The introduction of this new index is indeed in line with the times, as financial players are increasingly taking a sustainable approach to investments.

Transparency and result-oriented environmental-social-governance policies should be expected from this new ESG index.

V.E. appears to have guided Euronext in creating the ESG rating methodology of the CAC 40 ESG index, whereas Euronext will simply arbitrate and make the index available to investors.

Little information is however available on Euronext’s website nor on its presentation leaflet, as per the Global Compact principles and the French SRI label.

The lack of information in this regard turns out to be surprising when considering one of the key principles of the SRI label is increased transparency for financial products.

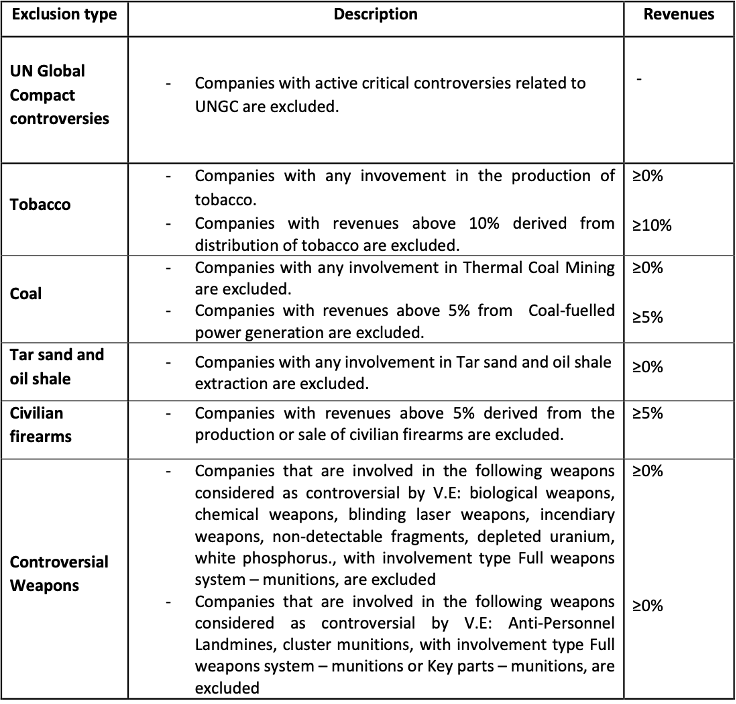

- PProduction of weapons or weapon systems

- PTobacco production

- PCompanies facing heavy controversy under the UN Global Compact

- PCivilian arms production (over 5% of company revenue)

- PTobacco distribution (more than 10% of company revenue)

- PCompanies involved in coal mining, coal-fired power generation (more than 5% of company revenue)

V.E. therefore acts as ESG advisor and has no control over the selection of criteria for the composition of the score.

According to V.E., the ESG rating is equally weighted for each major pillar: E (Environment) represents 33.33% of the overall score, as well as for the S (Social) and G (Governance).

Two-hundred, fifty analysts at V.E. retrieve and process data from publicly listed companies, in accordance to the selected 38 criteria for the creation and updating of the index.

The data is sourced from:

- PCompany websites

- PCompany annual reports

- PFactiva (Dow Jones database)

- PBloomberg

- PReuters

- PEnvironmental protection

- PSafeguarding the environment

- PPrevention of environmental damage

- PEstablishment of an appropriate management strategy

- PEco-design

- PProtection of biodiversity

- PReasonable control of environmental impacts on the overall life cycle of products and services.

- PRespect for trade unions

- PFreedom and promotion of collective bargaining

- PNon-discrimination and promotion of equality

- PEradication of prohibited labour practices

- PPrevention of inhuman or humiliating treatment

- PContinuous improvement of industrial relations

- PCareer development

- PQuality of working conditions

- PContribution to the economic and social development of the territories where it is located and their human communities

- PConcrete commitment to controlling the societal impacts of products and services

- PTransparent and participatory contribution to public interest causes.

- PConsideration of clients' rights and interests

- PIntegration of social and environmental standards both in the supplier selection process and in the overall supply chain

- PEffective prevention of corruption

- PCompliance with competition laws

- PEfficiency and integrity

- PEnsuring both the independence and effectiveness of the board

- PEffectiveness and efficiency of audit and control systems

- PInclusion of social responsibility risks

- PRespect for the rights of shareholders and especially of minorities

- PTransparency and moderation of executive remuneration

- PEnvironmental protection

- PSafeguarding the environment

- PPrevention of environmental damage

- PEstablishment of an appropriate management strategy

- PEco-design

- PProtection of biodiversity

- PReasonable control of environmental impacts on the overall life cycle of products and services.

- PRespect for trade unions

- PFreedom and promotion of collective bargaining

- PNon-discrimination and promotion of equality

- PEradication of prohibited labour practices

- PPrevention of inhuman or humiliating treatment

- PContinuous improvement of industrial relations

- PCareer development

- PQuality of working conditions

- PContribution to the economic and social development of the territories where it is located and their human communities

- PConcrete commitment to controlling the societal impacts of products and services

- PTransparent and participatory contribution to public interest causes.

- PConsideration of clients' rights and interests

- PIntegration of social and environmental standards both in the supplier selection process and in the overall supply chain

- PEffective prevention of corruption

- PCompliance with competition laws

- PEfficiency and integrity

- PEnsuring both the independence and effectiveness of the board

- PEffectiveness and efficiency of audit and control systems

- PInclusion of social responsibility risks

- PRespect for the rights of shareholders and especially of minorities

- PTransparency and moderation of executive remuneration

On a positive note, the criteria are adapted according to the sector of activity. For example, a question regarding eco-design will be directed to a company in the consumer sector, but not necessarily to a company in the pharmaceutical sector.

The ESG evaluations are only made on a relative basis, in which each assessment of a criterion is scored from 1 to 4.

The analysis is repeated on a quarterly basis in order to arbitrate which companies enter or exit the ESG index.

While barring those companies in conflict with the UN Global Compact is most sensible, little detail is given as to how companies are assessed with respect to human rights, labour laws, child exploitation, etc.

The launching of the CAC 40 ESG index supports transparency in the corporate world, yet the Euronext website hardly shares any information on this front.

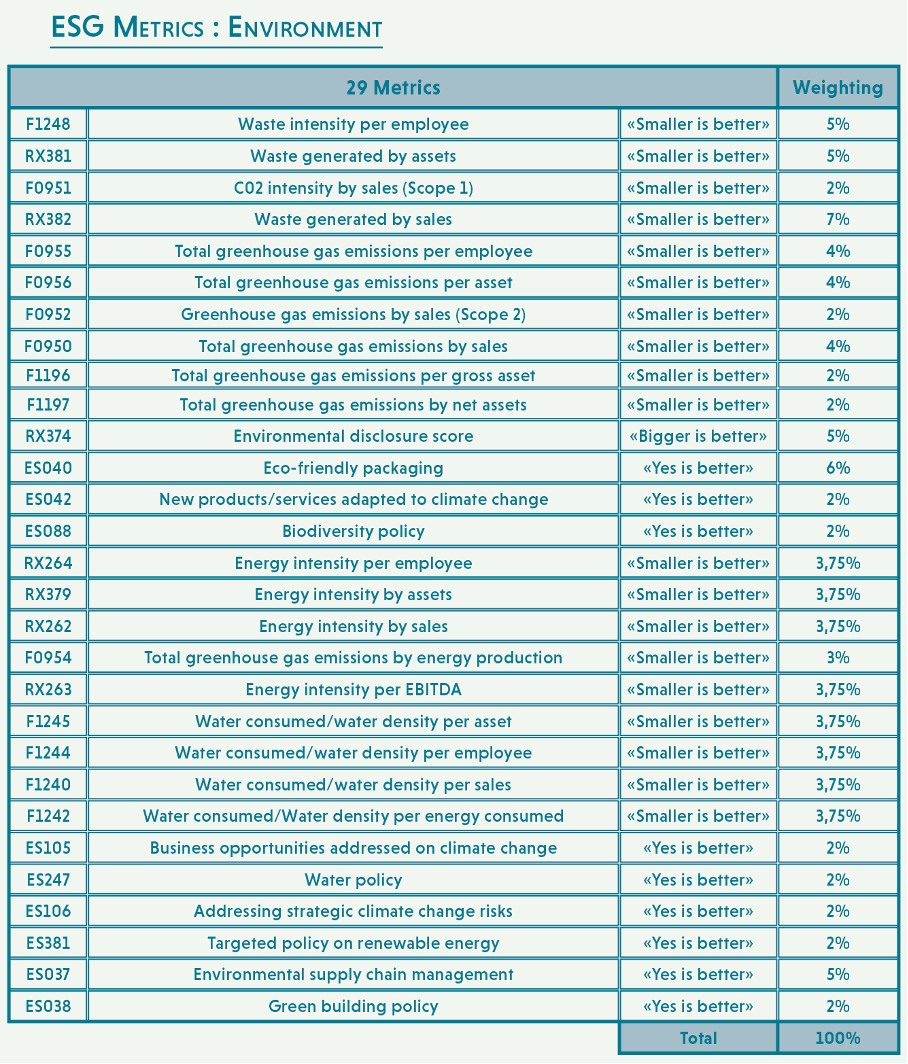

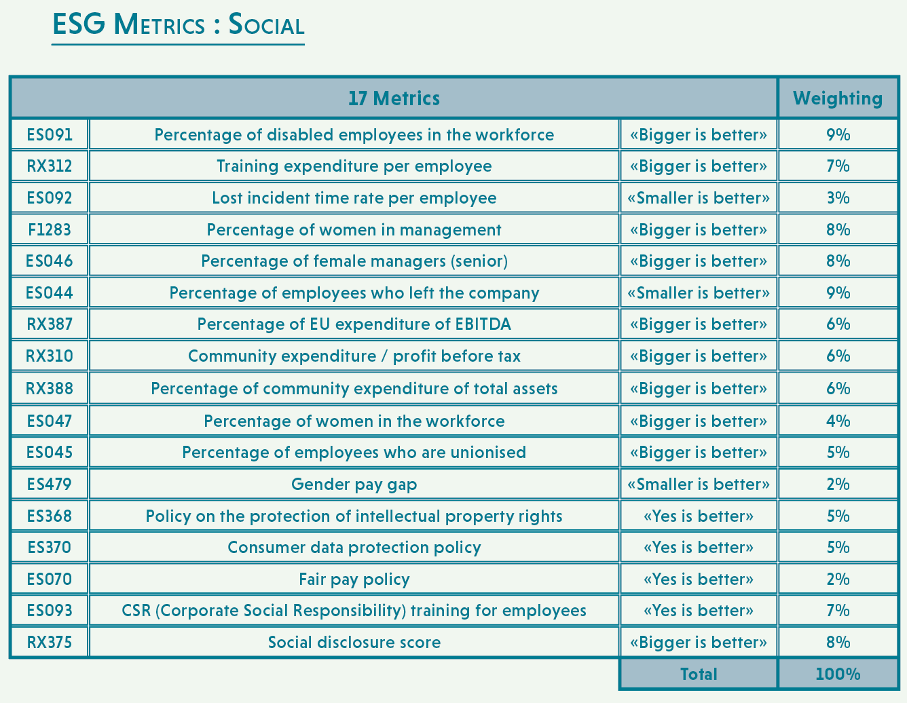

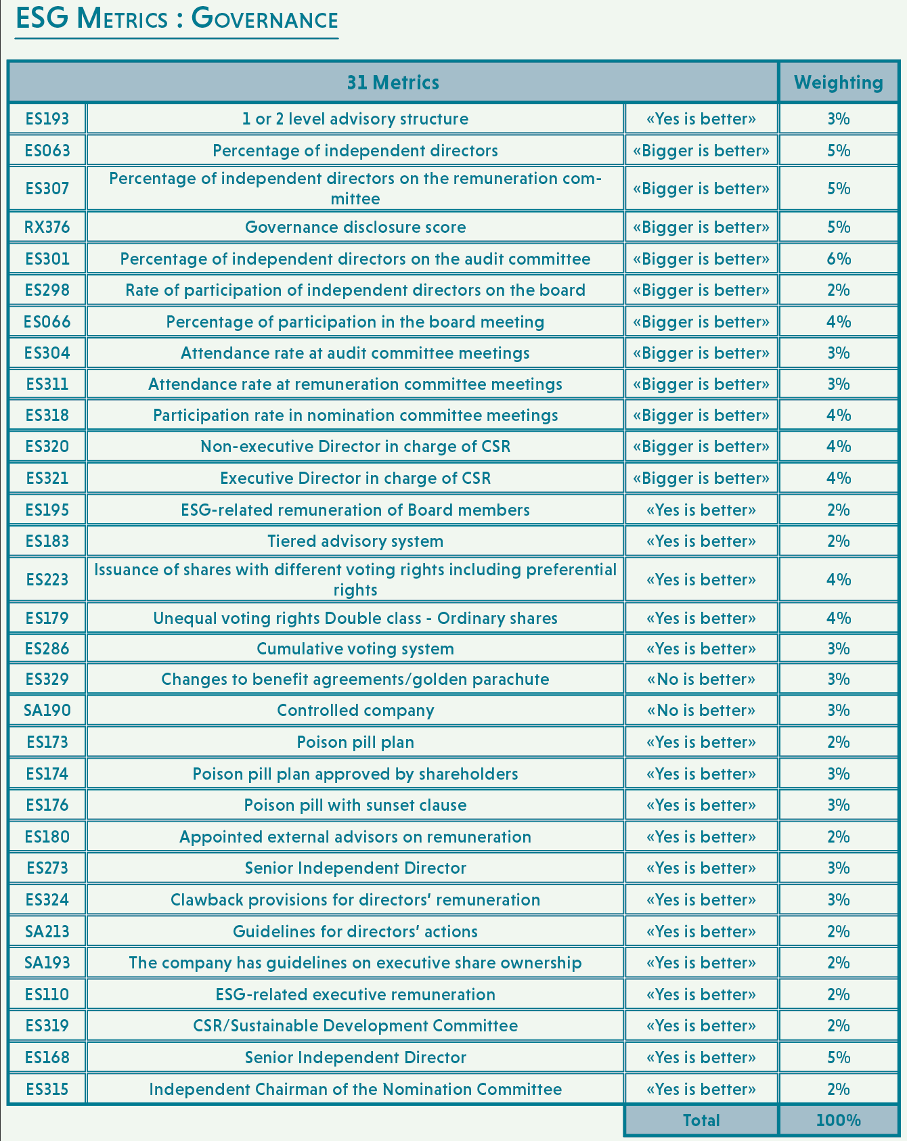

Euronext chose to use only 38 criteria to establish the ESG rating of the new index. In comparison to the hundreds of ESG-related criteria used in the evaluation processes of other rating agencies (Bloomberg, Sustainalytics, Robecco etc.), Euronext’s more limited criteria appear meagre.

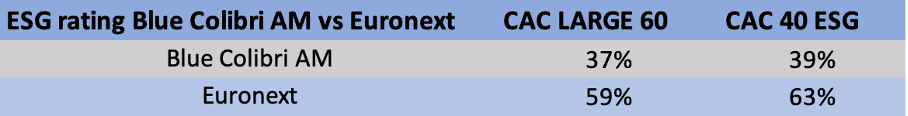

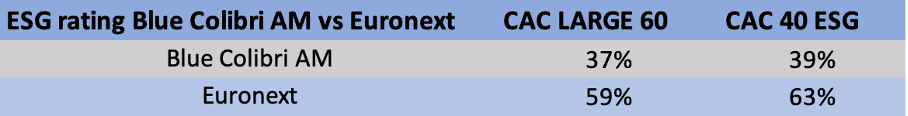

Colibri Asset Management uses 78 criteria for the ESG rating of its allocations, and we expect to use more than 200 over the medium term.

From an informational qualitative viewpoint, data analysis in both relative and absolute terms deem to be an optimal methodology. Absolute data of greenhouse gas emissions (in thousands of tonnes), as an example, can be a valuable indicator to measure the carbon footprint of a company.

V.E.’s current approach of scoring an indicator, from 1 to 4, only gives a relative estimate of a company’s ESG practices versus more precise, pertinent, absolute data.

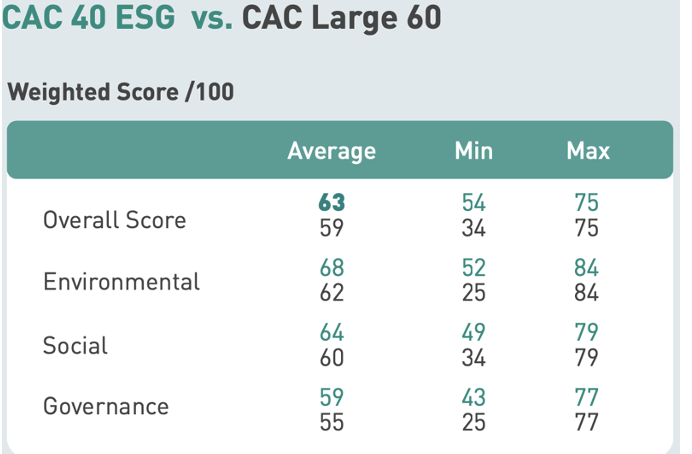

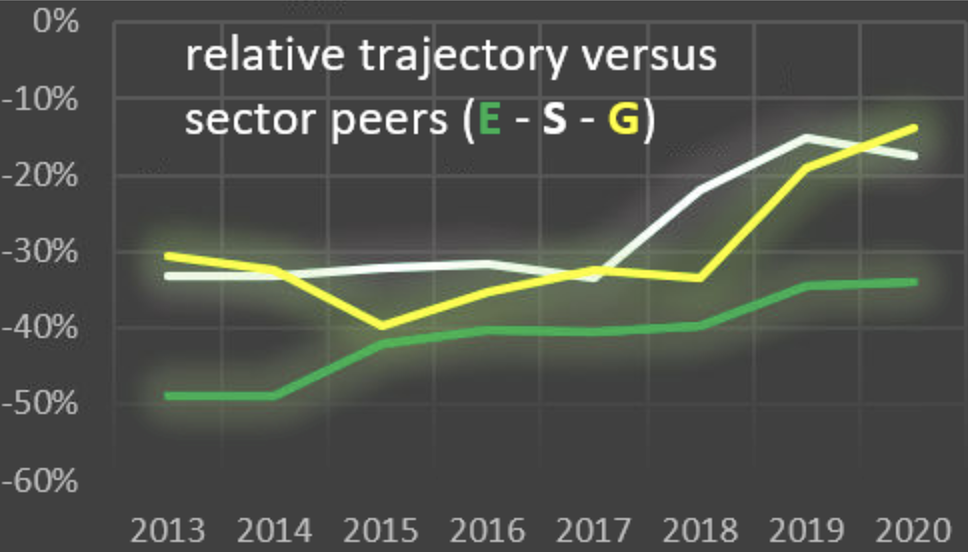

When reading through Euronext’s brochure, it can be seen the highest ESG rating in the CAC 40 ESG index is 75. While high ESG ratings should translate into richer valuations of companies, less upside potential could put a drag on the index overall. Instead of focussing on best-in-class stocks, wouldn’t investors gain more value if E-S-G trajectories were at the centre of Euronext’s evaluation process?

This implies the CAC Large 60 companies could almost match the CAC 40 ESG companies in terms of stock price performance. What is therefore the point of creating the new CAC 40 ESG index if CAC Large 60 companies barely differ in ESG ratings?

V.E. states the variation in Overall Scores is negligible because the incremental reduction in focussed companies from 60 to 40 is not a significant change in absolute terms. The explanation may at first appear valid, but wouldn’t heavily polluting companies, such as Total in the CAC Large 60, pull down the Overall Score to much lower levels?

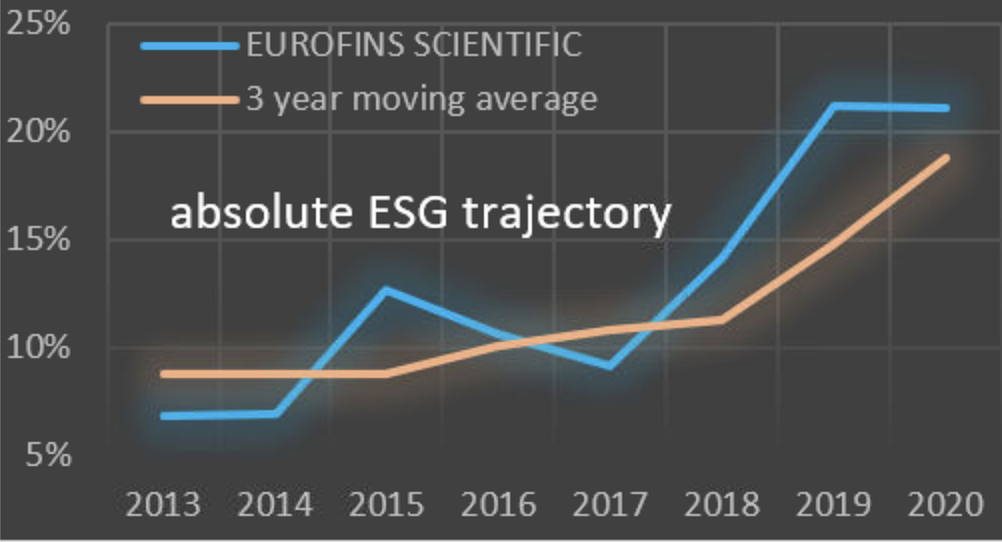

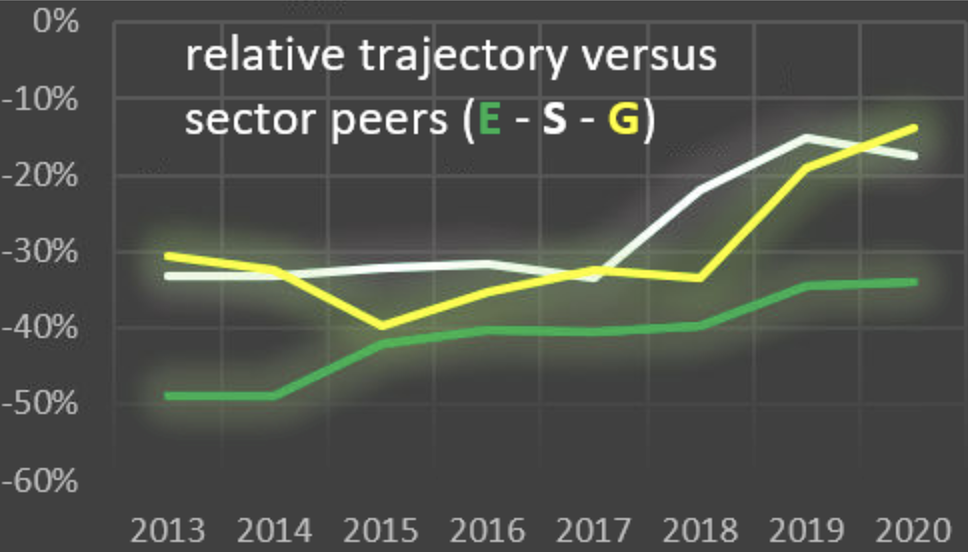

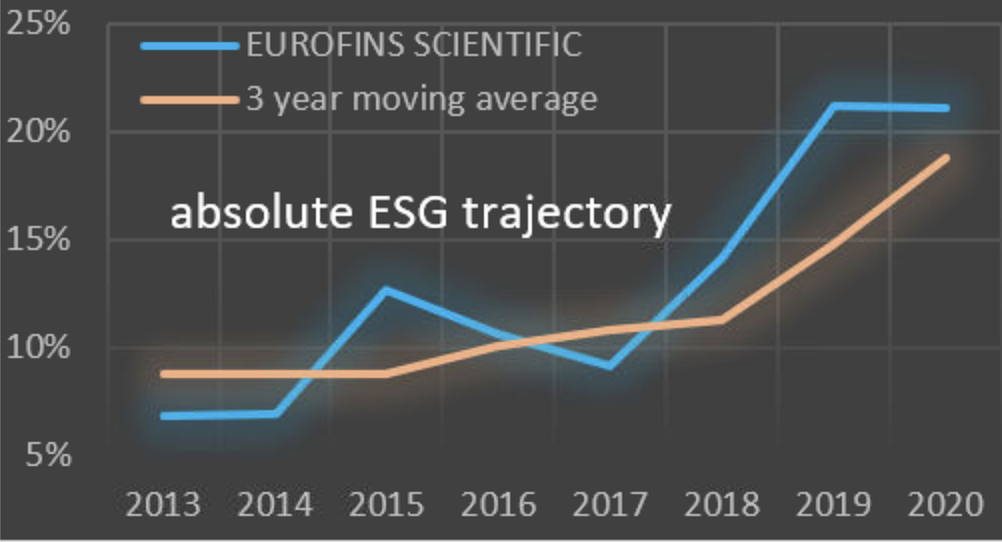

Source : Colibri AM

Source : Colibri AM

- Environment: 50%

- Social: 30 %

- Governance: 20 %

Our final differentiating factor blends absolute numbers (e.g. CO2 emissions in thousands of tonnes per year) with relative data (e.g. “yes” or “no” answers) to create the E-S-G trajectories of companies. The historic evolution perspective therefore permits Colibri Asset Management and its clients to better evaluate the current trends for investment idea generation.

- Environment: 50%

- Social: 30 %

- Governance: 20 %

Source : Colibri AM

Our final differentiating factor blends absolute numbers (e.g. CO2 emissions in thousands of tonnes per year) with relative data (e.g. “yes” or “no” answers) to create the E-S-G trajectories of companies. The historic evolution perspective therefore permits Colibri Asset Management and its clients to better evaluate the current trends for investment idea generation.

Source : Colibri AM

The initiative launched by Euronext is commendable and meets the requirements of new European standards.

However, the apparent lack of ambition in this fine project caps the needed change we need in the world today.

Selecting best-in-class for the CAC 40 ESG benchmark proposes investors high quality companies, yet the flip side points to little leeway in making improvements and hence, generate decent investment returns.

If this project is carried out in the spirit of exposing reality to French large caps, (i.e. not living up to consumer demands), we could witness a game changing evolution.

The environment after all needs to gain more recognition by means of appropriate social and governance practices.

– Principle 2: Businesses should make sure that they are not complicit in human rights abuses.

– Principle 4: Companies are invited to contribute to the elimination of all forms of forced or compulsory labour.

– Principle 5: Companies are invited to contribute to the effective abolition of child labour.

– Principle 6: Companies are invited to contribute to the elimination of discrimination in employment and occupation.

– Principle 8: Companies are invited to take initiatives to promote greater environmental responsibility.

– Principel 9: Companies are encouraged to promote the development and diffusion of environmentally friendly technologies.

- Environmental impacts: waste management, initiatives to reduce greenhouse gas emissions or electricity consumption, etc.

- Social impacts prevention of accidents at work, respect for human rights, the fight against discrimination and for gender equality, employment of disabled people, etc.

- Governance impacts: the fight against corruption, transparency of managers’ salaries, etc.

- Respect for human rights : fight against poverty, for example