Profit Sharing Fund

How to put finance at the service of society

09/01/2020

Back in the 1990’s during my student years I visited many countries in Africa. My father’s career with the United Nations Development Program had him based in that emerging part of the world. Our numerous road trips crossed beautiful country sides, deserts, jungles, arid plateaus and coastlines, but poverty was sadly widespread. I studied economics and was always curious as to how the financial markets could help improve the lives of these impoverished people. After having worked in the investment fund management industry the past twenty years, I am convinced the profit sharing model can offer a solution.

In the competitive fund management business, a firm’s robust investment performance and product differentiation can attract a rise of assets under management (AUM), which would result in expanding profits.

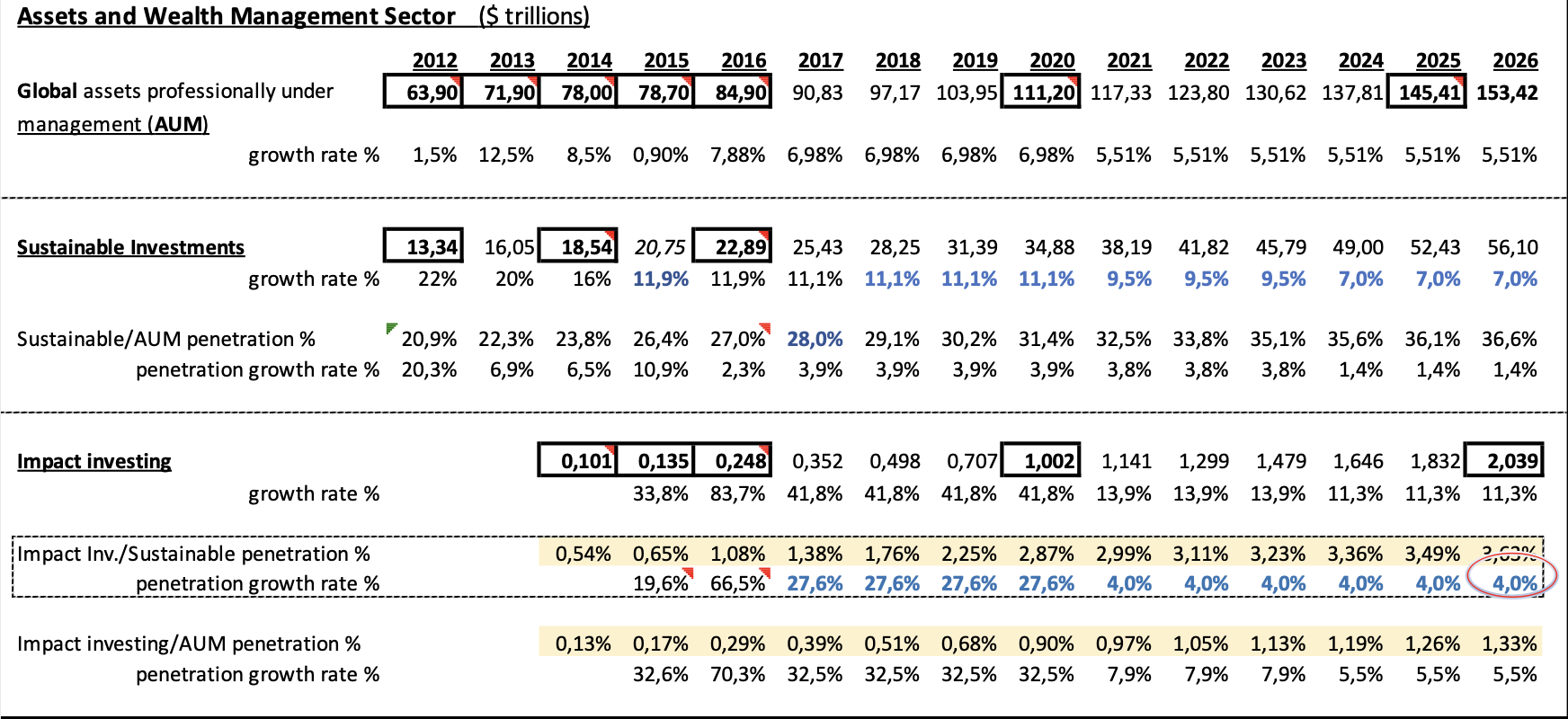

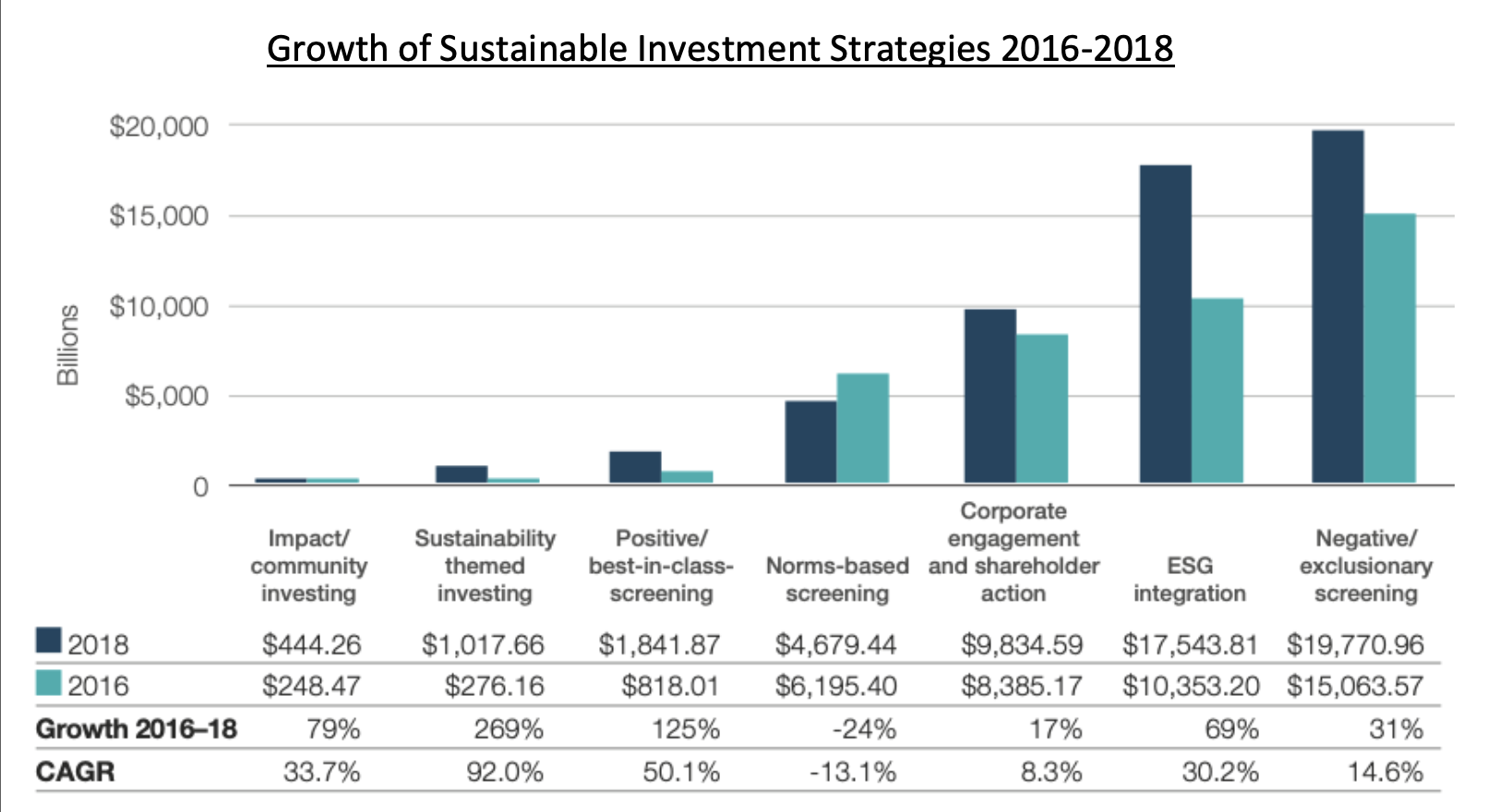

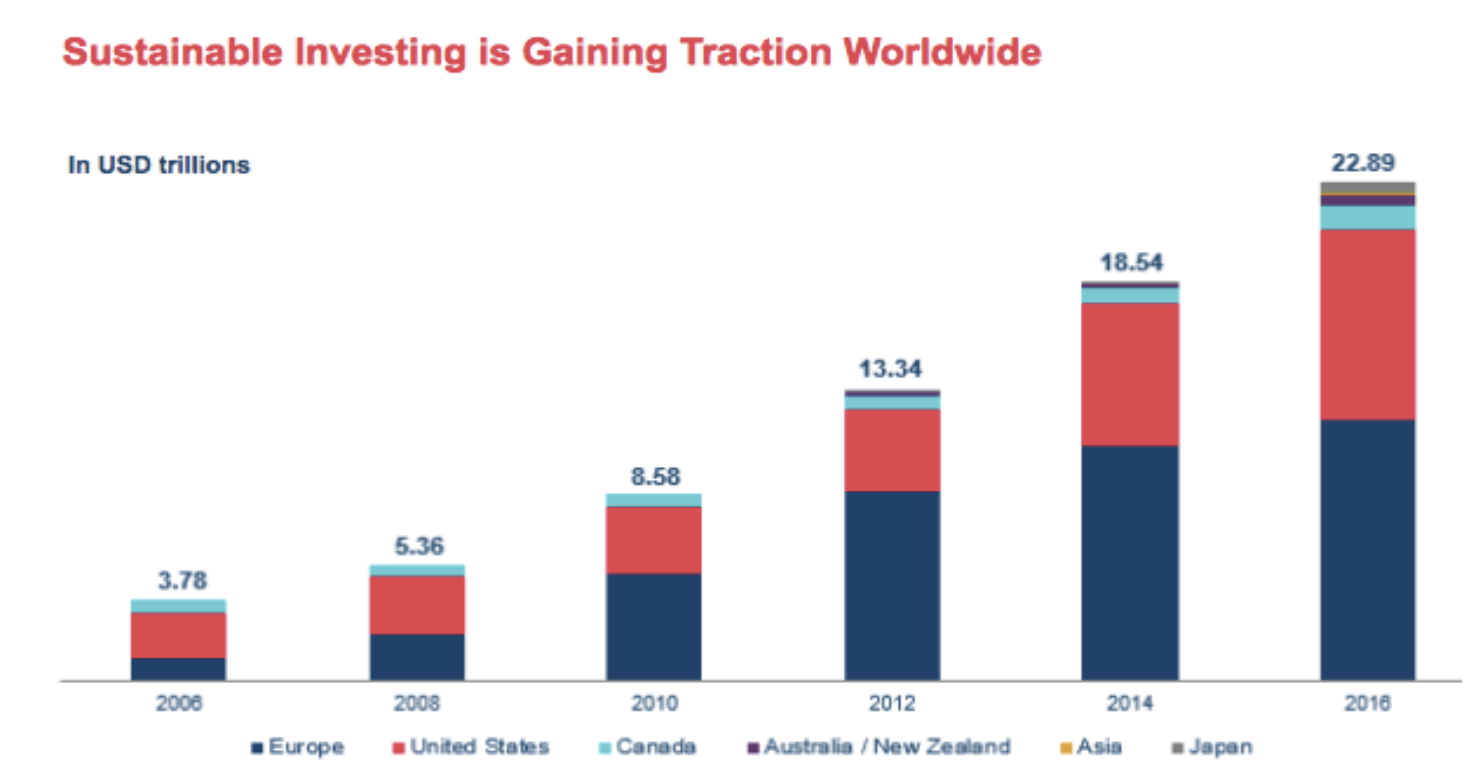

Demand for sustainable/ESG investment funds (environmental, social, governance criteria) has grown substantially the past several years due to the increased awareness of the benefits. The investments are expected to produce sustainable excess returns over the long term and investors’ capital is invested in “good” companies to help improve society.

Sources : PwC Market research centre analysis, Global Sustainable Investment Alliance

Demand for sustainable/ESG investment funds (environmental, social, governance criteria) has grown substantially the past several years due to the increased awareness of the benefits. The investments are expected to produce sustainable excess returns over the long term and investors’ capital is invested in “good” companies to help improve society.

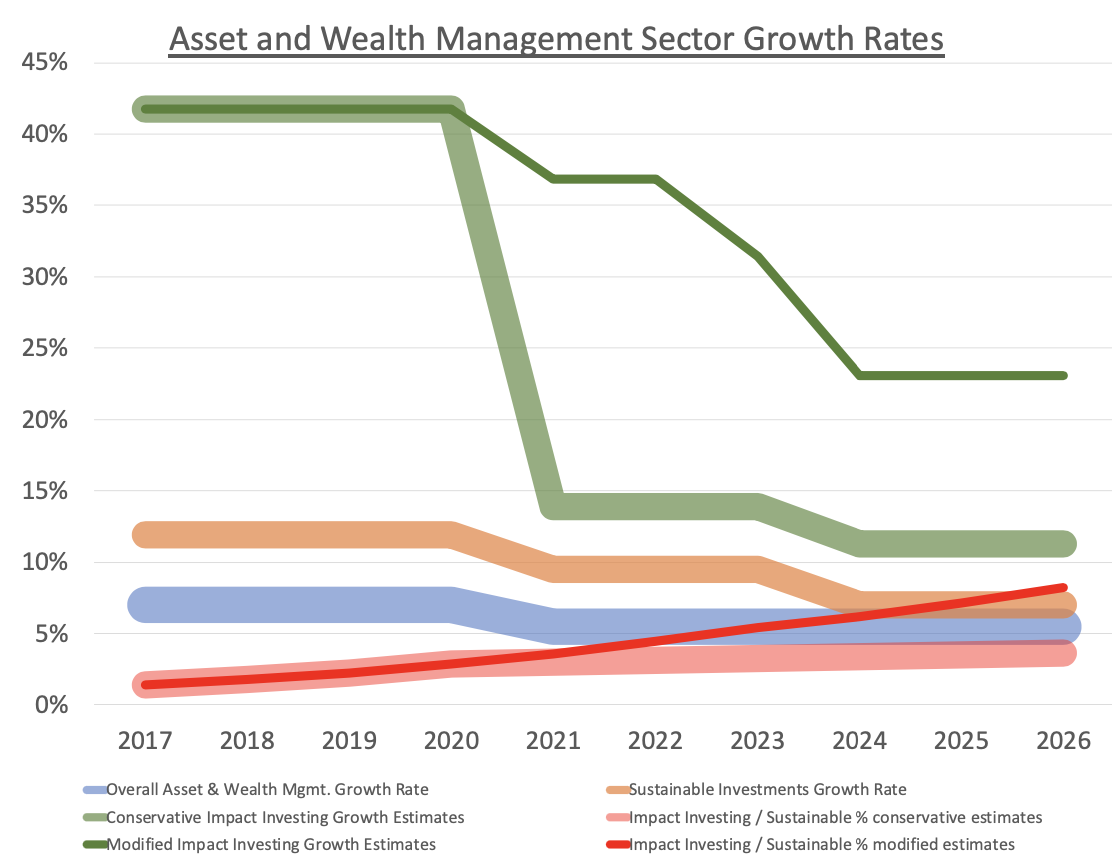

Many players in the asset management industry have therefore labeled themselves as sustainable investors to capture AUM in this higher growth rate segment. The forecasts in the table above portrays continued high growth rates for sustainable investments over the long term, but at a less robust level than the past. The impact investing sub-segment meanwhile remains in its infancy with a much higher growth potential and could help steer investor’s attention towards the Profit Sharing Fund (PSF).

I propose to extend the ESG concept more downstream in the investment value chain with more emphasis on tangible social projects. In addition to choosing the “good” stocks for an investment fund, a portion of fund management profits would be allocated to impact investing projects (poverty alleviation, protecting the environment, improving health & sanitation, etc.) with risk-adjusted market-rate returns and below-market-rate returns. The Global Sustainable Investment Alliance (GSIA) defines impact investing as “targeted investments, typically made in the private-sector markets, aimed at solving social and environmental problems.”

Investor interest would be expected to gain traction because the Profit Sharing Fund will offer a competitive risk/return profile versus other comparable funds in the marketplace PLUS a portion of the fund manager’s profits will be earmarked to transparent, social and environmental projects. While client fund investors will be earning competitive returns with the Profit Sharing Fund, their capital will permit the portfolio manager to generate excess returns and make donations.

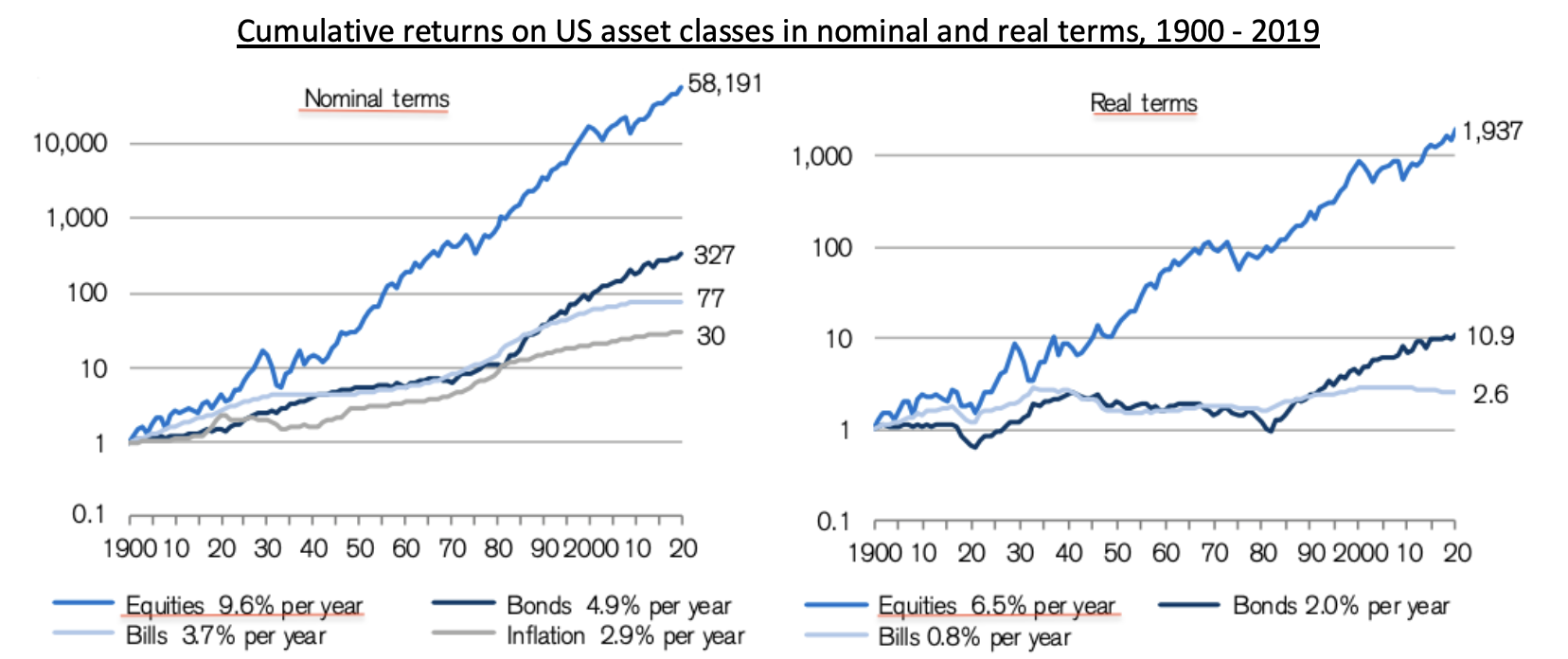

The proposed profit-sharing investment scheme would benefit client investors, fund benefactors, implicated fund managers and the seed capital investor providing the initial funds to start-up the project. Other “alpha-generating” fund managers would be invited to join the profit-sharing investment Network. The seed money to kick start the project would target a minimal 7% return, which would be in-line with equity investment returns over the long-term.

Fund benefactors would receive increased resources, investors would earn competitive returns along with making tangible contributions to society, those fund managers within the Network would gain recognition and the seed money could earn standard equity market returns (or better).

Sources: Elroy Dimson, Paul Marsh and Mike Staunton, Triumph of the Optimists, Princeton University Press, 2002, and Global Investment Returns Yearbook, Credit Suisse, 2020

The client investors themselves would additionally be invited to voice their opinions as to which projects would receive the donations. Over the course of the projects’ developments, shareholders of the Fund would have access to the progress in a transparent manner. They could simply view the projects online from home or take the plane to make visits on-site.

The observation of tangible progress related to social and environmental issues within the PSF scope would be the differentiating factor versus the more abstract positive impacts of most competing sustainable-themed, investment funds. At the same time, those funds wishing to replicate the proposed PSF model would be welcome to join the Network or launch a competing profit-sharing fund. The world awaits much more concrete improvement.

Upstream – fundraising

Investment strategy : alpha generation

Downstream – impact/community investing

Transparency will however be the cornerstone of this Profit Sharing Fund. In addition to monitoring the social and environmental projects, investors will have real-time access to the investment positions held in portfolio. Shareholders of the Fund will therefore get visibility throughout the investment value chain, starting with the alpha generation of the Fund down to the work-in- progress of the impact investing projects.

The client investors themselves would additionally be invited to voice their opinions as to which projects would receive the donations. Over the course of the projects’ developments, shareholders of the Fund would have access to the progress in a transparent manner. They could simply view the projects online from home or take the plane to make visits on-site.

The observation of tangible progress related to social and environmental issues within the PSF scope would be the differentiating factor versus the more abstract positive impacts of most competing sustainable-themed, investment funds. At the same time, those funds wishing to replicate the proposed PSF model would be welcome to join the Network or launch a competing profit-sharing fund. The world awaits much more concrete improvement.

Transparency will however be the cornerstone of this Profit Sharing Fund. In addition to monitoring the social and environmental projects, investors will have real-time access to the investment positions held in portfolio. Shareholders of the Fund will therefore get visibility throughout the investment value chain, starting with the alpha generation of the Fund down to the work-in- progress of the impact investing projects.

Impact Investing

The table on the right indicates the tiny, relative size of the impact/community investing market within the overall sustainable investments universe, along with its recent, strong growth rates. Impact investments have indeed existed since many years, but were largely confined to the circles of wealthy individuals and philanthropic trusts. The increased awareness of this asset class has begun spreading to the mainstream and the Profit Sharing Fund could help facilitate its access to ordinary people.

The vertical integration of ESG criteria for the stock selection of the Fund down to making concrete impact investments is a concept we seldom see in the market. Multitudes of sustainable investment funds exist today and many impact investing projects have recently come in the past few years, but the connection of the former with the latter has been rare to- date. The Profit-sharing concept would glue together the ESG stock selection for the Fund with impact investing to create a fully integrated investment offering.

Source : Global Sustainable Investment Alliance

The Global Sustainable Investment Review 2016 (GSIA) define sustainable investments along the following global standards of classification:

- \Impact/community investing : targeted investments, typically made in private markets, aimed at solving social or environmental problems and including community investing, where capital is specifically directed to traditionally underserved individuals or communities, as well as financing that is provided to businesses with a clear social and environmental purpose.

- \Sustainability themed investing: investment in themes or assets specifically related to sustainability (for example clean energy, green technology or sustainable agriculture;

- \Positive/best-in-class screening: investment in sectors, companies or projects selected for positive ESG performance relative to industry peers;

- \Norms-based screening: screening of investments against minimum standards of business practice based on international norms;

- \Corporate engagement and shareholder action: the use of shareholder power to influence corporate behavior, including through direct corporate engagement (i.e., communicating with senior management and/or boards of companies), filing or co-filing shareholder proposals, and proxy voting that is guided by comprehensive ESG guidelines;

- \ESG integration: the systematic and explicit inclusion by investment managers of environmental, social and governance factors into financial analysis;

- \Negative/exclusionary screening: the exclusion from a fund or portfolio of certain sectors, companies or practices based on specific ESG criteria.

- \Impact/community investing : targeted investments, typically made in private markets, aimed at solving social or environmental problems and including community investing, where capital is specifically directed to traditionally underserved individuals or communities, as well as financing that is provided to businesses with a clear social and environmental purpose.

- \Sustainability themed investing: investment in themes or assets specifically related to sustainability (for example clean energy, green technology or sustainable agriculture;

- \Positive/best-in-class screening: investment in sectors, companies or projects selected for positive ESG performance relative to industry peers;

- \Norms-based screening: screening of investments against minimum standards of business practice based on international norms;

- \Corporate engagement and shareholder action: the use of shareholder power to influence corporate behavior, including through direct corporate engagement (i.e., communicating with senior management and/or boards of companies), filing or co-filing shareholder proposals, and proxy voting that is guided by comprehensive ESG guidelines;

- \ESG integration: the systematic and explicit inclusion by investment managers of environmental, social and governance factors into financial analysis;

- \Negative/exclusionary screening: the exclusion from a fund or portfolio of certain sectors, companies or practices based on specific ESG criteria.

The Profit Sharing Business Model

As numerous asset managers have trended to obtain the high growth “sustainable” investment label, the profit-sharing fund will strive to capture the even higher growth rates of the impact investing niche. But membership of the impact investing category will likely require more commitment, in terms of providing donations for the financing of projects and maintaining relations with non-governmental organizations on the ground.

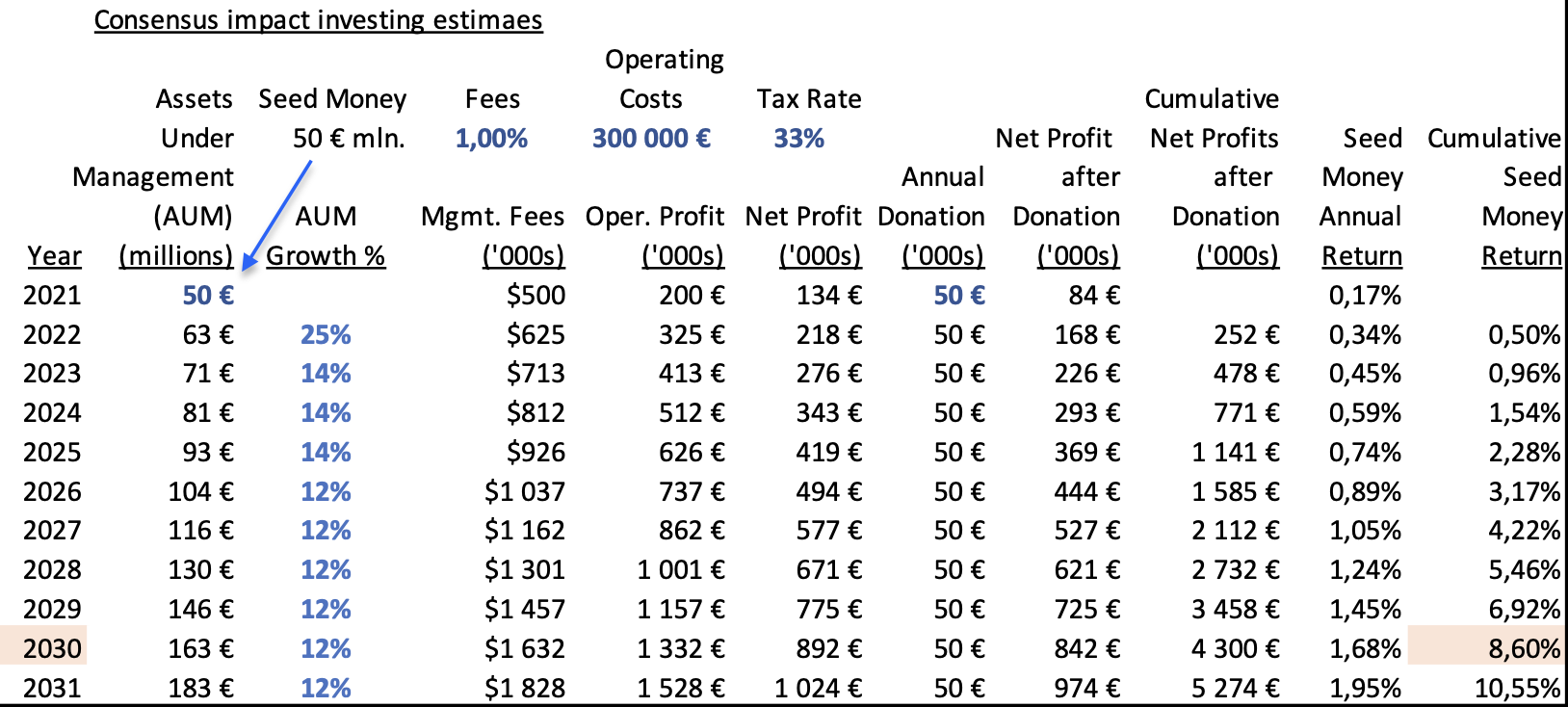

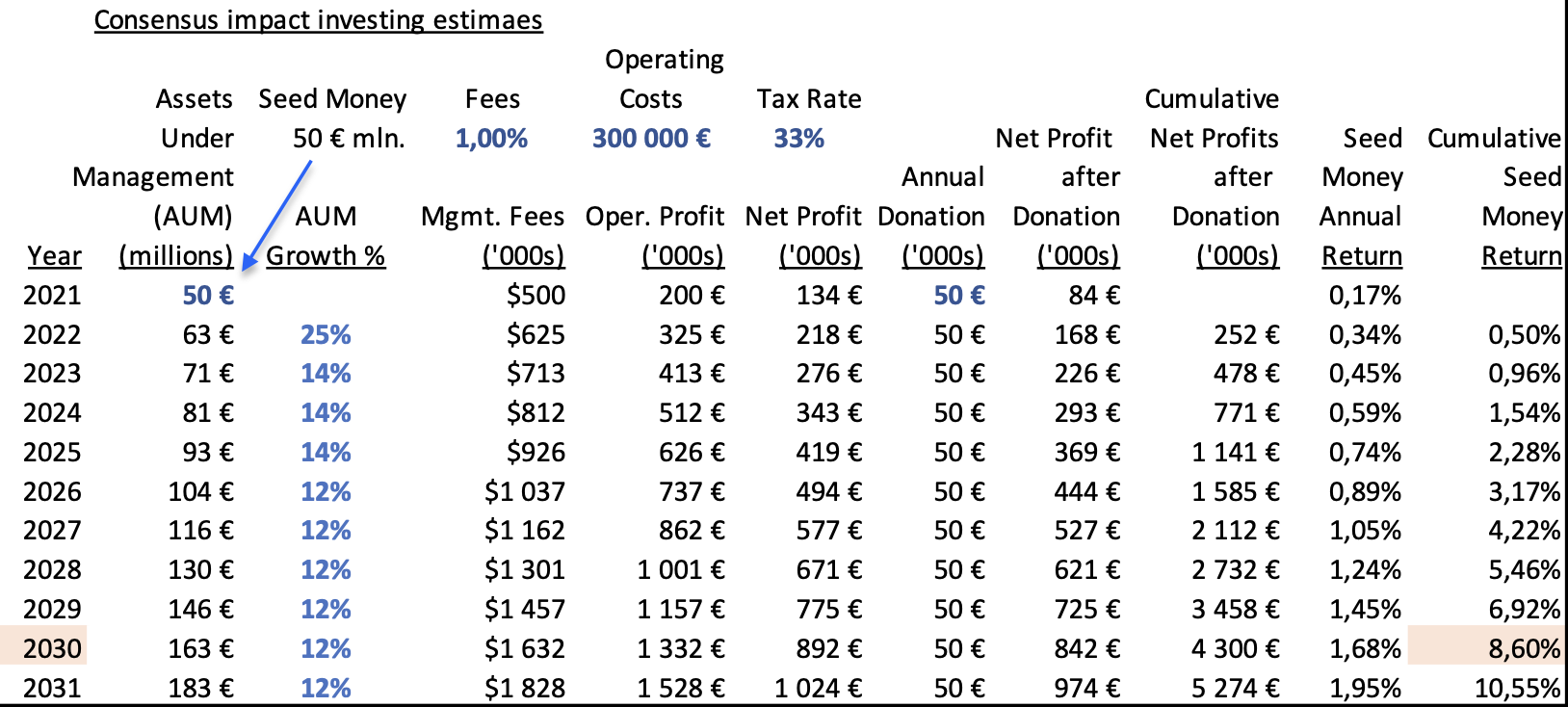

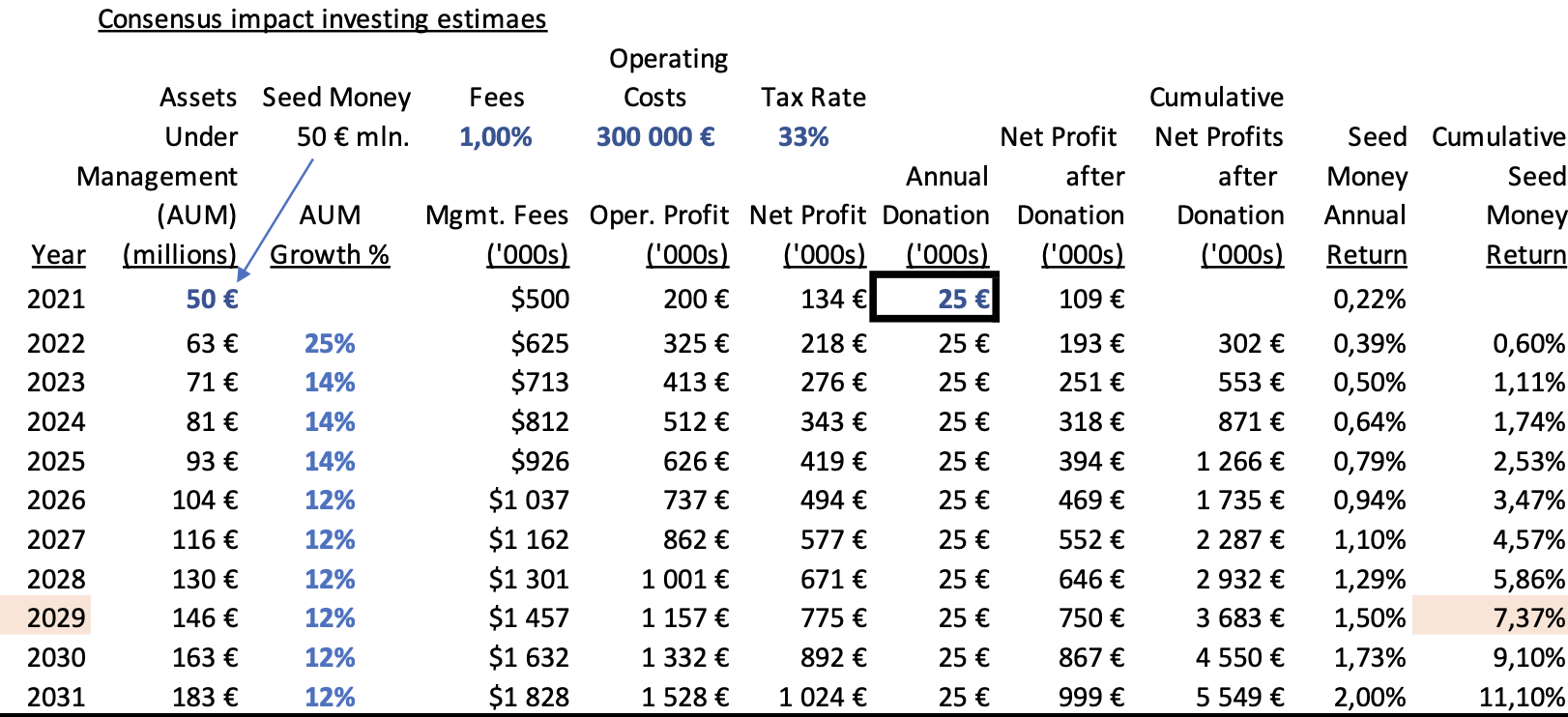

The optimal level of annual donations dedicated to impact investing projects would need to be significant enough to attract fund client investors, but at the same time permit the fund management company to function properly and reach the 7+% target for the seed money investor. If we expect the financial markets to provide abundant, competitive capital to start-up the project, the Profit Sharing Fund would need to deliver results with respect to financial market demands in terms of expected return. In addition to the 7+% return, the seed investor will most likely expect to reach the target within a five-year time span.

Equity investments are after all recommended to be held throughout an economic cycle, which usually range between five to seven years. The late, very long bull run has extended beyond the traditional yardstick thanks to the to-date successful, experimental central banks’ quantitative easing programs.

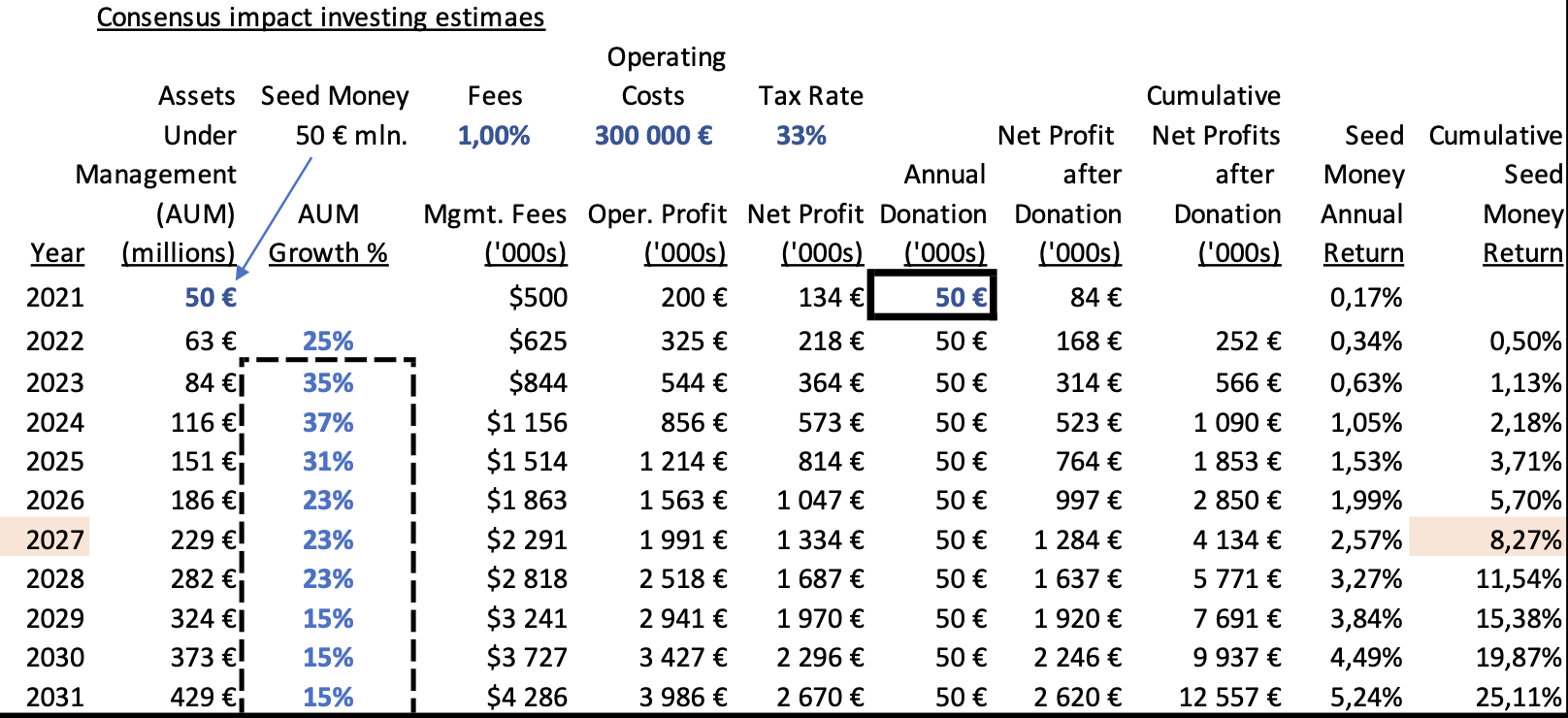

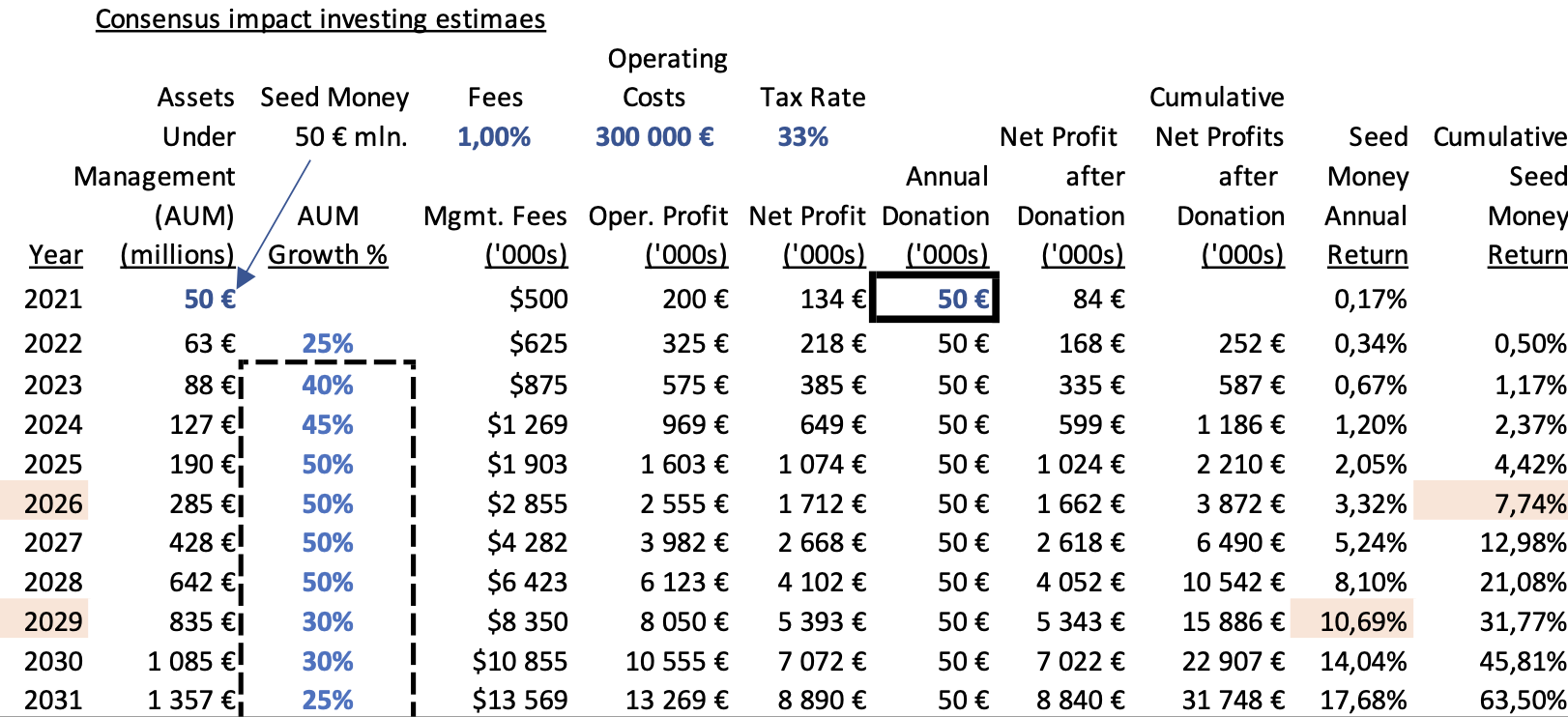

The size of annual donations would additionally be a function of the amount of seed money provided by the seed investor. In the fund manager business model on the right, the simulation assumes consensus growth expectations of the impact investing sector (see the table at the top of the article), 50-million-euro seed capital, management fees of 1%, operating costs of 300,000 euros per annum, a tax rate of 33% and annual donations of 50,000 euros. Under this first simulation, the Profit-Sharing Fund, starting in 2021, would only begin earning 7+% annual returns after nine years (year 2030), making the business case unattractive.

A lower annual donation of 25,000 euros, as seen in the table on the left, would only move forward the 7+% return target to year 2029 and could be considered too little by client investors to be an effective impact investor. The Fund would subsequently have difficulty in acquiring the high growth impact investor asset class image. In order to attract attention, the annual donations would most likely need to be larger.

The other variables in the business model (commission fees, operating costs, tax rate) could be modified marginally, but these adjustments would not improve the seed money return drastically either. As a reminder, delivery of the seed money targets would most likely be the only means to attract capital to start-up the Profit Sharing Fund and acquire the high growth rates of the impact investing asset class.

If we return to the table top of the article and revisit the consensus growth forecasts of the overall assets & wealth management, sustainable investments and the impact investing sub-segment, it can be agreed most of the numbers appear to be acceptable. Both the assets & wealth management and sustainable investments markets are expected to normalize at a mid-single digit growth rate (+5.5% and +7% respectively), while the impact investing segment should normalize downwards as well to an +11.3% growth rate and reach a $2 trillion market value by year 2026.

The graph on the right permits us to visualize these growth rate downtrends, in which the cliff edge fall of the thick, light green line could indicate an exaggeration to the downside. Consensus estimates could therefore appear to be under-estimating the future market value of the impact investing segment. The thinner, darker green line permits us to pencil-in a softer landing of the impact investing growth trend to +23% per annum by year 2026 and appears to be less drastic and more realistic.

This more realistic scenario would bring the seed investor’s 7+% targeted return one year earlier to year 2027, thanks to the increased growth rates of assets under management.

Under the above more realistic scenario and the fact that impact investing stands in its infancy today, it can be concluded our Profit Sharing Fund could have the potential to grow AUM above market trend, permitting us to hit the seed money target return of 7% as early as year 2027. Cumulative annual seed money returns would enter double digits from 2027 onwards.

If client investors can earn the same return under a profit-sharing model, in comparison to the conventional funds with a straight model, PLUS help finance transparent impact investing projects at no extra cost to their investment returns, why wouldn’t clients transfer some of their funds to this truly socially responsible Fund? Earning equally competitive investment returns and having the luxury to contribute to society at no cost should attract attention.

Under the above more realistic scenario and the fact that impact investing stands in its infancy today, it can be concluded our Profit Sharing Fund could have the potential to grow AUM above market trend, permitting us to hit the seed money target return of 7% as early as year 2027. Cumulative annual seed money returns would enter double digits from 2027 onwards.

If client investors can earn the same return under a profit-sharing model, in comparison to the conventional funds with a straight model, PLUS help finance transparent impact investing projects at no extra cost to their investment returns, why wouldn’t clients transfer some of their funds to this truly socially responsible Fund? Earning equally competitive investment returns and having the luxury to contribute to society at no cost should attract attention.

This unique Fund’s above trend growth could even reach a 7+% return by year 2026.

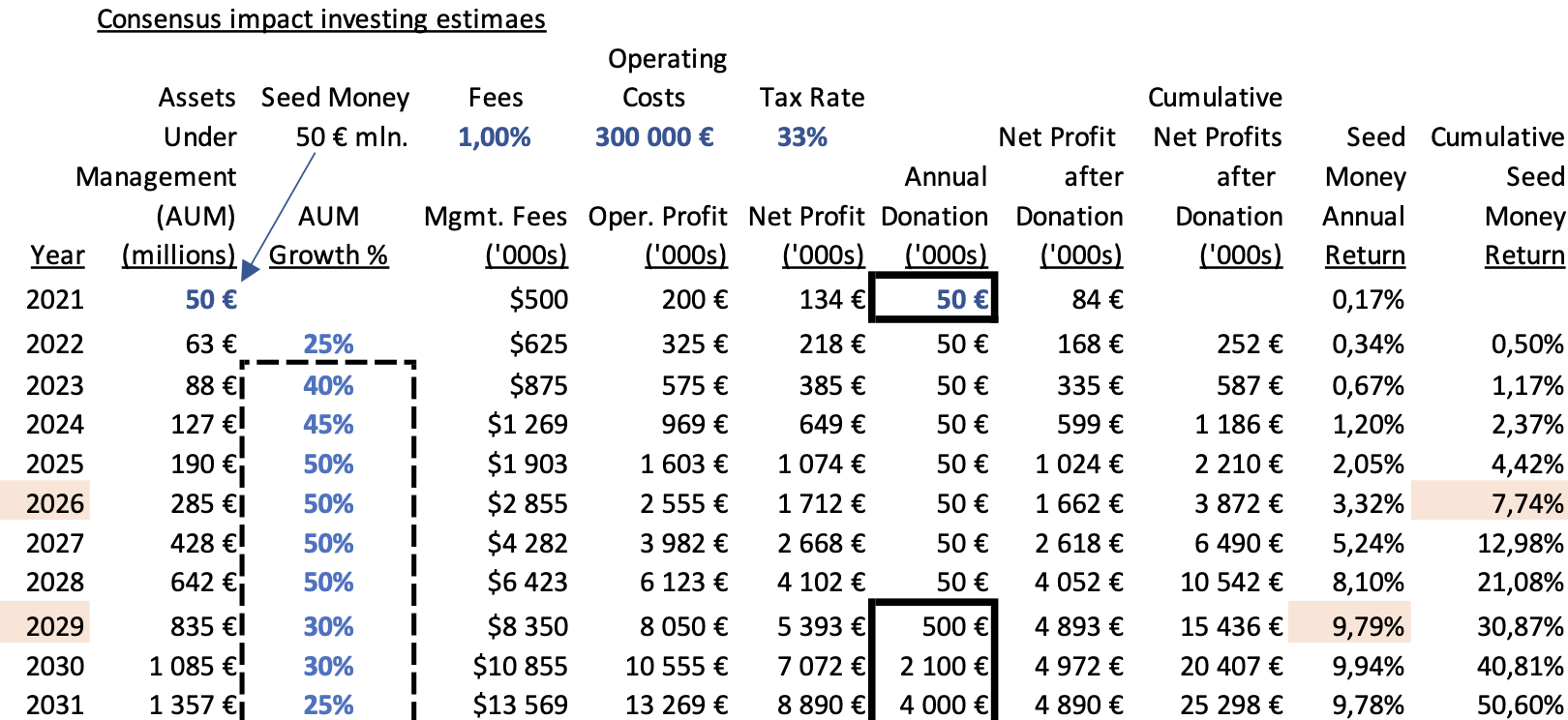

By year 2029 the seed investor could either collect strong double digit returns on an annual basis if he/she maintained the donations at 50,000 euros or cap the annual returns to roughly 10% by paying out more donations (millions) to contribute more to society. The model simulation on the next and final page shows annual donations could rise to between 500,000 to 4 million euros.

The PSF is expected to be powered by market forces while the resulting net profits will be the source of funds for social and environmental impact investments. The broad participation of the financial markets under the PSF scheme could potentially raise large sums of money and the funds would be put to work in a professional and transparent manner. Philanthropy could become more mainstream and its effect would be durable. Impact investing addresses needed ESG improvements on a sustainable basis over the long term, in which the projects strive for economic independence.

All of the benefits behind raising more funds for projects such as poverty alleviation, protecting the environment, improving health & sanitation issues, etc. can be listed endlessly. Demand for more resources to improve the world will remain strong. The trick is therefore finding the mechanism which could liberate more available capital via the financial markets. This Profit- sharing model could be a stepping stone in the right direction.

The PSF is expected to be powered by market forces while the resulting net profits will be the source of funds for social and environmental impact investments. The broad participation of the financial markets under the PSF scheme could potentially raise large sums of money and the funds would be put to work in a professional and transparent manner. Philanthropy could become more mainstream and its effect would be durable. Impact investing addresses needed ESG improvements on a sustainable basis over the long term, in which the projects strive for economic independence.

All of the benefits behind raising more funds for projects such as poverty alleviation, protecting the environment, improving health & sanitation issues, etc. can be listed endlessly. Demand for more resources to improve the world will remain strong. The trick is therefore finding the mechanism which could liberate more available capital via the financial markets. This Profit- sharing model could be a stepping stone in the right direction.

As a consequence, the PSF fund manager will pitch a unique story in the financial markets, which could raise assets under management. Since sustainable (ESG) investment consciousness has increasingly gained market share in the investment world, profit-sharing funds are likely to gain importance as well. The fact that the PSF model can generate a high single digit return (or more) for the seed money over the medium term should equally attract attention to launch this vertically, integrated, truly socially responsible Fund.

Source : Global Sustainable Investment Alliance