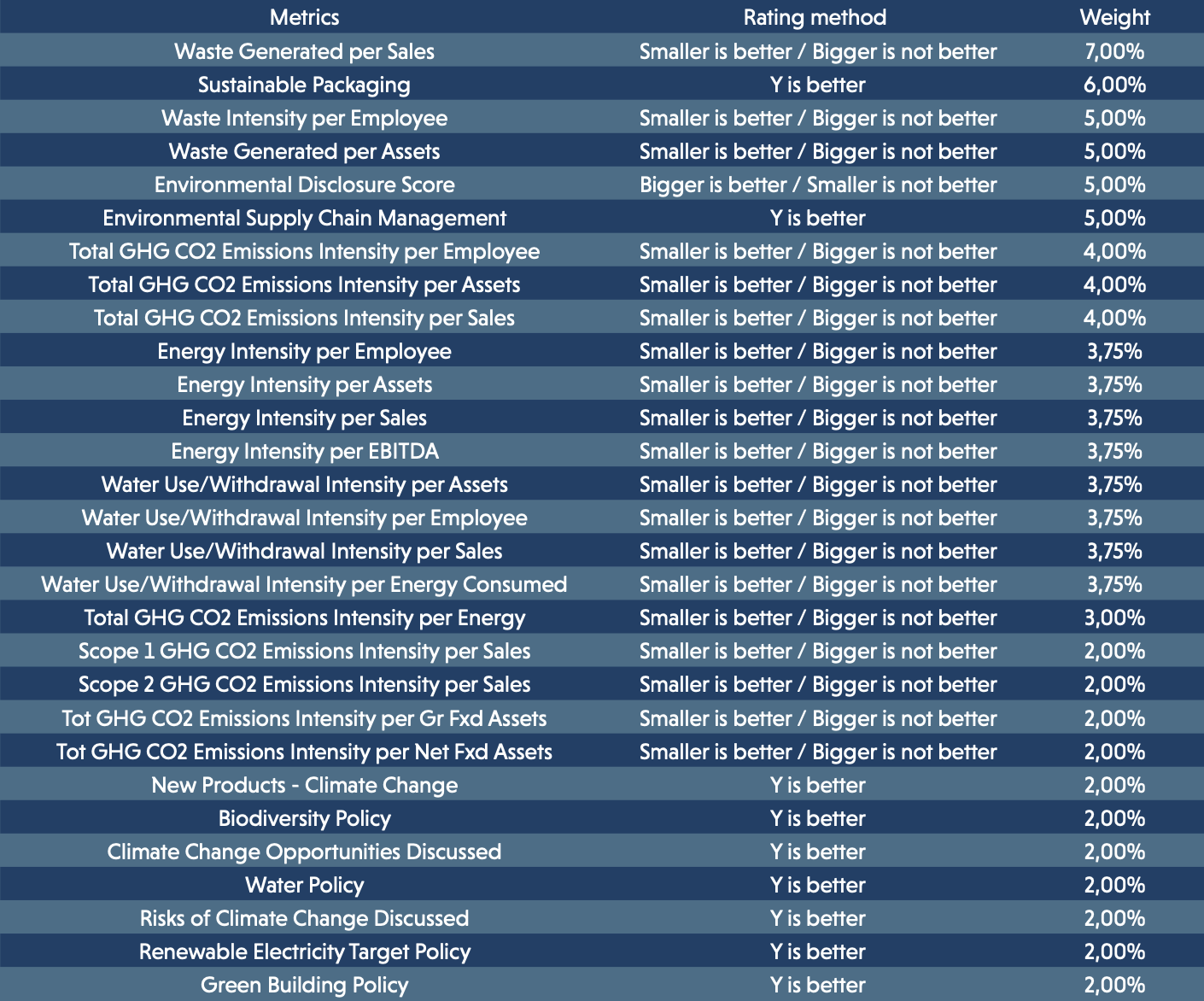

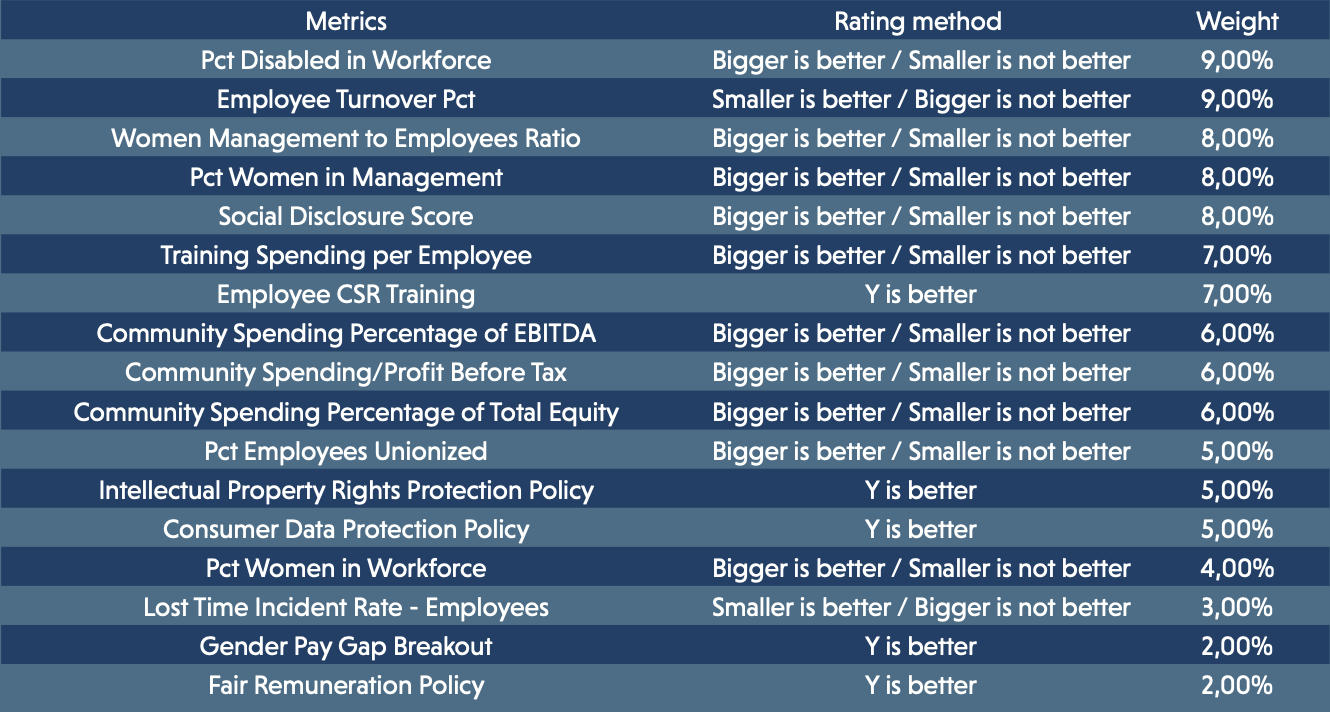

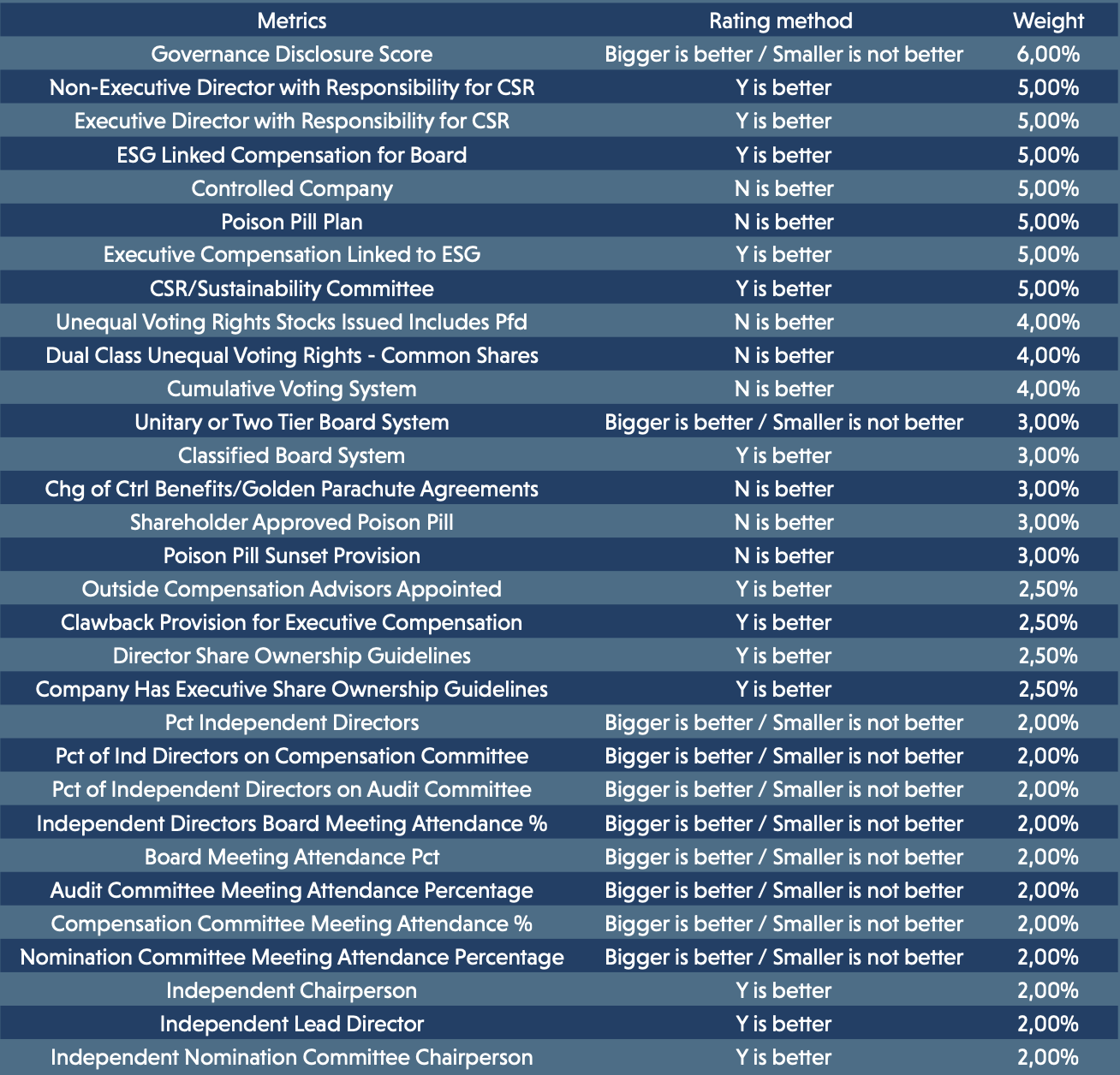

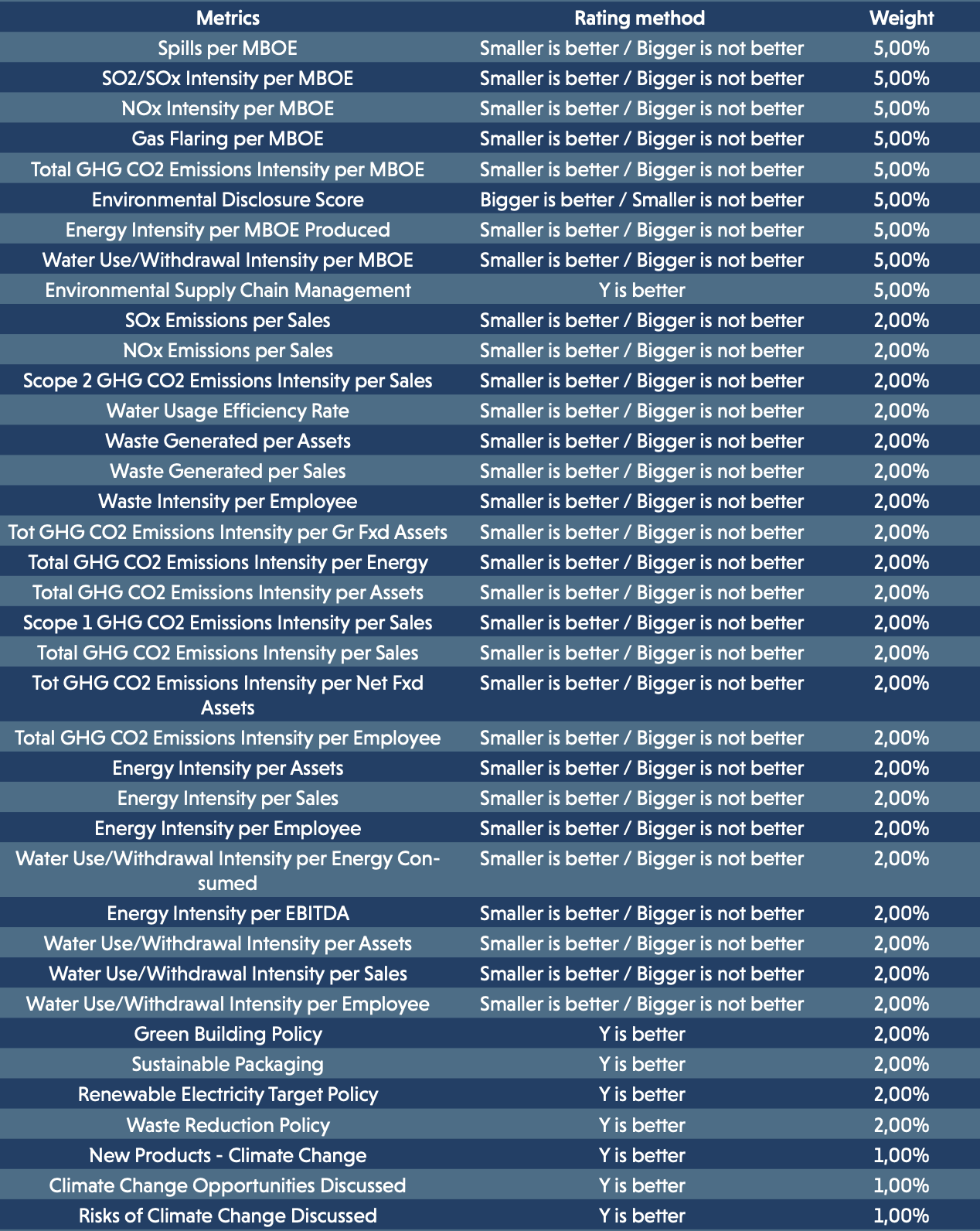

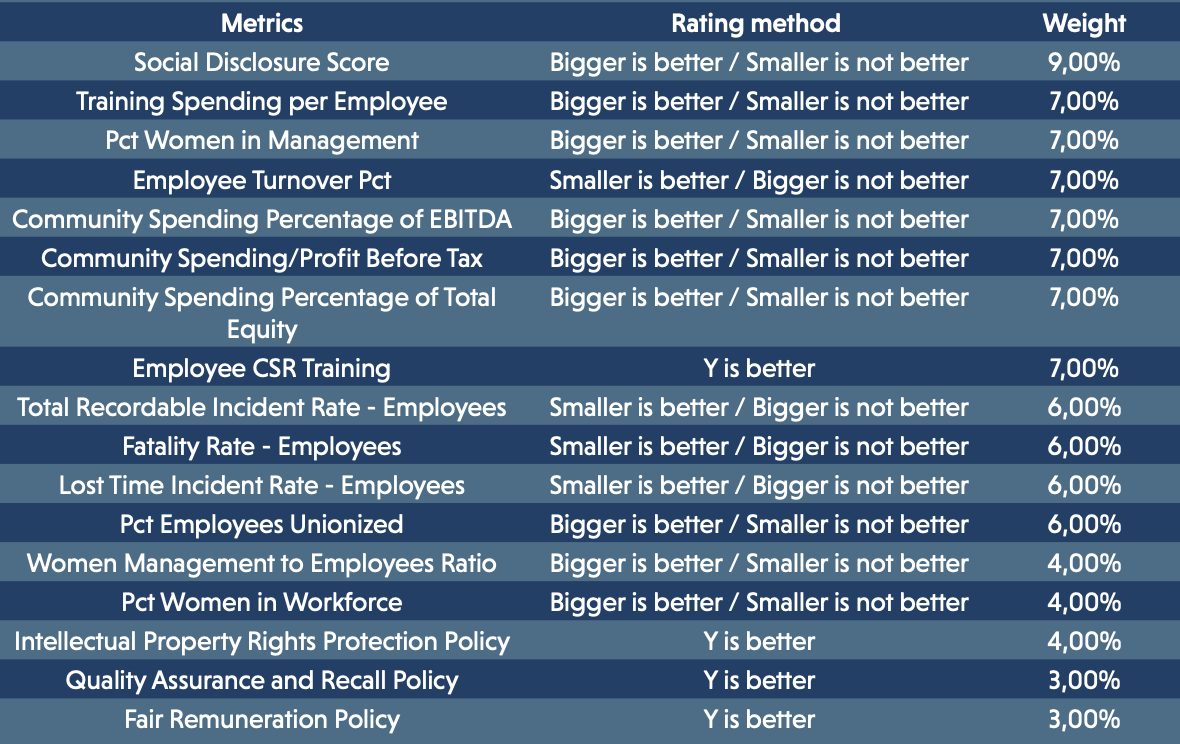

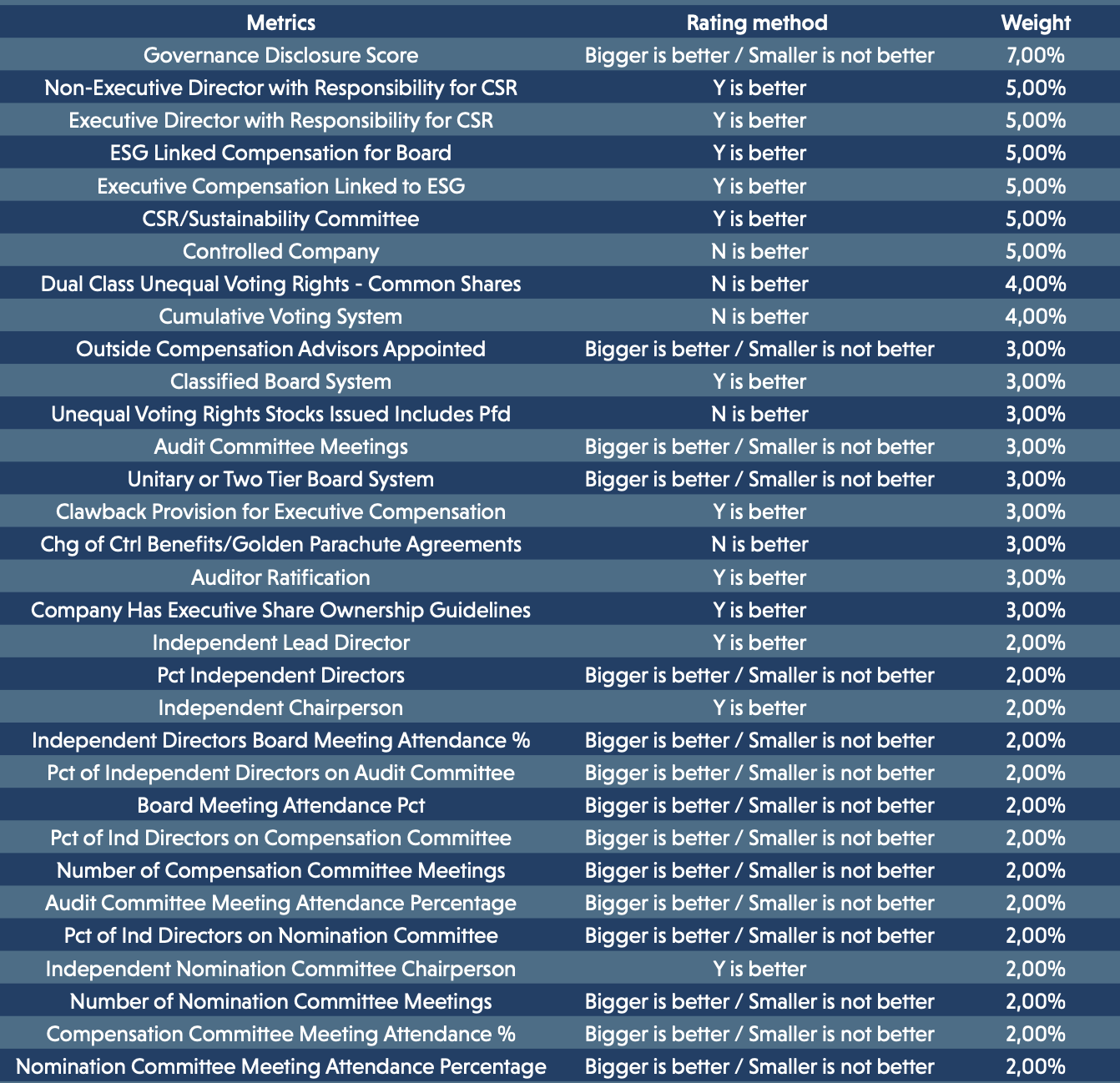

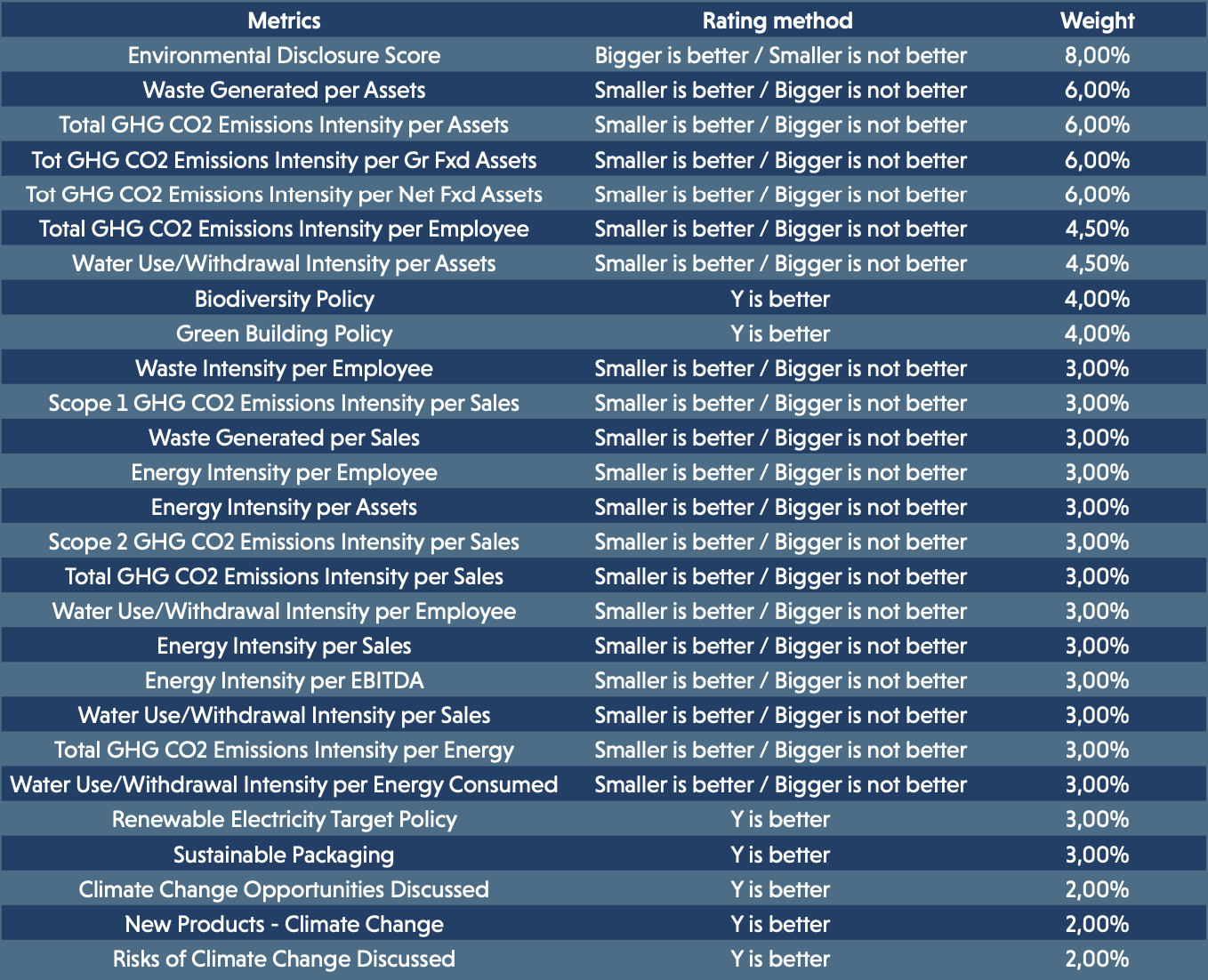

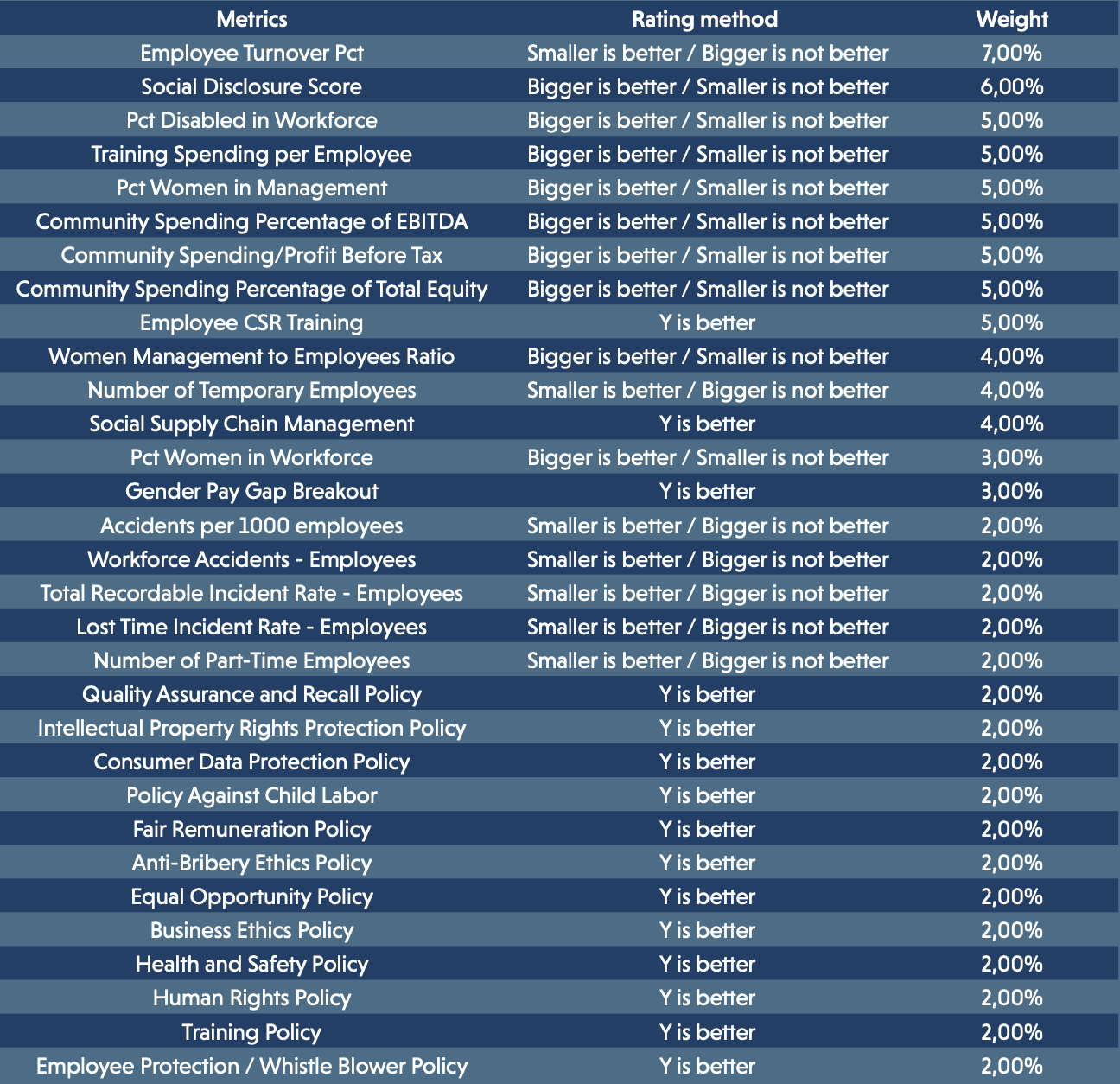

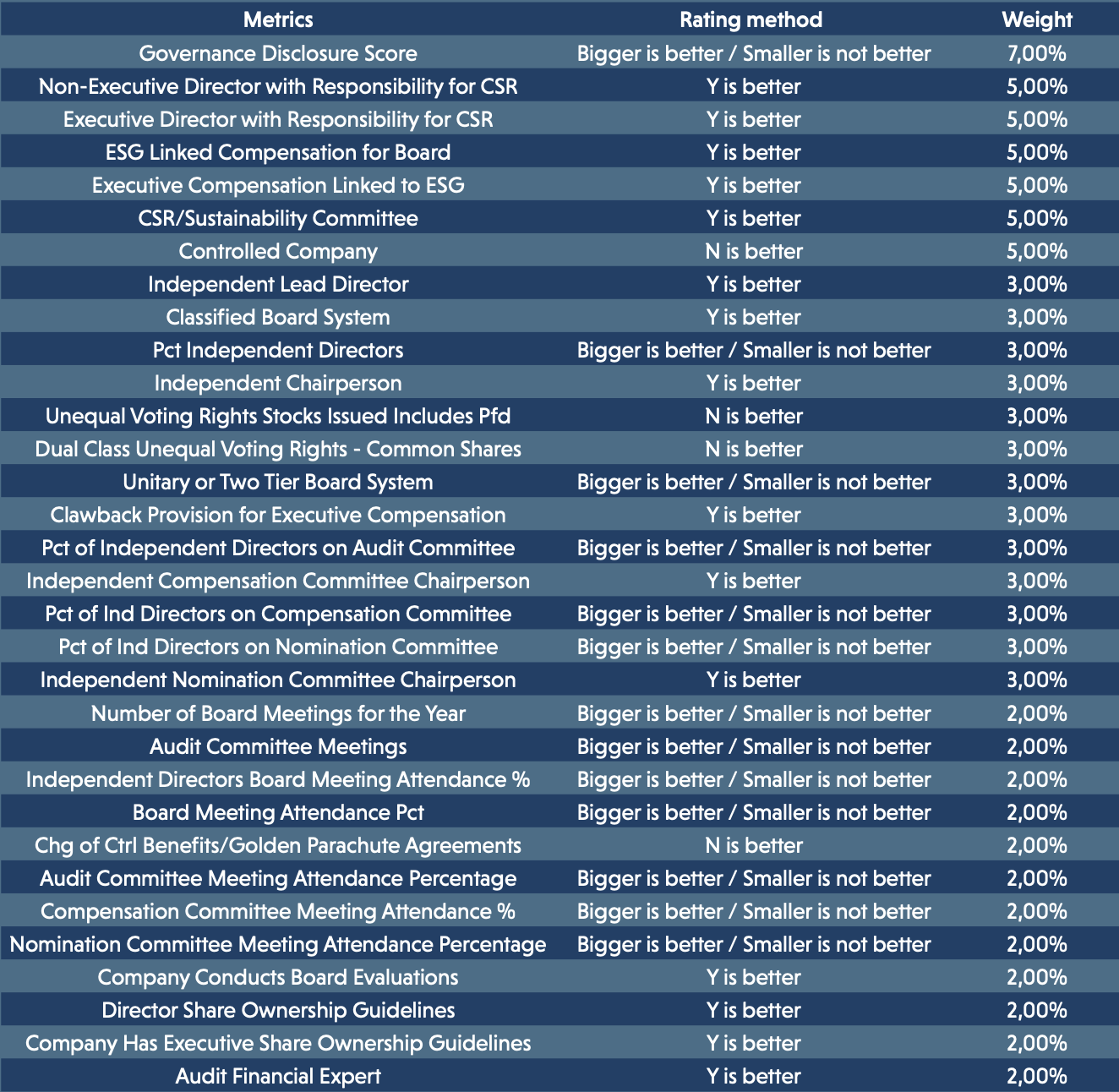

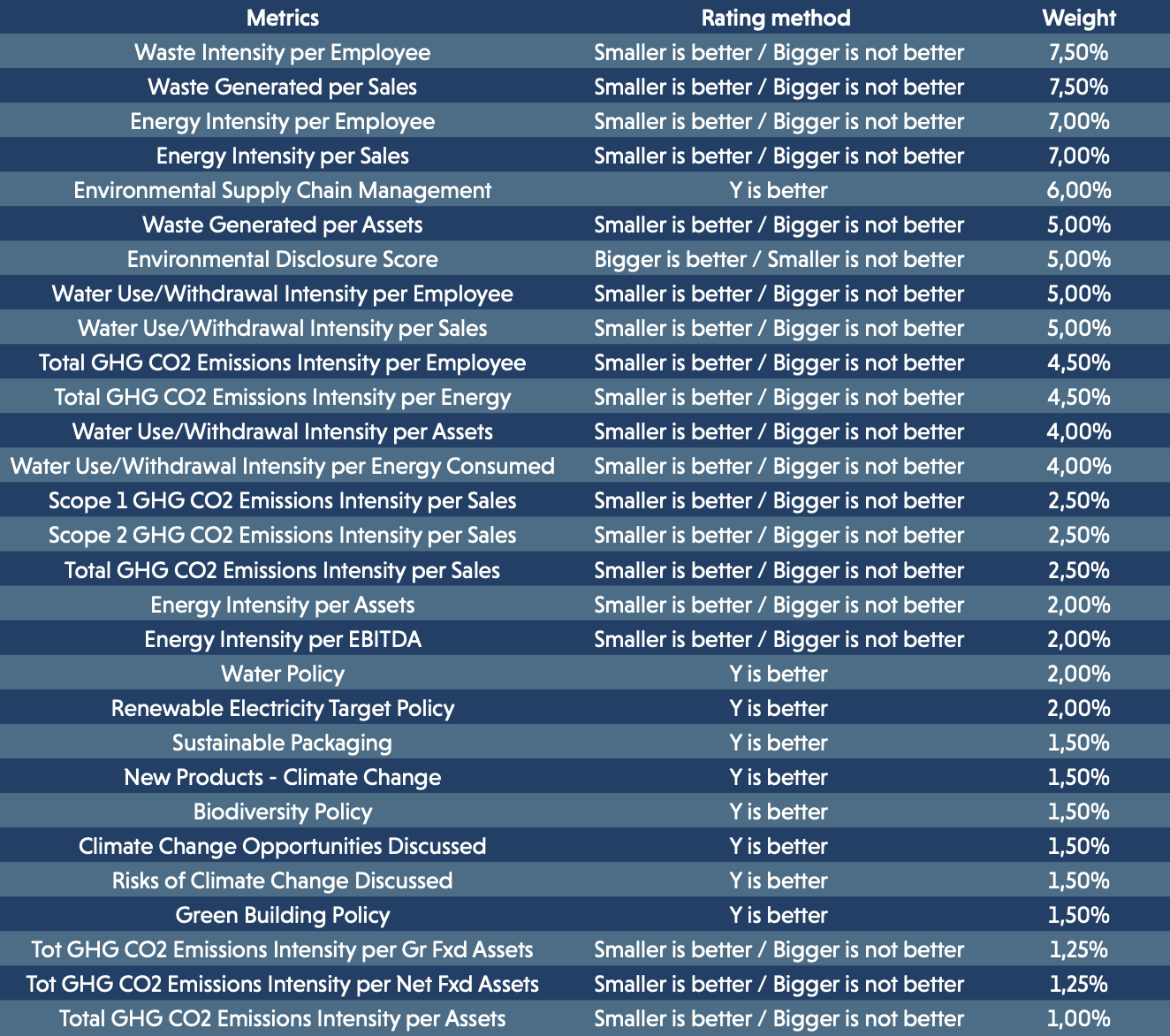

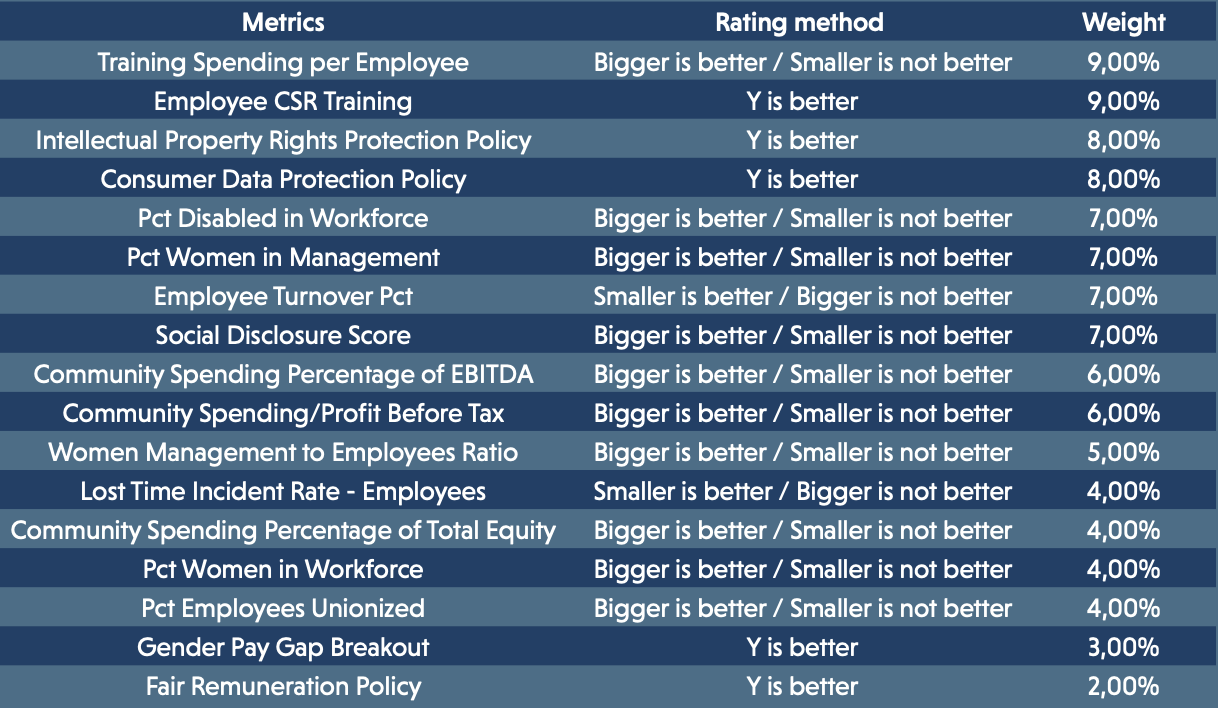

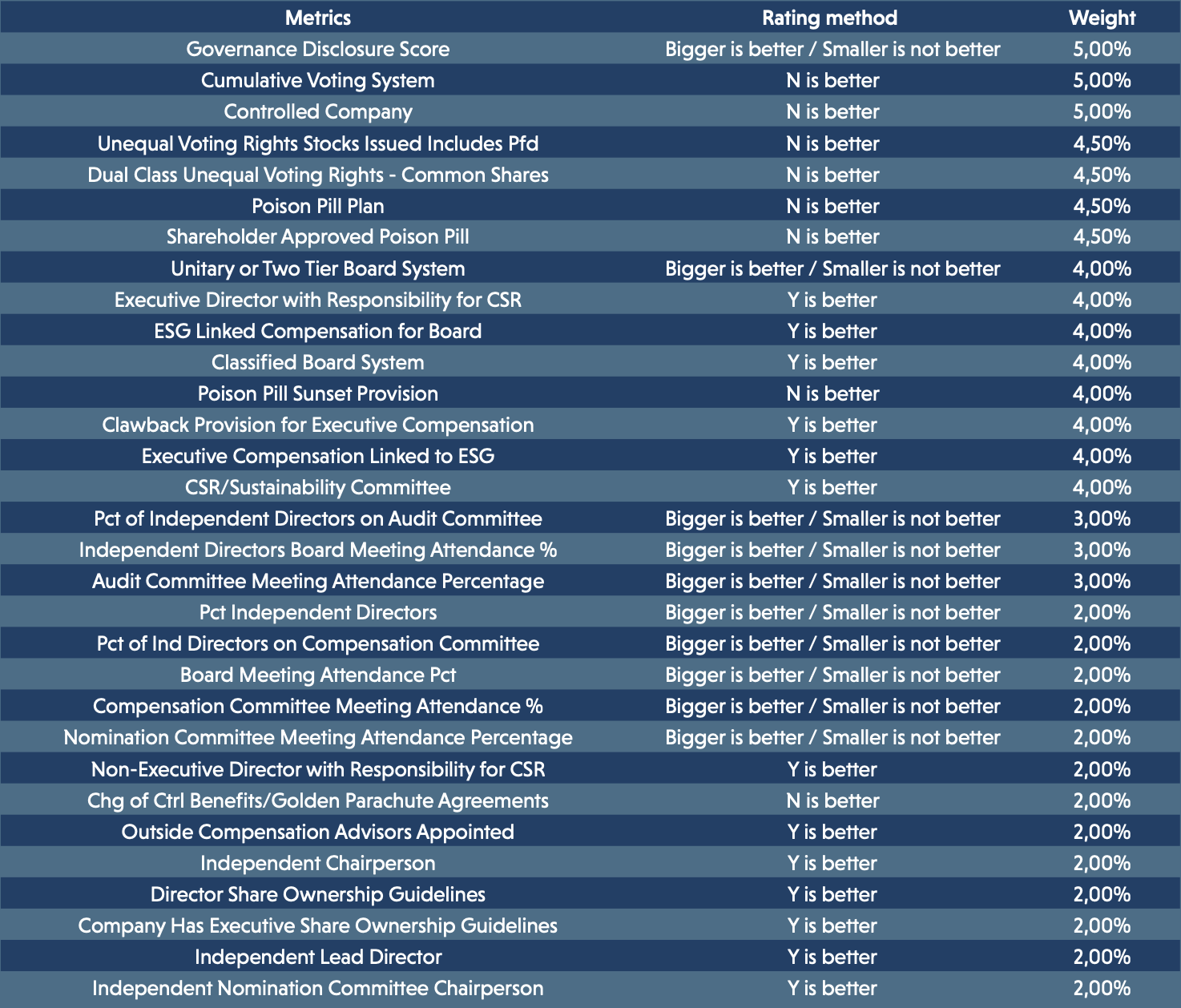

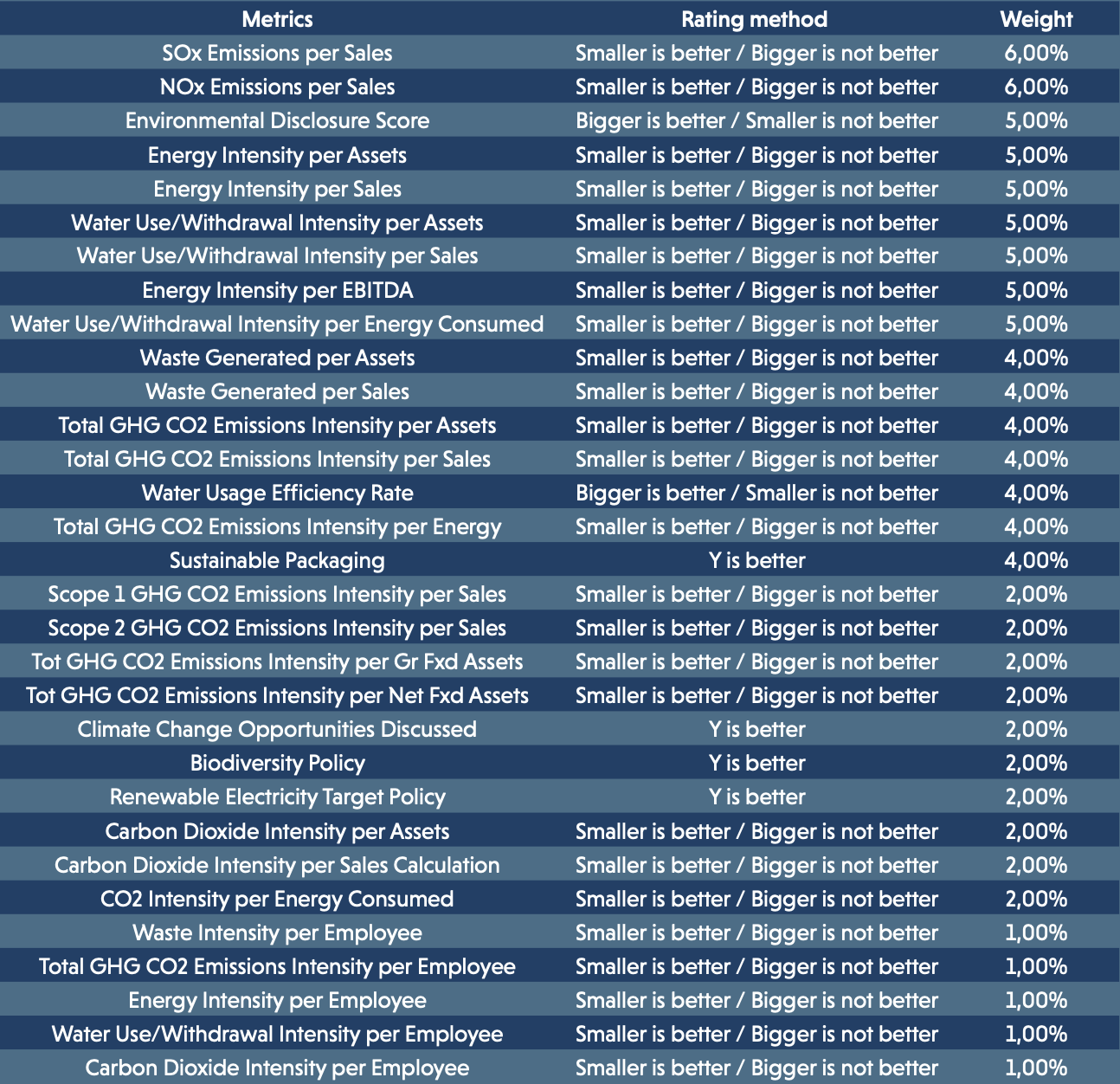

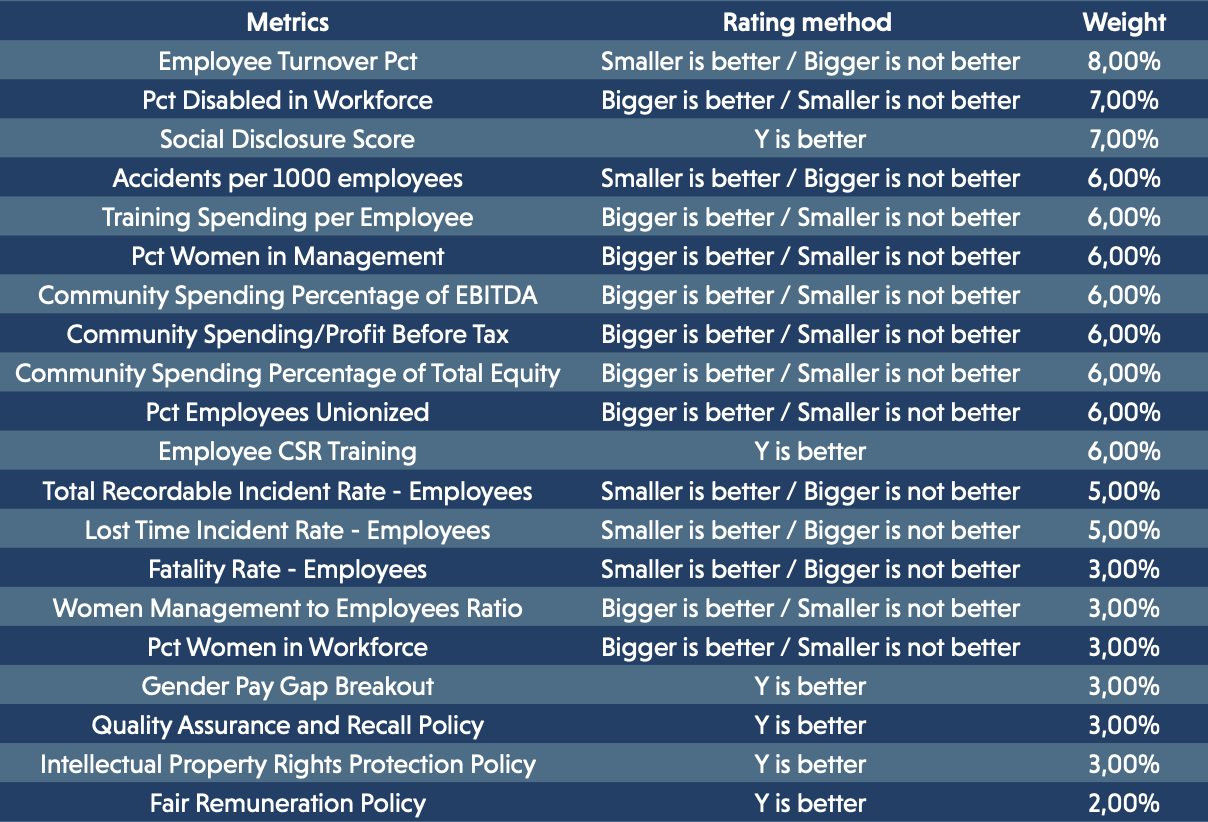

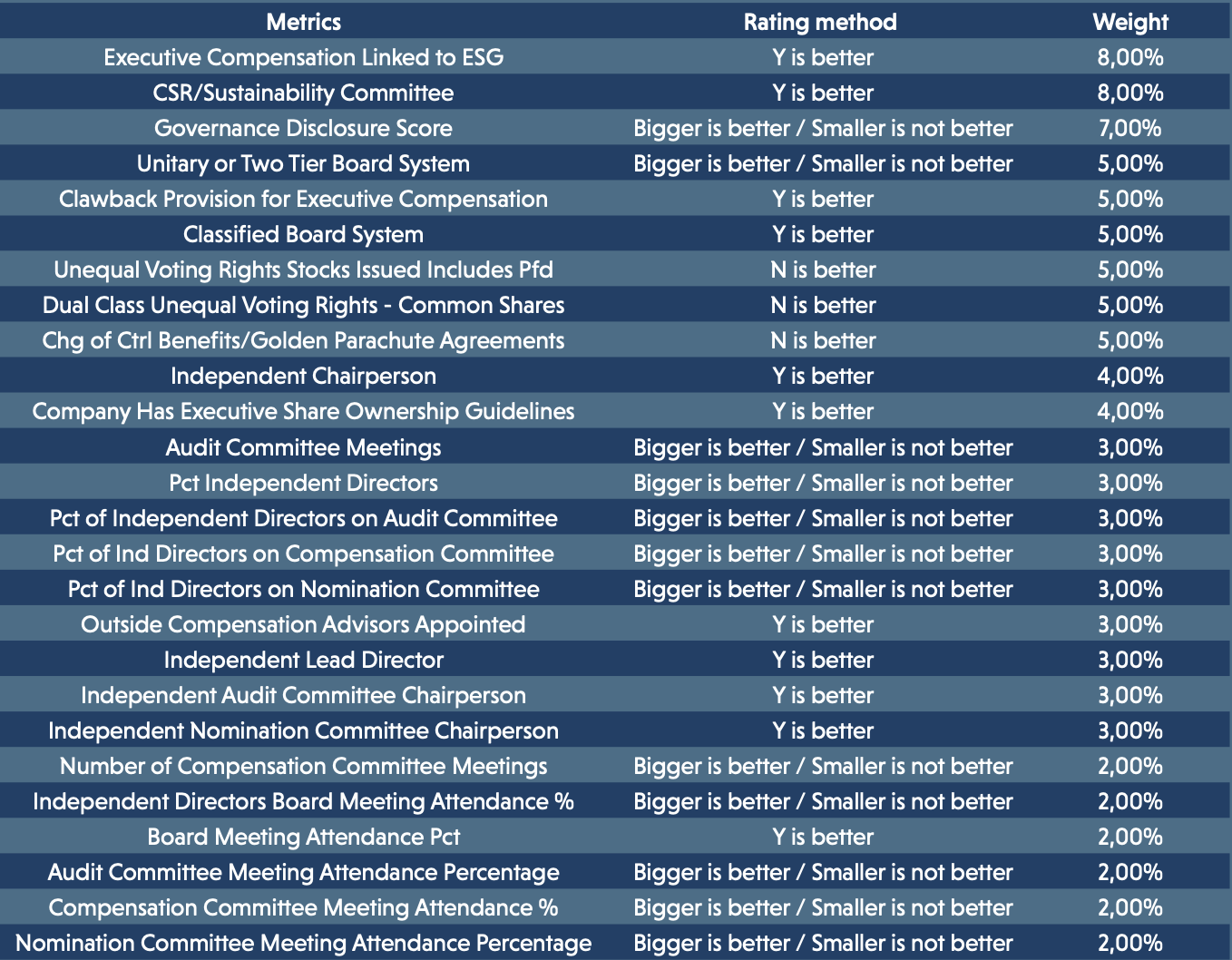

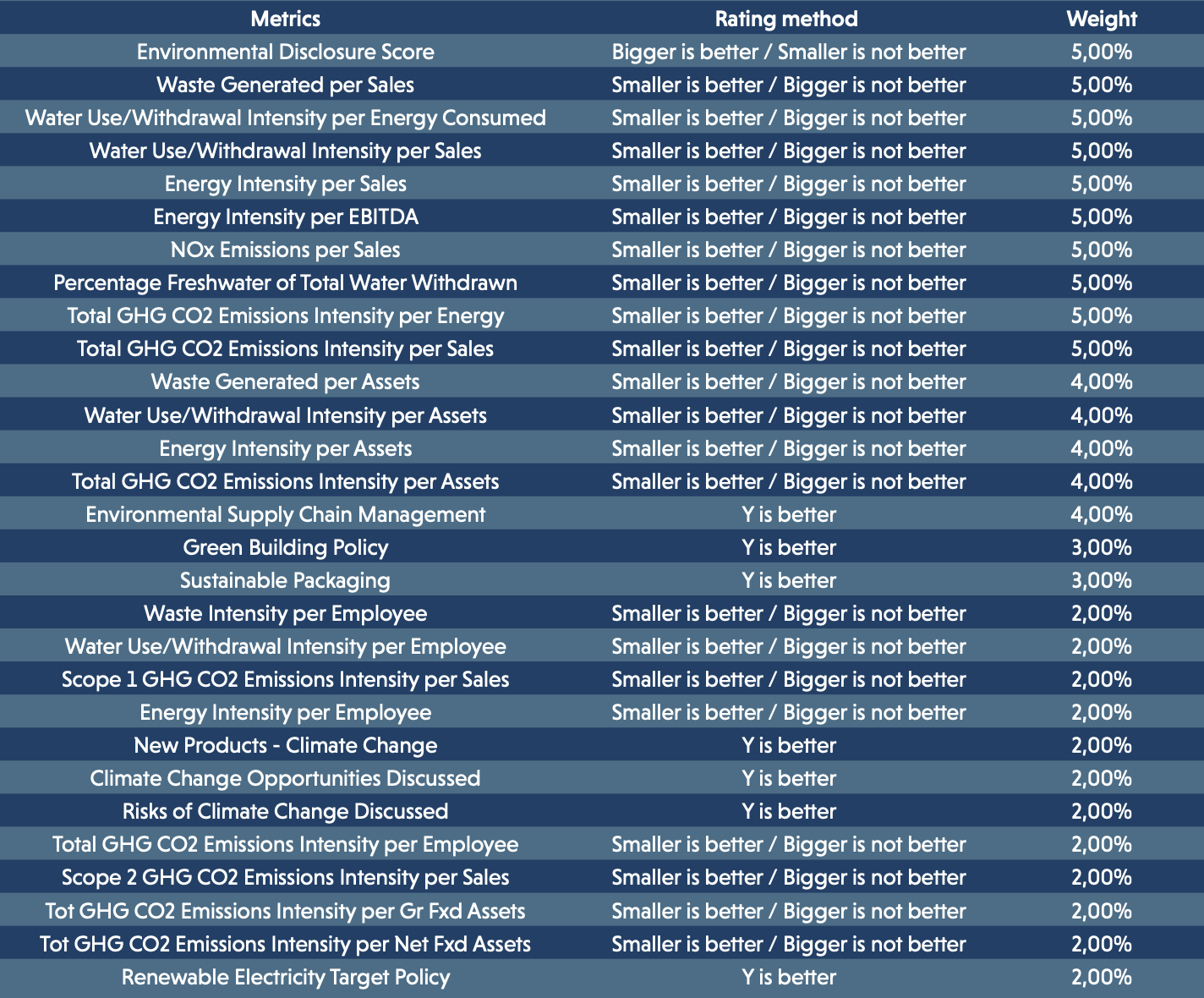

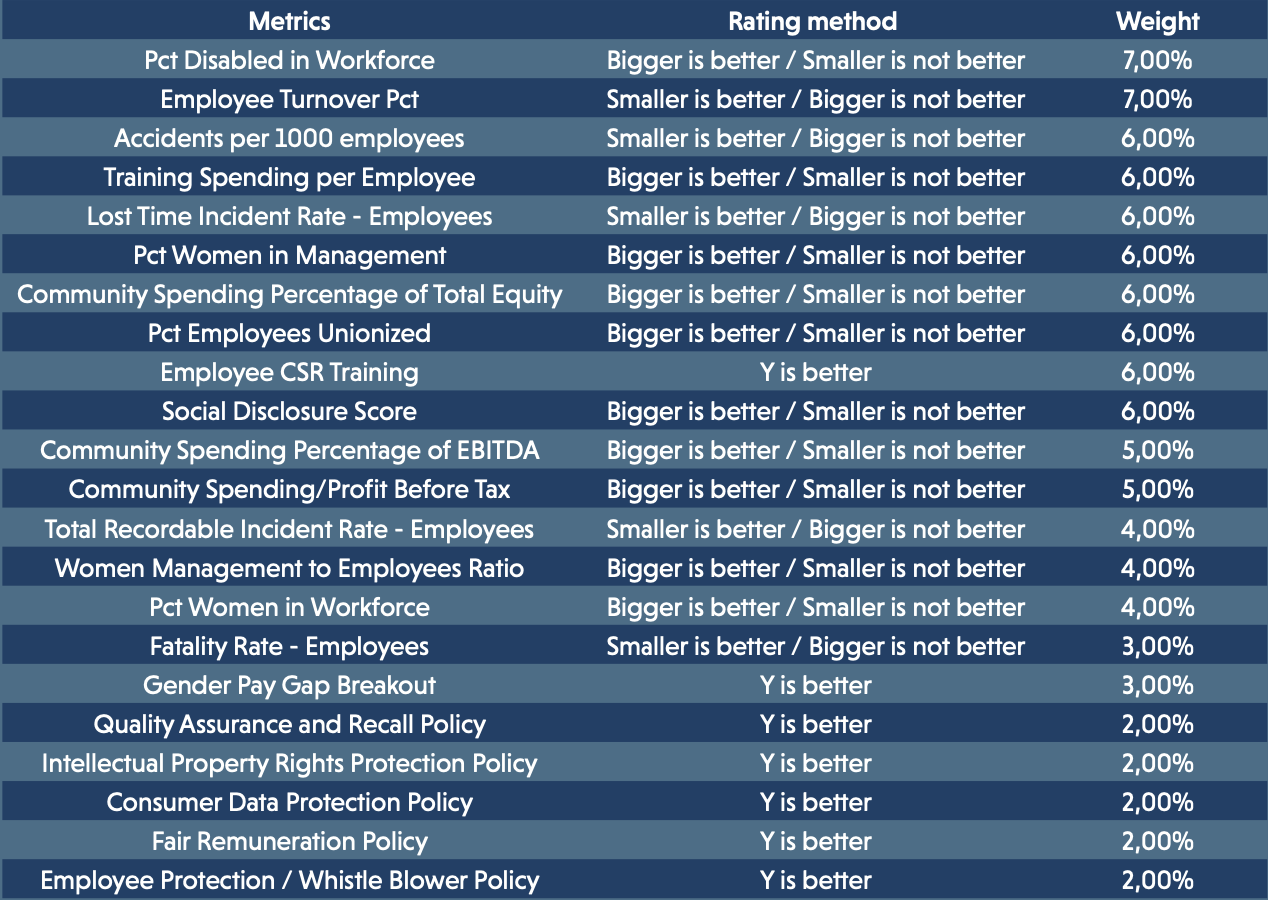

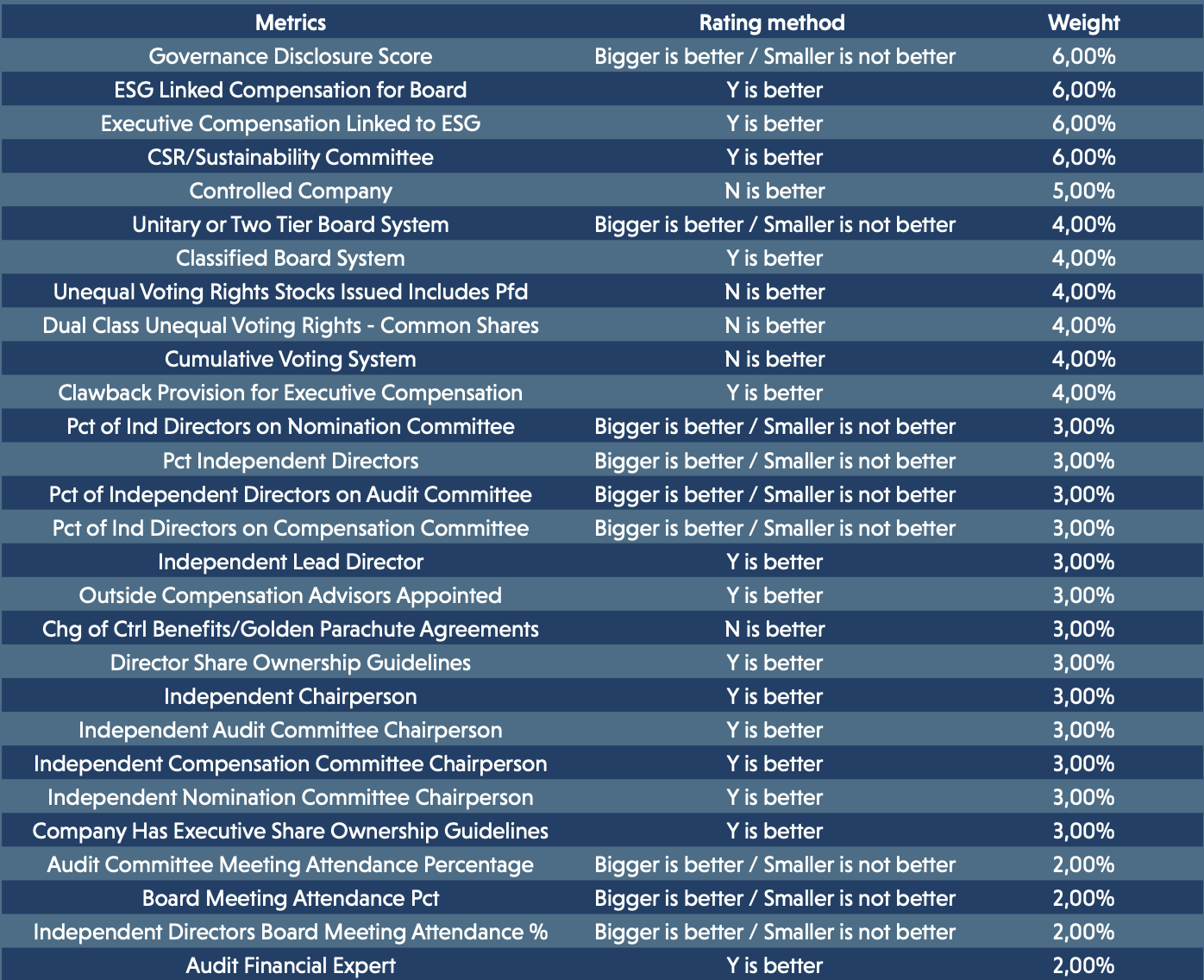

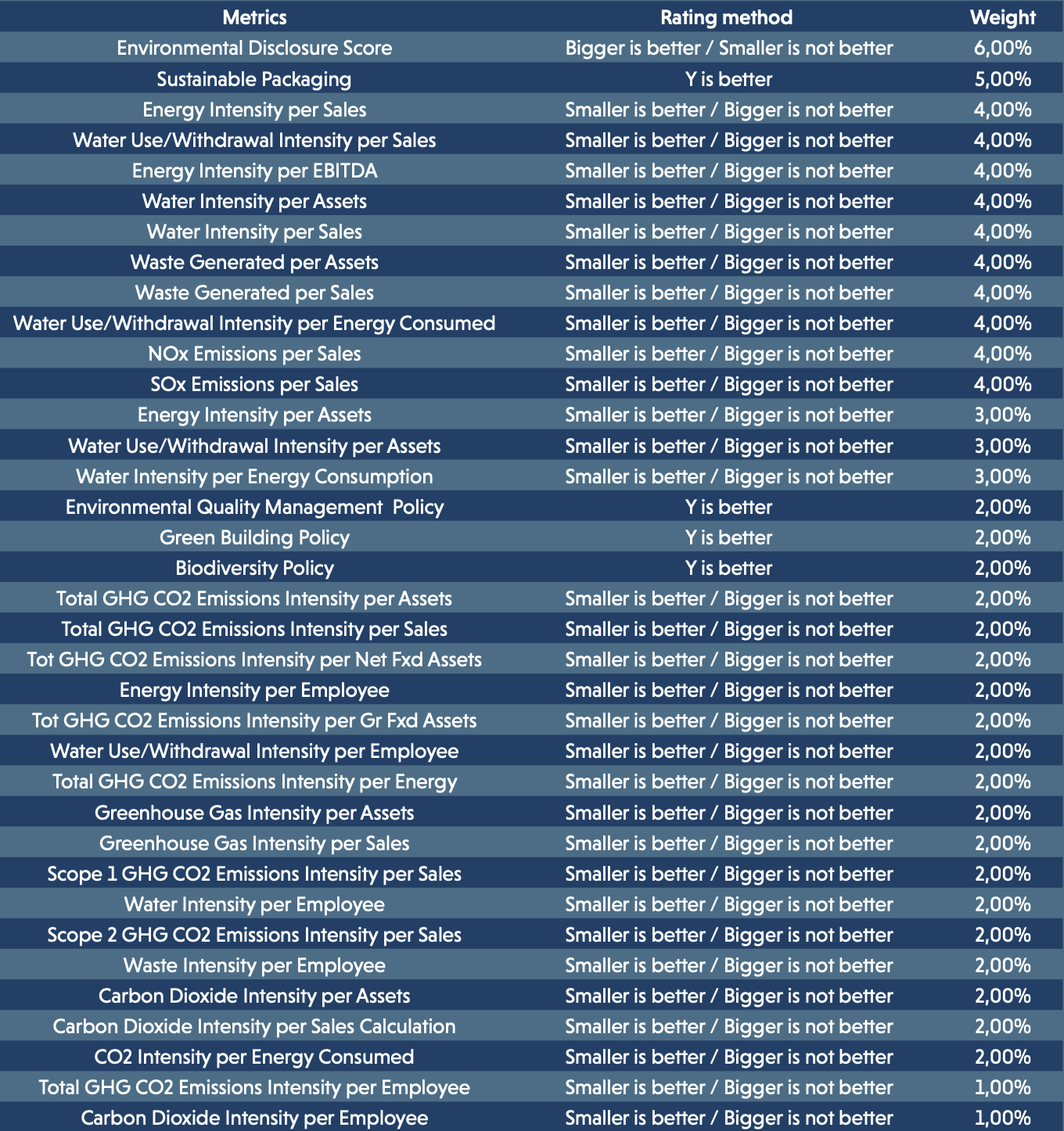

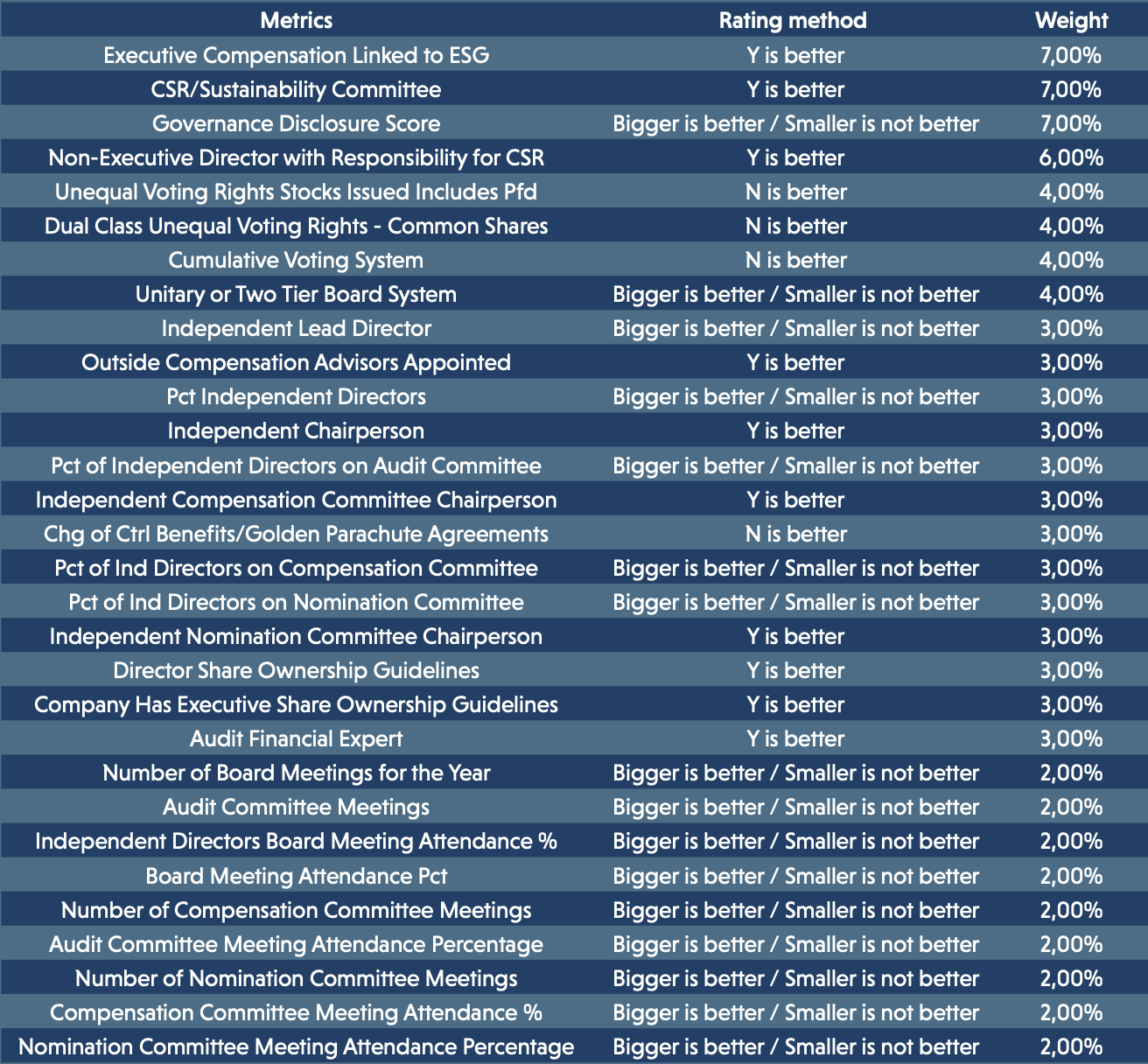

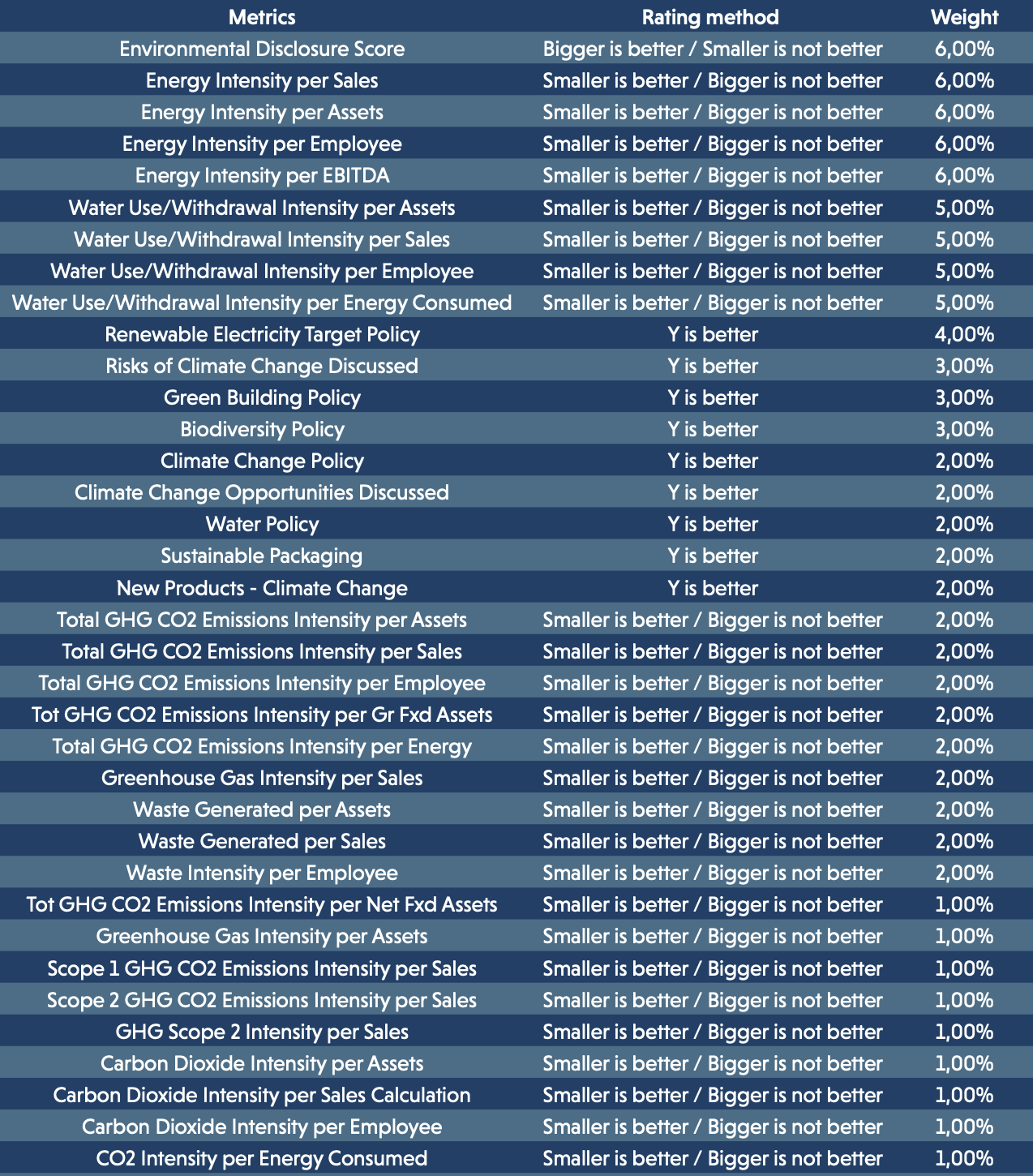

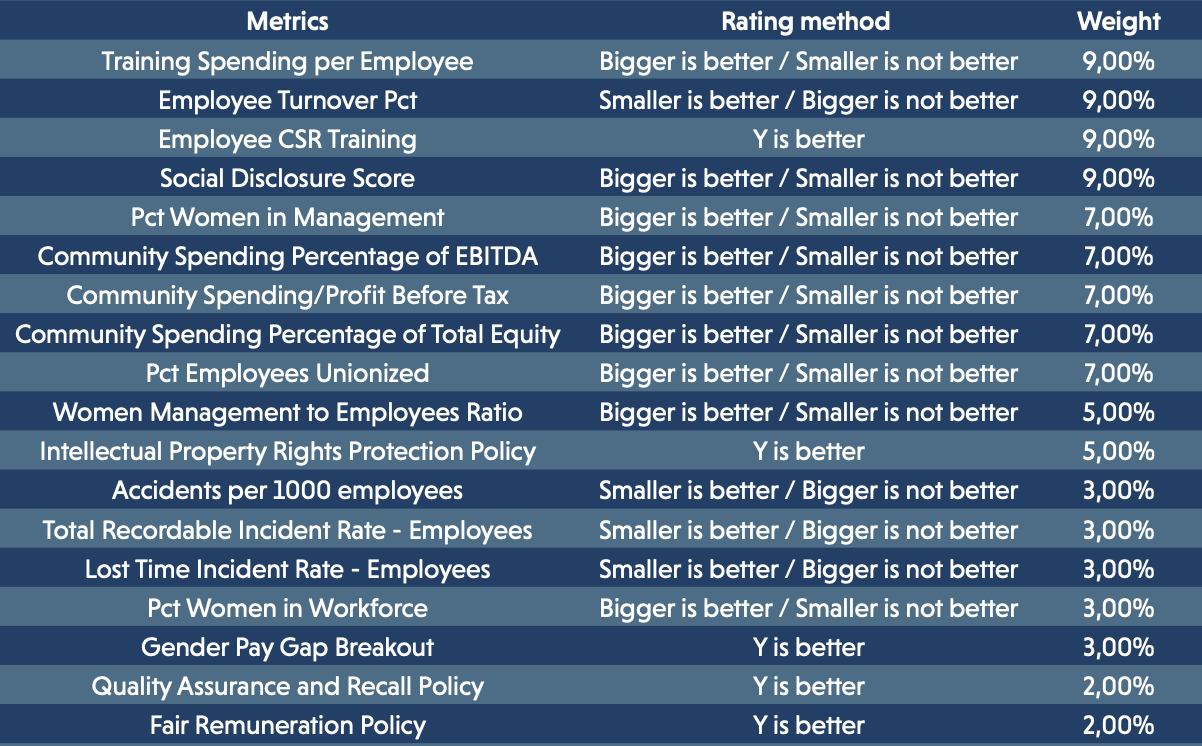

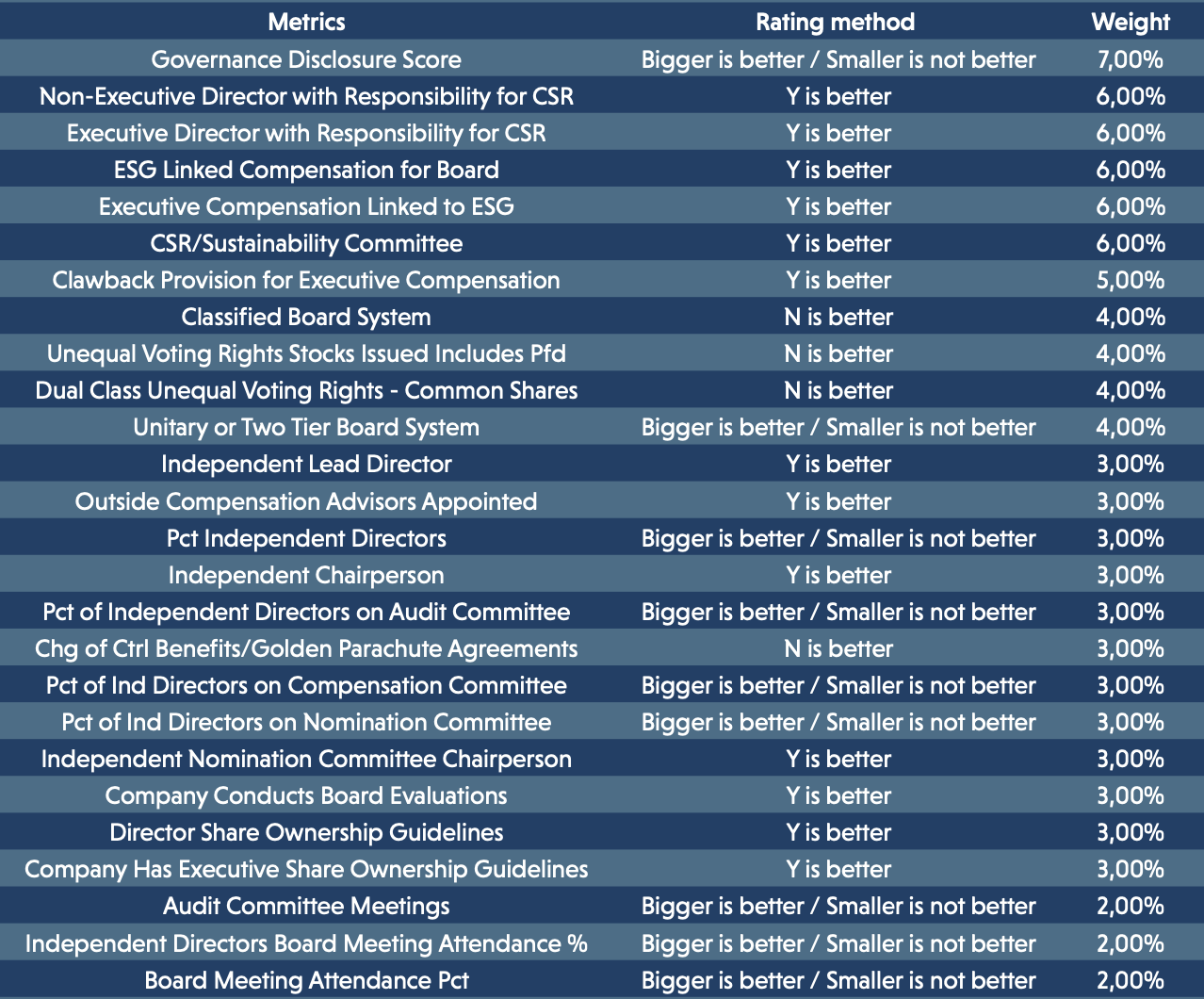

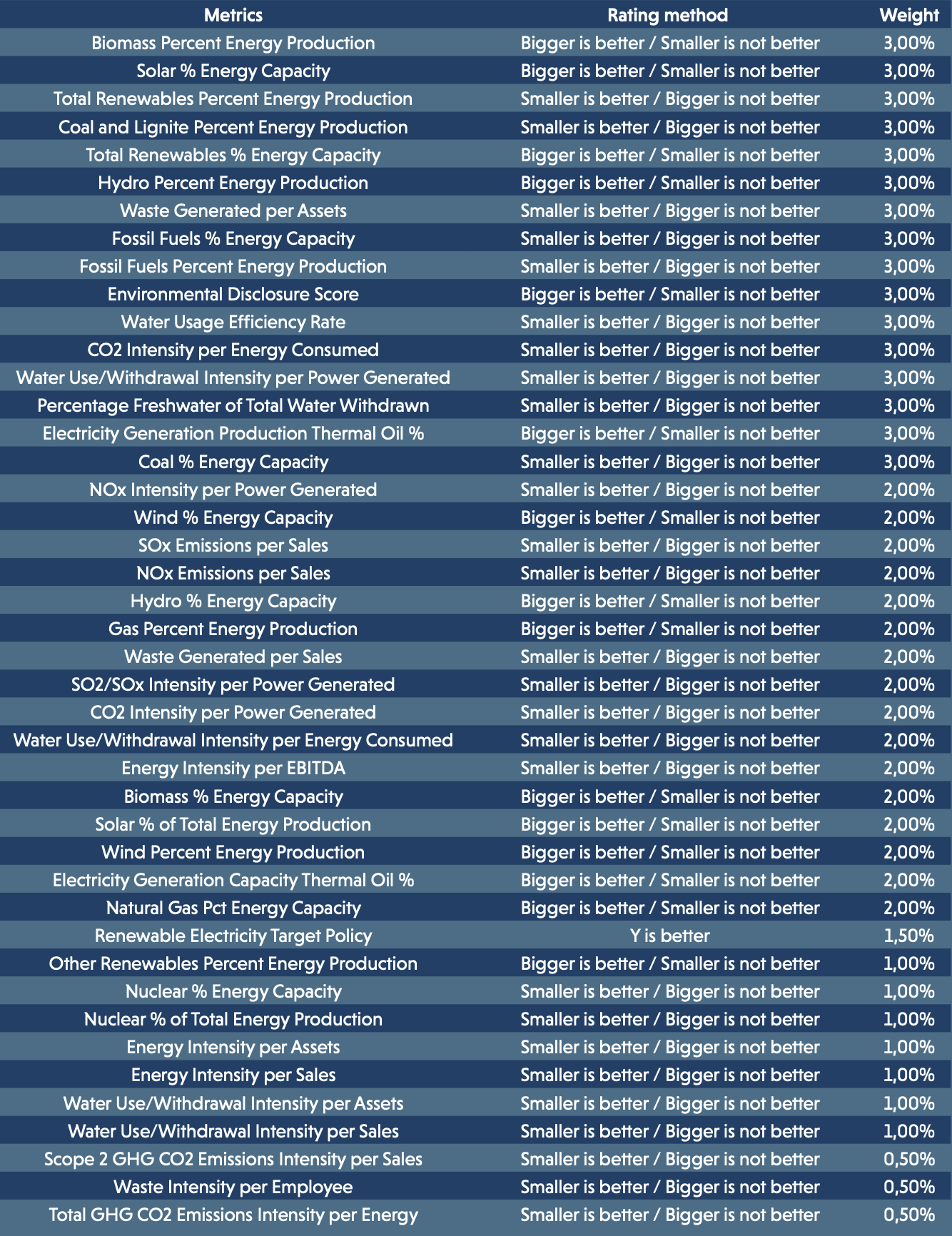

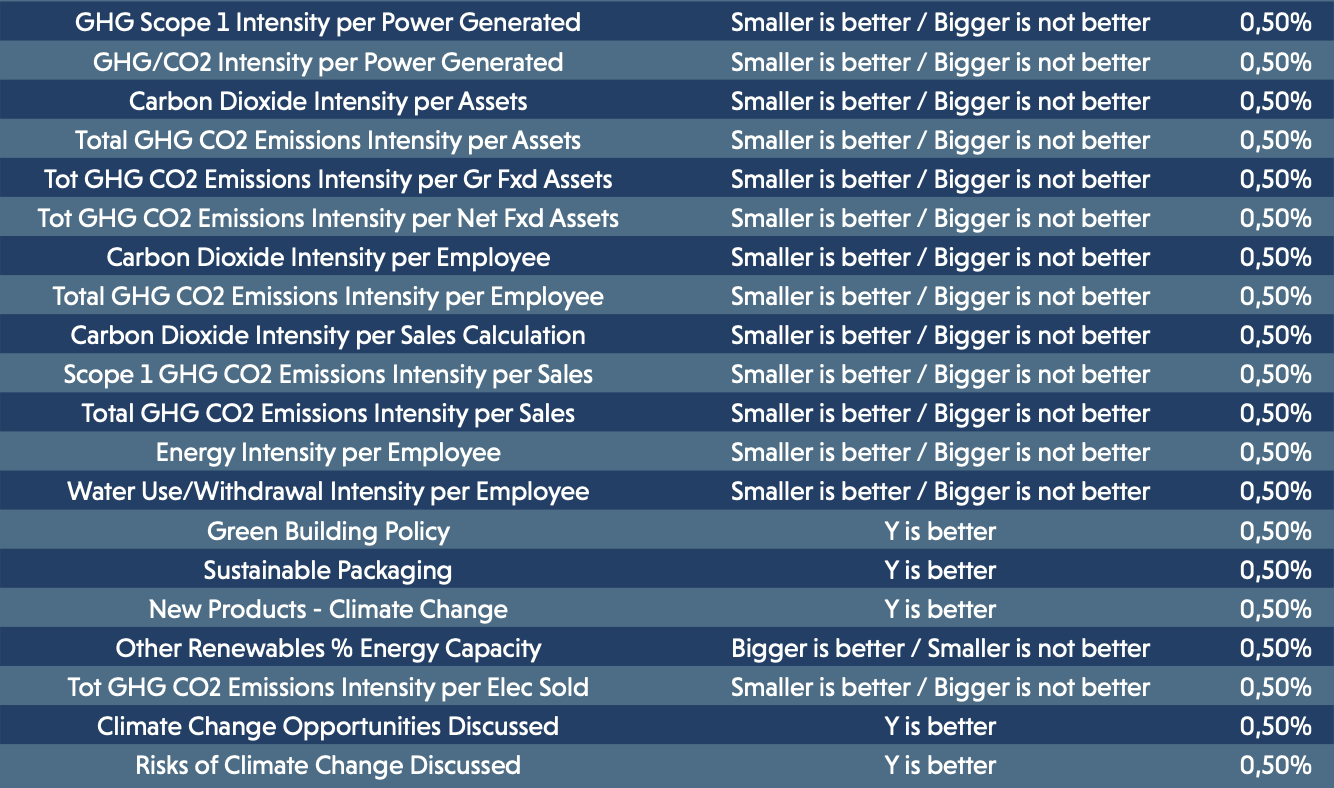

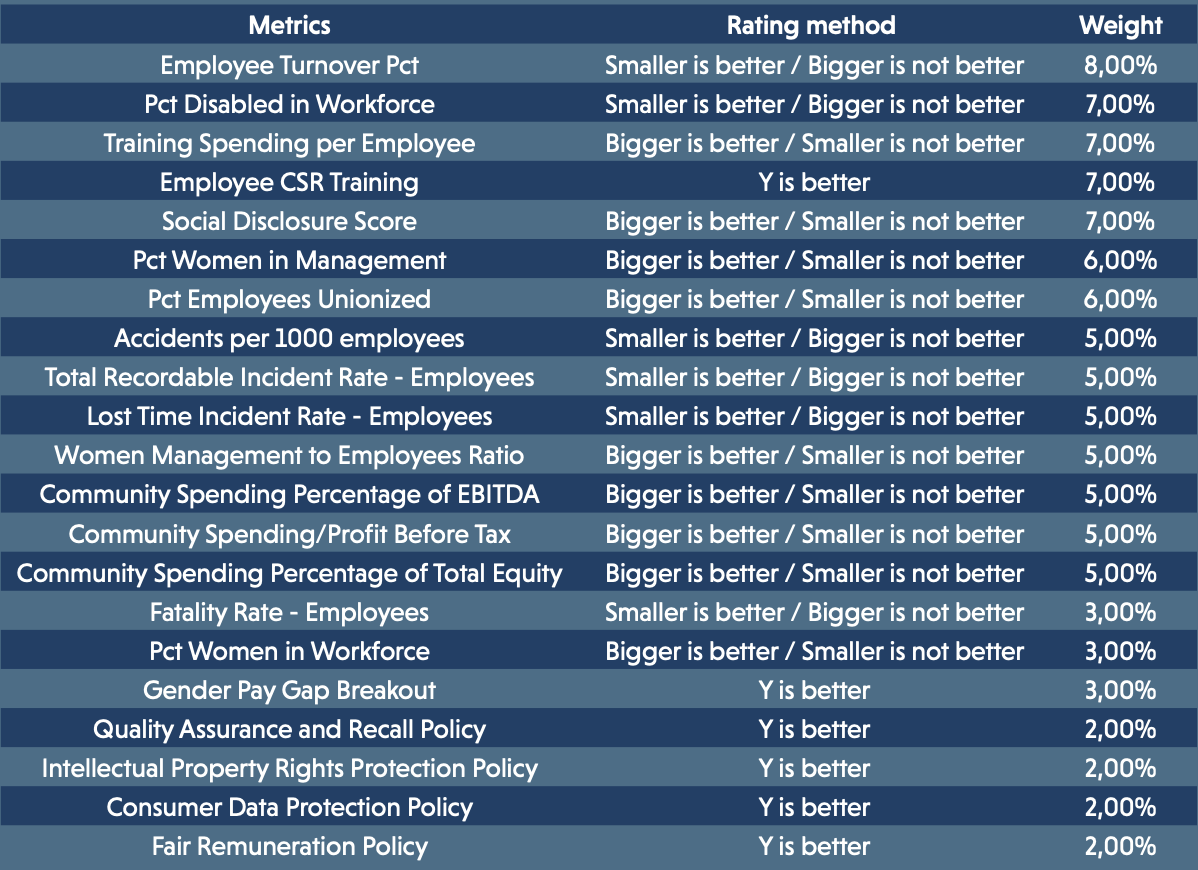

Details of ESG metrics by business sector

Below are the metrics we have selected for each of the E, S and G pillars, based on the business sectors of the companies we select in our management strategies.

Communication

Basic consumption

Discretionary consumption

Energy

Finance

Real estate

Industry

Materials

Health

Technology

Utilities

Communication

Basic consumption

Discretionary consumption

Energy

Finance

Real estate

Industry

Materials

Health

Technology

Utilities

Selected metrics for the communication sector

Environment

Social

Governance

Selected metrics for the consumer staples sector

Environment

Social

Governance

Selected metrics for the consumer discretionary sector

Environment

Social

Governance

Selected metrics for the energy sector

Environment

Social

Governance

Selected metrics for the finance sector

Environment

Social

Governance

Selected metrics for the real estate sector

Environment

Social

Governance

Selected metrics for the industry sector

Environment

Social

Governance

Selected metrics for the materials sector

Environment

Social

Governance

Selected metrics for the health sector

Environment

Social

Governance

Selected metrics for the technology sector

Environment

Social

Governance

Selected metrics for the utilities sector

Environment

Social

Governance